Best Day Trading Platform in UK in 2025

Which is the best trading platform in the UK? Is the best day trading platform also best for beginners and day trading?

How do we decide which Platforms are Best for Trading?

When we are making the decision about which to use and what should we be looking for when we decide on the best day trading platform? For some traders it will be the ease of use as a key factor, is it a simple, user friendly, trading platform? But other advanced traders will want to be able to do lots of in-depth technical analysis on the platform. These active traders would want a platform that has fantastic charting tools. For fundamental traders though it could be critical to have access to news reports, research and fundamental information, that allows them to make more informed trading decisions. Or you might pick your trading platform or online broker based on the number of different markets that you are able to invest in or trade. Active traders will probably be very sensitive to how wide the bid/ offer spread is.

Depending on your trading style and approach to markets you will probably view these different factors differently. But no matter what your goals are, what, your needs and requirements are, you should choose your day trading platform and day trading brokers wisely. Picking the best day trading platforms for you could be the difference between failure and success as you make your way through the world of trading and investing.

We have reviewed a great number of online day trading platforms and found the answer in the list below. A few of the best platforms that didn’t make the list were day trading platforms from Tradefred, BDSwiss, Nord FX, HotForex and Saxo Bank. The winner from these reviews: eToro’s trading platform is the best trading platform in the UK. AvaTrade and PrimeXBT is also great for day trading, whereas we would say that eToro has the best trading platform for beginners. Capital.com also made the top three day trading platforms in the UK market.

What are the Best Trading Platforms and are they free?

The wonderful news for you as a trader is that all the eight day trading platforms in the list below are completely free. The eight best day trading platforms in the UK are:

- eToro Trading Platform, great for beginners.

- PrimeXBT

- AvaTrade Trading Platform, great for day trading.

- Plus500 Trading Platform, great for trading in multiple markets.

- Markets.com Trading Platform

- BlackBull Markets Trading Platform

- Trade Nation Trading Platform

- XTB Trading Platform

Of course, all the eight best day trading platforms are run by onlinebrokers that are correctly regulated and thus you can feel safe about your money. However, as always with trading, never invest more than you can afford to lose. Below you can read our more in-depth reviews of the ten best day trading platforms for the UK market.

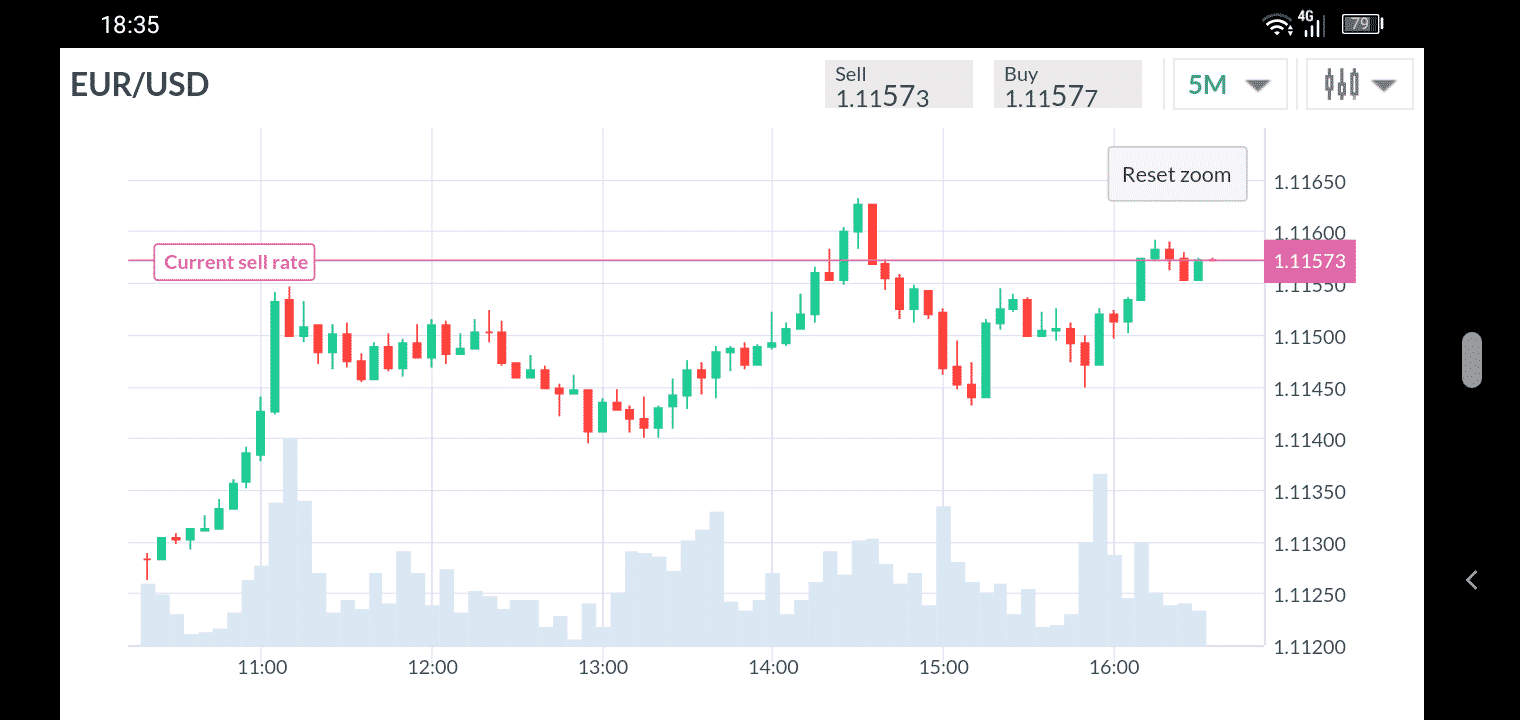

1. eToro Trading Platform

eToro has designed an original financial day trading platform that incorporates graphic trading scenarios depicted as a race between currencies or a tug of war. The company also has a professional trading application called “Expert Mode”, as well as a web-based trading platform called “WebTrader”. A screenshot of the software can be viewed here.

Mobile App

eToro also offers customers a mobile app that can be downloaded from the Apple App Store for the iOS version and from Google Play for the Android version one of the UK’s most downloaded trading app. Read more about eToro’s excellent trading app here. The eToro platforms only allow you to trade in U.S. Dollars because a unified currency is required for transparency purposes on their global network.

Trading platform

The eToro trading platform is great for beginners both as it is really easy to start trading with and also because of its Copy Trading. Copy Trading is the bread and butter of the operation. At the centre of the scheme stands the Copy People screen, which offers you several ways to locate traders who match your needs/trading style. The Popular Investor section is the display case of the Popular Investor program. Through this program, the online broker rewards traders who are copied, thus offering them another way to monetise their trading skills. Everyone can become a Popular Investor, including you.

Social Newsfeed

The Social Newsfeed seems to be the pride of the eToro platform. Through it, you as a trader can interact, open discussions, follow the moves of your peers, etc.

Notifications are also fed to you on the web platform as well as mobile. Every time a followed trader makes a move or posts something, you as the follower will be notified.

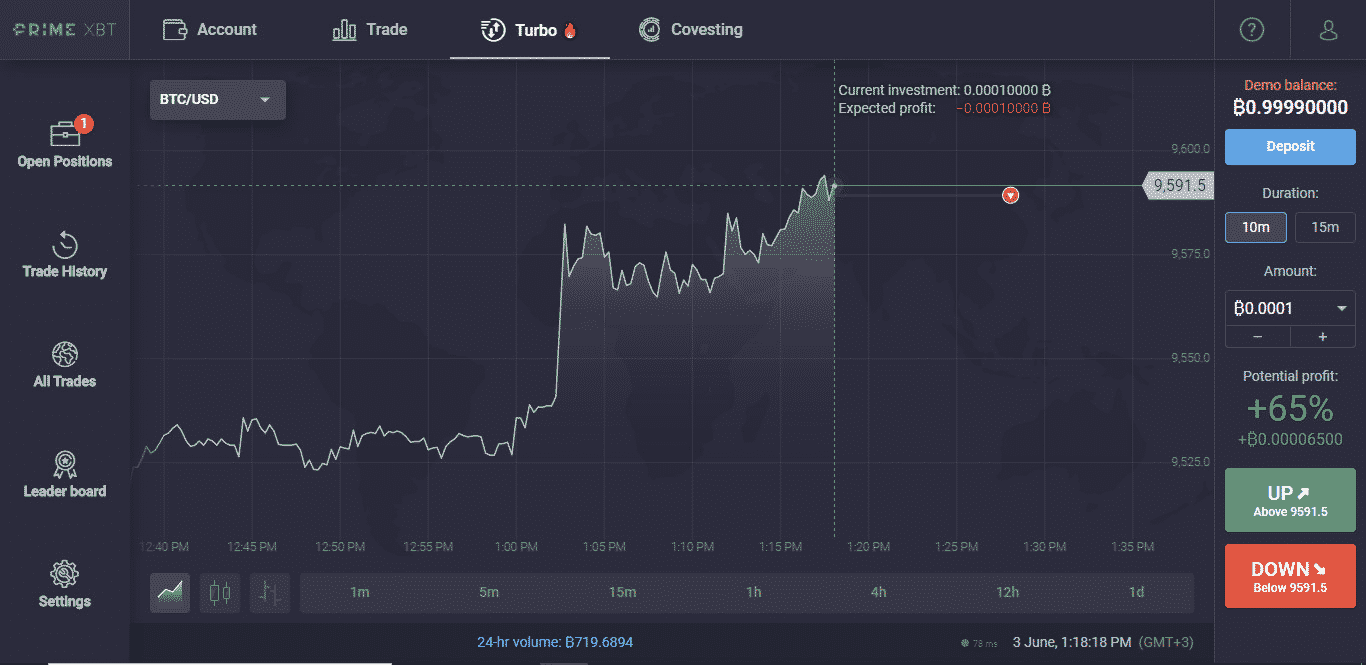

2. PrimeXBT Trading Platform

Platform

As mentioned, PrimeXBT relies solely on its proprietary trading platform. It does not currently support MT4 or MT5.

The PrimeXBT platform is attractive, its functionality is good, and its features are sufficient. Charting-wise, it is surprisingly comprehensive and powerful.

PrimeXBT’s platform supports scores of time frames, drawing tools, and chart types. It offers an impressive number of technical indicators, as well as the possibility for traders to keep their eyes on several charts simultaneously. Users can customise their chart layouts while analysing their trading history and tracking their activity.

Custom workspaces

Users are free to set up custom workspaces. The platform allows for regular trading, one-click trading, and double-click trading.

- Regular trading opens up an order window and requires order confirmation before trade execution.

- One-click trading is all about speed. It lets traders create new orders, cancel working orders, and close positions without confirmation, at a single click.

- Double-click trading lets users accomplish the same, at two clicks. A single click in this trading mode opens the order window or a confirmation window before closing a position.

In addition to all the trading-related features and widgets, the app also offers three quirky and popular investment tools.

Social trading

Covesting is PrimeXBT’s social trading feature. With the guidance of a fully transparent global leaderboard system, users can select from scores of top-ranked traders, whom they can then follow and automatically start copying to benefit from their winning moves. The platform offers detailed statistics on these experts, complete with a chart of their performance and trading details.

Covesting is not live yet, although it is already available in what one could call a preview mode. Traders can select from scores of experts, whom they can then follow and benefit from their winning moves. The platform offers detailed statistics on these experts, complete with a chart of their performance.

Yield accounts

Yield accounts allow passive investors to earn sustainable yield on staked crypto assets. By staking idle ETH, USDT, or USDC, investors are able to receive daily payouts directly into their staking balance for compounded returns. APY can be boosted by up to 2X by activating COV token membership.

Trading contests

Weekly trading contests is an area where traders can take advantage of in a multitude of ways. Participants who enter into weekly trading competitions are met with risk-free virtual funds to trade in a simulated environment. Top traders in each contest are rewarded with a portion of a crypto prize pool. Since there is no risk with using virtual funds, traders can use the contest module to backtest or try new day trading strategies as well as practice what they learned from the PrimeXBT Trading Academy.

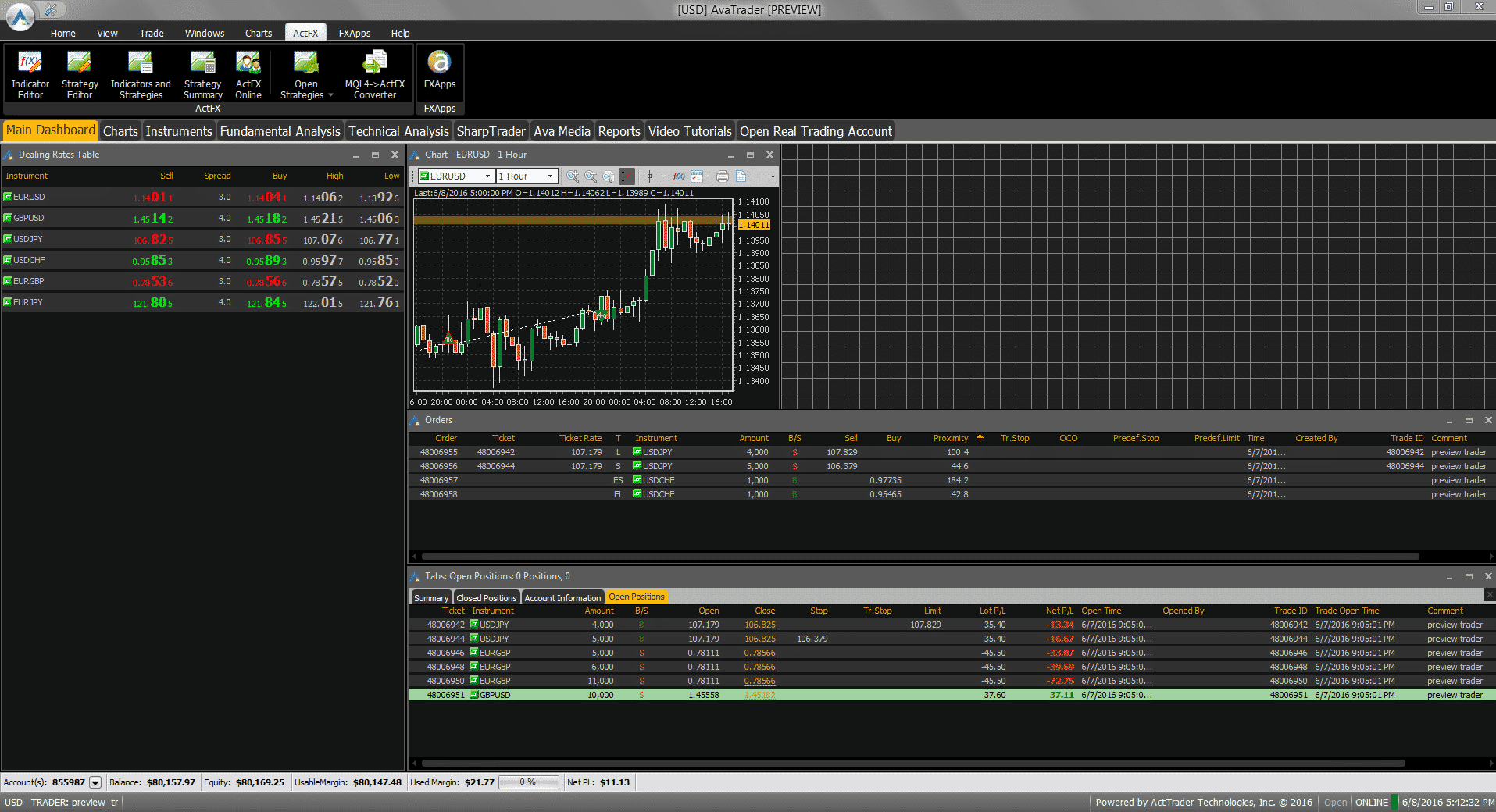

3. AvaTrade Trading Platform

Multiple trading platforms

AvaTrader

AvaTrade supports a wide variety of day trading platforms. The online brokers’ proprietary client-side AvaTrader trading platform works on Windows XP, Vista and 7, and a Macintosh version is also available. Of course, all of them are very easy to download and install directly on your desktop or laptop computer.

The screenshot below shows the extensive functionality of AvaTrader, including technical and fundamental analysis, reports, tutorials and account management features.

AvaOptions

Also, the AvaOptions Web platform and the MT4 WebTrader allow you to sign in to your AvaTrade account using any Internet browser without having to install it on your computer. Lastly, the AvaTradeGo app allows you to trade in an AvaTrade account using an iPad, iPhone or Android phone and/or tablet so you can manage and view your AvaTrade trading account while away from home. Read more about the AvaTradeGO app here

Other trading platforms

In addition to its own AvaTrader trading platforms, AvaTrade nicely also supports the following day trading platforms for day trading: Metatrader 4, Metatrader 5. DupliTrader, and ZuluTrade. For those already using MetaTrader, AvaTrade also offers their own version of this popular forex trading software to make your account installation easier.

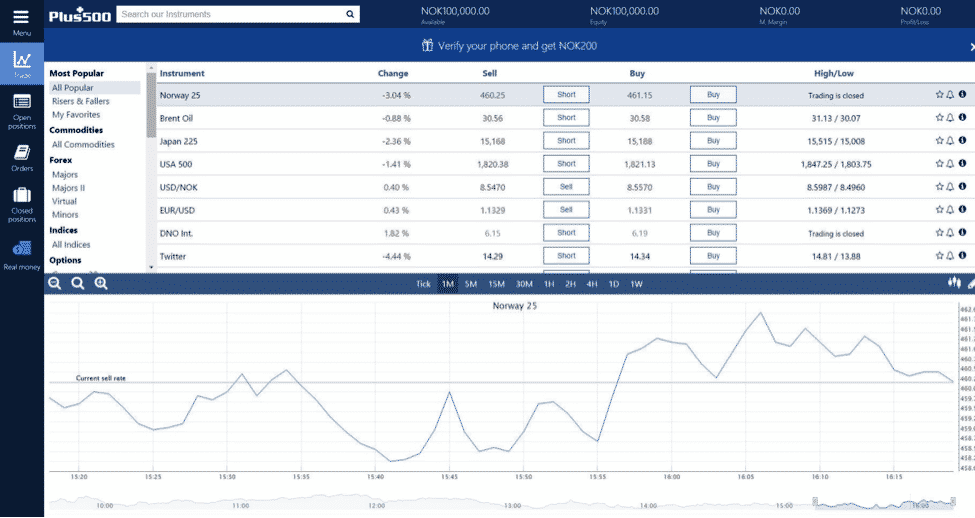

4. Plus500 Trading Platform

The day trading platforms offered by Plus500 are very simple to operate and seem especially suitable for those interested in dealing in multiple markets. From one single screen, traders can obtain quotes in real-time for any of these asset markets and can execute transactions as well.

Windows Trader and Web-Trader

The Plus500 trading platform is available in a desktop version called Windows Trader and a web-based version called Web-Trader for trading CFDs. In addition, a popular mobile version of the Plus500 platform is available that works on Apple devices like the iPhone, iPad, iPod Touch and Apple Watch. Plus500 apps also exist for mobile devices using the Android and Windows Phone operating systems. Read more about the Plus500 mobile trading app here.

The screenshot shown below displays the functionality of the Plus500 CFD trading platform, which includes trade execution, market pricing overview, a basic chart, position and account balance reports. The platform also has fund management capabilities, which give you as a trader the ability to make deposits and withdrawals from your trading account.

In addition to being able to watch various markets and execute trades, Plus500’s trading platform lets traders easily review past transactions and keep track of current positions. The software also includes a rather basic charting facility with multiple time periods available. Unfortunately, only one chart can be displayed at a time since the system does not support the simultaneous display of multiple charts.

In addition to the functionality provided by offering different versions of the Plus500 trading platform, the broker has also made some nice extra tools available for you as a trader.

Platform tools

One such tool is the Economic Calendar and the platform also offers a Trade Alerts service, as well as a Trader’s Guide.

Nicely there are also several tools available for risk management. Plus500 supports Guaranteed Stops and Trailing Stops, as well as Close at Profit and Close at Loss rates. For your convenience, these tools and their peculiarities are thoroughly explained at the broker’s website.

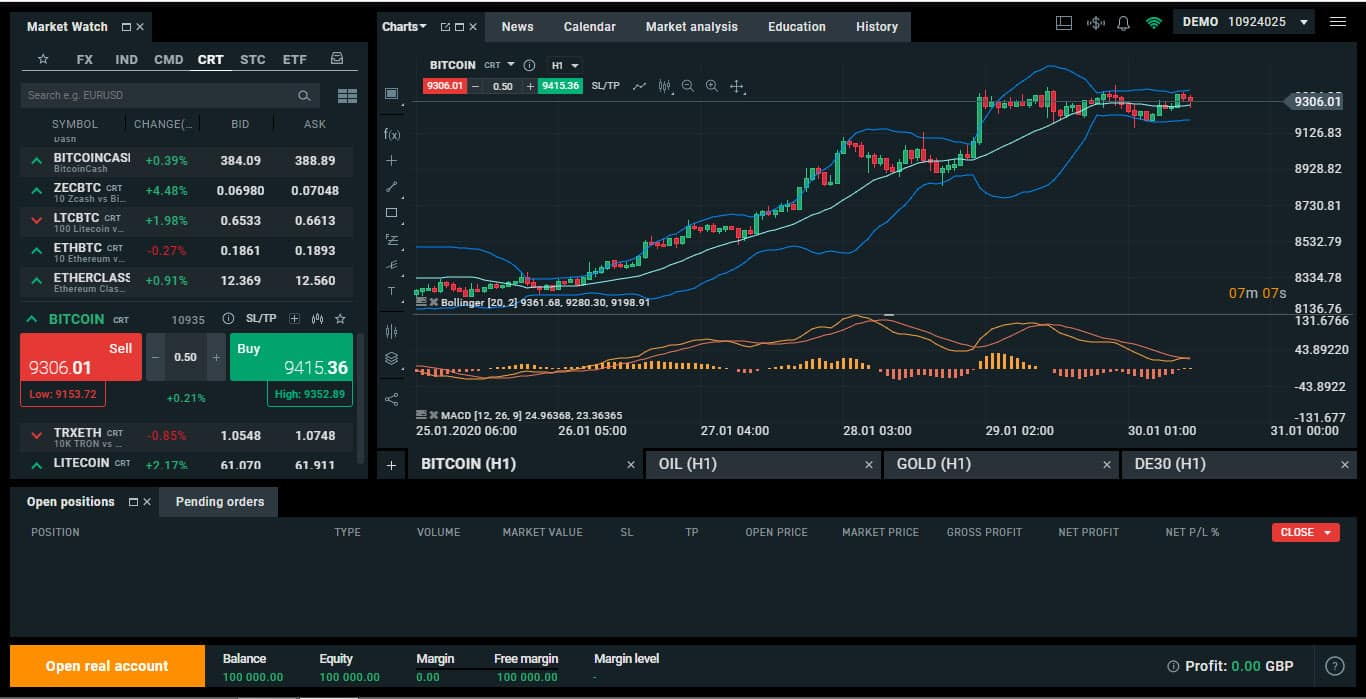

5. Markets.com Trading Platform

The Markets.com proprietary platform is the go-to platform for trading forex and trading CFDs at Markets.com. Besides being surprisingly powerful charting and analysis-wise, this multi-asset web-based platform is also available in mobile versions, for Android- as well as iOS-based devices.

Technical indicators

Scores of technical indicators are included in the Markets.com package and there are many unique features too. Real-time news feeds are also delivered for those keen on trading the fundamentals in combination with technical analysis tools.

MT4 and MT5

MT4 and MT5 are also part of the Markets.com platform offering. The world’s most popular (and arguably: best) trading platform MT4, hardly needs an introduction. It offers superb charting and analysis, with scores of technical indicators pre-installed in the freely downloadable version. Traders are free to add additional indicators and those so inclined, can even code their own.

MT4’s favorite feature is its support for EAs and for EA creation. EAs work best when coupled with a proper VPS service.

As an upgrade to MT4, MT5 is a powerful trading platform with many advanced features and analytical tools. Both MetaTrader 4 and MetaTrader5 platforms can be accessed directly from your web browser and via a download to your PC or preferred mobile device.

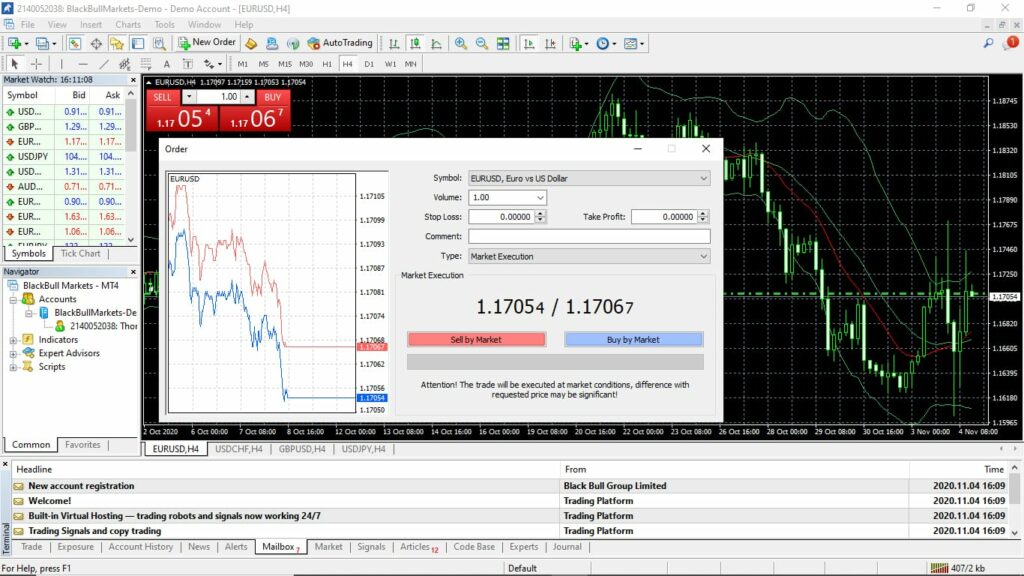

6. BlackBull Markets Trading Platform

BlackBull Markets offers four trading platforms.

MT4 is a fully customizable online trading environment most traders know and love. The broker has made it available in a range of versions for Windows, Mac, iOS, and Android.

BlackBull’s version of the platform offers an institutional-grade experience. It supports EAs (Expert Advisors), and together with the VPS service the broker also offers, this sets the stage for profitable algorithmic trading.

Like most of its other features, MT4’s EAs are fully customizable. You do have to be handy with MetaScript, however, if you intend to program your custom EAs.

In addition to EAs and superb charting/technical analysis tools, BlackBull’s MT4 supports multiple order types and analysis tools. Other noteworthy features/functionalities of the platform are enhanced order execution capabilities and a market watch window.

MT5 is another popular MetaQuotes trading platform, covering slightly different needs than MT4.

MT5’s main strengths are fast order processing, support for advanced pending orders and hedging, as well as a bevy of trading tools and technical indicators.

The version available for download at the BlackBull Markets website comes equipped with more than 30 preinstalled technical indicators, covering more than 20 time frames. The platform also features an integrated economic calendar to help with fundamental analysis.

Traders looking to access MT5 need to talk with the BlackBull Markets support first and obtain permission.

The BlackBull Markets Web Trader is a simplified version of the MT4 platform. Its trading interface is intuitive, and it offers a great selection of drawing tools and technical indicators.

According to the broker, its Web Trader delivers all the benefits of MT4, in a highly compatible no-download package.

TradingView

BlackBull Markets clients can now(August 2022) trade 26,000+ instruments directly in TradingView while taking advantage of its extensive features, indicators, and social network of investors.

TradingView is used by over 30 million investors world wide, and caters to both beginner and expert traders offering a free account option to get started.

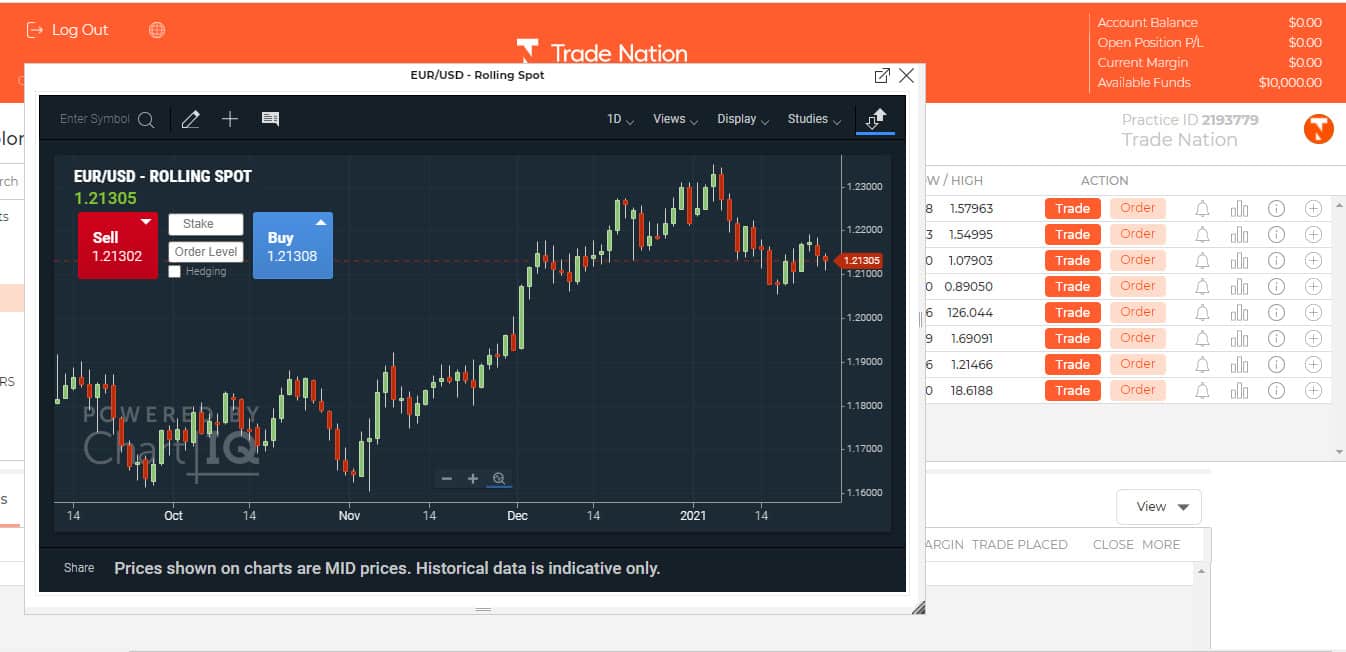

7. Trade Nation Trading Platform

Trade Nation’s bespoke trading platform is the embodiment of simplicity. According to the broker, it features everything traders need and nothing they do not.

Signing up for a practice account takes a few seconds. On a computer, the app launches through a browser, presenting a simple, almost barren trading interface.

On the left, there is a section presenting the tradable asset categories. Using the search tool, traders can look for their preferred tradable assets. The main section taking up most of the interface features a wide range of information on the listed assets. Using this interface, traders can gain a quick idea about the price of the asset, the direction of the price change, and the daily lows and highs. Users can open trades and orders directly from this interface.

They can also:

- Check additional information on trading hours, margin requirements, commissions, spreads, market expiry, etc.

- Set trading alerts with just a couple of clicks.

- View charts.

- Create watch lists and add assets to them.

Charting is surprisingly powerful. As traders click on the chart icon of their preferred asset, the platform opens a new window. This window can then be maximized.

The chart supports scores of technical indicators and time frames. An impressive number of drawing tools are also available. Launching trades is possible directly from the charts.

8. XTB Trading Platform

As mentioned, XTB supports two day trading platforms (three if we count the mobile app): MT4 and XStation5.

MT4

MT4 is a great centrepiece for every online trading operation. It is proven, people love it and it offers superb trading tools. XTB’s version of MT4 is no exception either. It comes with scores of technical indicators and drawing tools. It aids technical trading in several ways. Among its special features are:

- A chart pattern recognition tool. With this tool, traders can define Stop-Losses and Take-Profits. They can also set entry- and exit points for their trades, quickly and easily.

- The Strategy Tester is another superb addition. It allows traders to back-test their trading strategies and thus to fine-tune them.

- Custom indicators. The platform lets traders create and purchase custom indicators. Installing these indicators is quick and simple.

Those looking to trade at XTB through MT4 can download the software for free. There is also a free browser-based option available.

XStation5

The XStation5 is the proprietary day trading platform of the broker. It is an award-winning piece of software. XStation5 supports a massive range of tradable assets – more than MT4. It is also easy on the eyes.

The platform offers outstanding execution speeds, scores of drawing tools and a superb selection of technical indicators.

XStation5 is available in a web-based and mobile app format. The two versions look similar. The web-based one does not require downloading. It works well with all the major browsers.

To sum it up:

- XStation5 lets traders buy and sell more than 4,000 tradable assets. FX, as well as a wide range of CFDs, are available on a single platform.

- The featured charts are clear. They lend themselves well to technical analysis.

- Users set SLs and TPs directly on the charts. There is a built-in trading calculator, which details potential profits and losses.

- The online broker maintains a team of professional traders. This team shares tips and trading signals with users. An Economic Calendar also helps with fundamental analysis.

- The sentiment indicator offers a glimpse into how your peers trade a given instrument.

Both platforms support real money- as well as Demo accounts for paper trading.

What Is an Online Trading Account?

An online brokerage account is a convenient and accessible way to trade and invest in financial assets. Opening trading accounts online are easily funded by transferring money from your bank account.

Once your account is set up and funded, you gain access to the brokerage’s online platform for day trading. This platform serves as your gateway to the financial markets, providing real-time market data, research tools, and the ability to place trades. You can buy and sell a variety of assets, such as stocks, bonds, mutual funds, and more.

How Does an Online Trading Account Work?

Your online brokerage account allows you to manage your investments, track performance, and access account statements. It provides a comprehensive overview of your holdings, cash balance, transaction history, and portfolio value. You can monitor the performance of your investments, track gains and losses, and assess the overall health of your portfolio. Some brokerages even offer advanced features like portfolio analysis tools and customisable alerts to help you make informed investment decisions.

What Factors are Important When Choosing the Best Online Trading Platform?

1. Security of Funds and Personal Information

Security is a paramount consideration when choosing a web trading platform. Protecting personal information and funds from cyber attacks should be a top priority for beginners and advanced traders. Look for platforms that prioritise security by implementing strong encryption protocols, such as SSL/TLS encryption, to safeguard data transmission. Two-factor authentication adds an extra layer of protection by requiring a secondary form of authentication, like a unique code generated on a mobile device.

Another crucial security feature is the practice of maintaining segregated client accounts, keeping client funds separate from the platform’s operational funds. Ensure the platform has obtained authorisation from a reputable financial authority and complies with regulatory standards. A secure platform is not a luxury but a necessity to safeguard your investments and financial well-being.

2. User-Friendly Interface

A user-friendly platform allows for immediate order placement and trade closure, often featuring one-click trading and efficient stop-loss management. Additionally, it should offer various order types and limits to cater to individual trading preferences.

A great trading platform not only provides essential functionalities but also offers additional charts and tools in a simple and accessible manner. It should have an intuitive interface that enables quick navigation, particularly for beginner investors. The platform’s design should optimise efficiency and ease of use, ensuring a seamless trading experience. Are there options to sync with day trading apps?

Think of a web trading platform as your window to the financial markets. The user interface should be intuitive, responsive, and free from clutter. Similar to a well-designed car dashboard, where controls are readily accessible, a trading platform should help with buying and selling stocks, analysing markets, and managing your account with ease.

Furthermore, customisation options are worth considering. Can you personalise the platform to suit your specific needs? The ability to set up alerts, customise charts, and arrange your workspace according to your preferences can significantly enhance your trading experience. Look for a platform that empowers you to make it your own.

3. Reliability

When selecting a trading platform, reliability becomes a crucial factor. A day trader should look for a platforms that remain stable and perform without crashes, especially during critical market moments or global economic events. This stability is vital for successful trading, particularly for an aggressive day trader who frequently engages in large trades. On the other hand, passive traders have more flexibility as they don’t actively monitor the markets.

To ensure consistent access to global markets and accurate trade execution, researching the platform’s historical uptime and downtime records is essential. A platform with a high uptime percentage indicates minimal disruptions and reliable service during trading hours. Reputable platforms employ redundant systems and backup measures to mitigate technical failures and unexpected events, providing uninterrupted service to traders. Moreover, the chosen platform should be recognised for its reliable and fast trade execution, minimising slippage and maintaining low latency. Trade execution delays or inaccuracies can have a significant impact on trading outcomes for both beginners and advanced traders.

4. Customer Service

In the dynamic world of trading, unexpected issues can arise, and having reliable support becomes crucial. Therefore, seek platforms that offer round-the-clock customer support to address any concerns promptly. Assess their response time and the various communication channels they provide, such as live chat, email, or phone.

However, it’s essential to recognise that effective customer support goes beyond problem-solving. It also involves preventing potential issues. A platform that proactively educates and assists a day trader in navigating potential challenges demonstrates a commitment to customer satisfaction.

5. Trading Fees

When choosing a trading platform, it’s crucial to consider the average trading costs associated with it. Look for a platform that offers a balance between providing a quality trading experience and charging reasonable trading fees. Commission free trading is rare, but other factors such as spreads, deposit and withdrawal fees, inactivity fees and other trading or custody fees should be considered. Transparency in fee structures is essential to avoid hidden costs. Additionally, evaluate the cost of not trading, as some platforms impose inactivity fees. Make an informed choice that aligns with your budget and trading preferences.

6. Range of Trading Tools

When selecting a trading platform, it’s important to consider the range of instruments it offers. Your trading preferences may evolve over time, so a flexible platform that caters to different asset classes is beneficial. A good trading account offers a variety of trading options, providing a diverse selection of financial instruments such as forex, commodities, and equities.

The trading tools provided by the platform should align with your trading strategy and style, making your trading experience smoother. Look for platforms that are customisable, allowing you to personalise them according to your preferences. It’s worth noting that some platforms specialise in specific areas, such as futures trading with Plus500.

7. Educational and Research Resources

Look for platforms that offer a range of educational materials, market analysis, news updates, and other resources to support informed trading decisions. A good platform invests in your growth as a day trader by providing webinars, tutorials, articles, and market analysis. Prioritise platforms that not only serve as trading arenas but also act as learning hubs, offering valuable tools and resources to enhance your trading skills and knowledge. By selecting a platform that emphasises education, you can improve your trading abilities and increase your chances of success in the markets.

8. Functionality and Extra Features

When choosing a trading platform, the type of order execution and execution speed are crucial factors to consider. This becomes particularly significant in foreign exchange markets where currency market price can fluctuate rapidly. Even slight changes in pips can lead to substantial losses, especially when trading large volumes.

In addition to order execution, it’s important to assess the range of features supported by the trading platform. Having access to a diverse selection of timeframes, technical indicators, and graphical objects is essential foe a day trading strategy. A reliable platform will even provide the ability to test new trading features and strategies before risking real money.

It’s also important to explore the additional features offered by the trading platform. Having a wide range of tools and resources at your disposal enhances your trading experience and decision-making. Look for a platform that provides a comprehensive selection of timeframes, technical indicators, and graphical objects to support your trading analysis. Furthermore, a platform that allows you to practice and experiment with new trading features and strategies before using real funds can be highly beneficial. Does the platform offer use of a demo account for paper trading?

These points have all been considered with the rankings given above.

How Much Money is Required to Start Investing?

Gone are the days when a significant amount of money was required to enter the world of investing. With the emergence of online brokerages and fractional share investing, the minimum investment threshold has vanished. You can now start investing with any amount of money, thanks to the availability of accounts with no required minimums and access to fractional shares.

While it’s true that you can invest even $1 in fractional shares of a specific stock, it’s important to consider your approach when working with limited capital. For those with smaller sums, utilising ETFs (Exchange-Traded Funds) can be a wiser strategy. ETFs, particularly index tracking ETFs, provide greater diversification for your dollar since each share (and fractional share) replicates an index composed of numerous companies from various industries.

Options

Another consideration, albeit one best suited for risk capital rather than your entire investment capital, is using options to leverage your dollars for a directional bet on the stock market or a specific stock. However, this approach requires careful consideration and understanding of options trading.

When stock market investing with limited funds, consistency becomes paramount in building wealth. Even if you can only allocate a small amount, such as $10 per week, regularly contributing to the market can yield surprising results over time. This consistent approach also helps smooth out the effects of market volatility, as you’ll be buying during stock market dips and peaks.

Do Online Brokers Offer Mobile Platforms?

In today’s fast-paced world, investors increasingly demand convenience and flexibility in managing their portfolios. Recognising this trend, many brokerage firms have stepped up their game by offering mobile platforms to cater to the needs of on-the-go investors. Mobile platforms, typically in the form of smartphone apps, provide a user-friendly interface that allows investors to access their brokerage accounts anytime and anywhere.

These apps often come equipped with robust features, such as real-time market data, customisable watchlists, interactive charts, and the ability to place trades on the fly. Additionally, they may offer research tools, news updates, and portfolio tracking functionalities, empowering investors to stay informed and make timely investment decisions. Whether you are commuting, traveling, or simply prefer the convenience of managing your investments from the palm of your hand, mobile platforms offered by online brokers have become an essential tool for today’s tech-savvy investors.

Is it Possible to Make Losses in a Broker Account?

Investing in a brokerage account comes with its inherent risks, and unfortunately, losses are a possibility. The volatility and unpredictability of financial markets mean that the value of investments can fluctuate, sometimes resulting in losses. Several factors can contribute to these losses, including market downturns, company-specific issues, economic factors, or even unforeseen events. It’s important to note that no investment is entirely risk-free, and even the most experienced investors can experience losses.

However, the extent of potential losses can vary based on factors such as the investment strategy employed, risk tolerance, diversification, and the overall market conditions. Managing risk through diversification, conducting thorough research, staying informed, and having a long-term perspective can help mitigate potential losses.

It’s crucial for investors to understand and accept the possibility of losses when entering the world of brokerage accounts and to make informed decisions based on their risk tolerance and investment goals. Seeking professional advice or utilising risk management tools can also be beneficial in navigating the complex and ever-changing world of investments.

Can You Buy Stocks Without a Broker?

In the past, to trade stocks without a broker was nearly impossible for individual investors. However, with the advent of online day trading platforms and the rise of direct stock purchase plans (DSPPs) and dividend reinvestment plans (DRIPs), it has become more feasible to day trading stocks without the traditional brokerage intermediary with a general investment account.

DSPPs and DRIPs allow investors to buy stocks directly from the company, bypassing the need for a broker. Additionally, some companies offer direct stock purchase options through their websites. Furthermore, the emergence of online peer-to-peer day trading platforms and mobile apps has made it possible to buy and sell stocks directly from other individuals. These platforms often facilitate transactions, provide access to market data, and allow for peer-to-peer communication.

While buying stocks without a broker can offer cost savings in terms of commission free trading, it’s essential to carefully evaluate the platform or service being used, consider any associated fees, and conduct thorough research on the companies before making investment decisions. It’s worth noting that for many investors, especially those seeking expert guidance, convenience, and access to a wide range of investment options, utilising a reputable broker may still be the preferred route.

Is There a Difference Between Investing and Trading?

Investing and trading are distinct approaches in the financial markets. Investors take a long-term perspective, gradually building wealth by purchasing assets expected to appreciate over time. They prioritise fundamental analysis, holding positions for years or decades, often focused on retirement planning.

In contrast, traders pursue short-term profits from price fluctuations, frequently buying and selling various instruments, often on the same day, using technical analysis and market timing. Investing carries lower risk, benefiting from market stability and long-term growth, while there is higher risk due to short-term volatility when you trade stocks. The choice between the two depends on financial goals, risk tolerance, and expertise, with investors seeking steady growth and experienced traders aiming for active, potentially lucrative strategies. Understanding associated risks is crucial when deciding on an approach.

Happy trading!

Please share all the comments you might have on these online trading platforms in the comment field below. Which is the best trading platform in the UK according to you? And would you say that the same platform is also best for beginners?