Have stock markets bottomed?

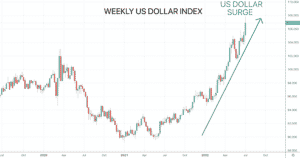

Selling pressure and elevated volatility have been crucial factors that investors have had to endure throughout a bruising year for financial markets in 2022. Anyone that has not been long of the US Dollar or has been unable to short the markets will likely be nursing some fairly hefty losses to their investing account. However, … Continued