Macroeconomic/ geopolitical developments

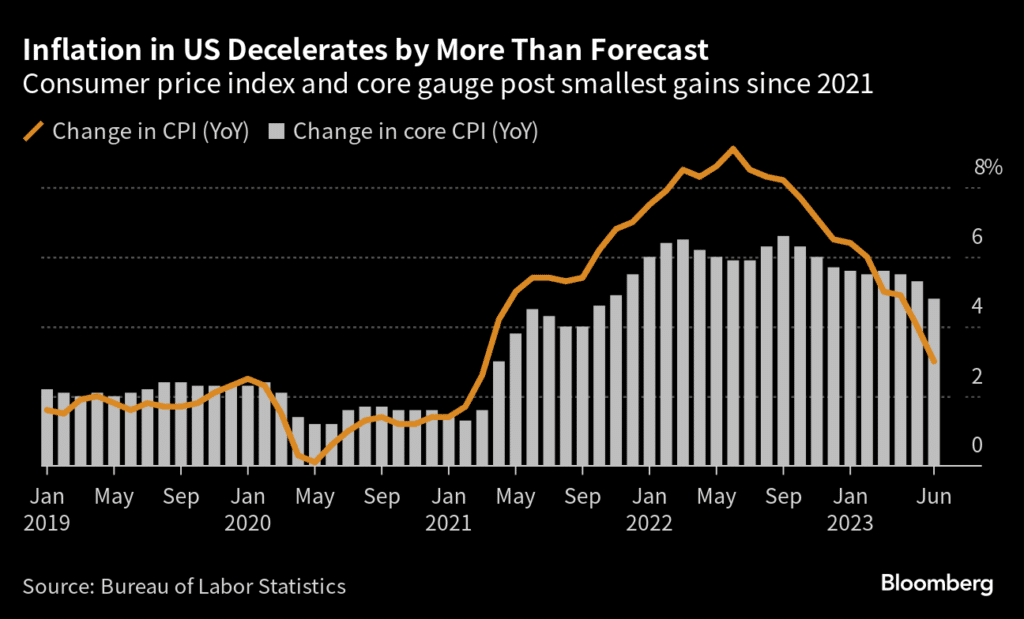

- The big focus last week was the US CPI inflation number released Wednesday, which saw a sharp downside surprise. Headline CPI fell to 3.0% YoY (from +4.0% in May) which was lower than the +3.1% expected. US Core CPI fell to +4.8% (from +5.3%), again lower than the +5.0% forecast.

- This fueled a “risk on” move across global financial markets, with US and global stock averages higher, US and global bond yields lower, a rally in Gold and Oil and a sell off in the US Dollar across the Forex board.

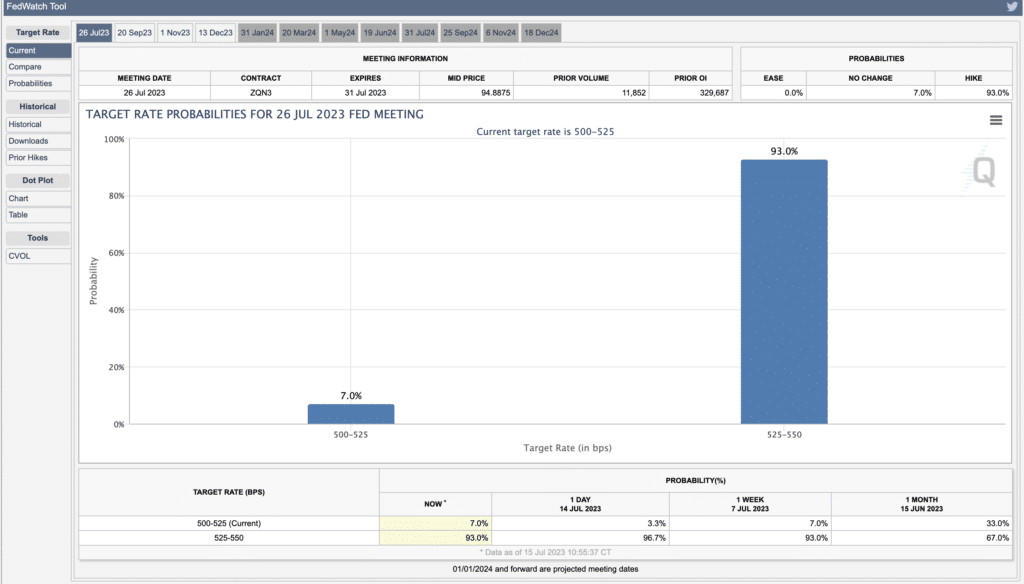

- This has seen expectation now falling for a second US rate hike in 2023, with a July hike expected, but now according to the CME Group FedWatch Tool, now only a 21% chance of a second hike by year-end (at the time of writing).

- Earnings season kicked off in the US reporting for Q2, and Friday saw solid earnings from JP Morgan, Wells Fargo and United Health, which rounded off a strong week for US stocks.

Global financial market developments

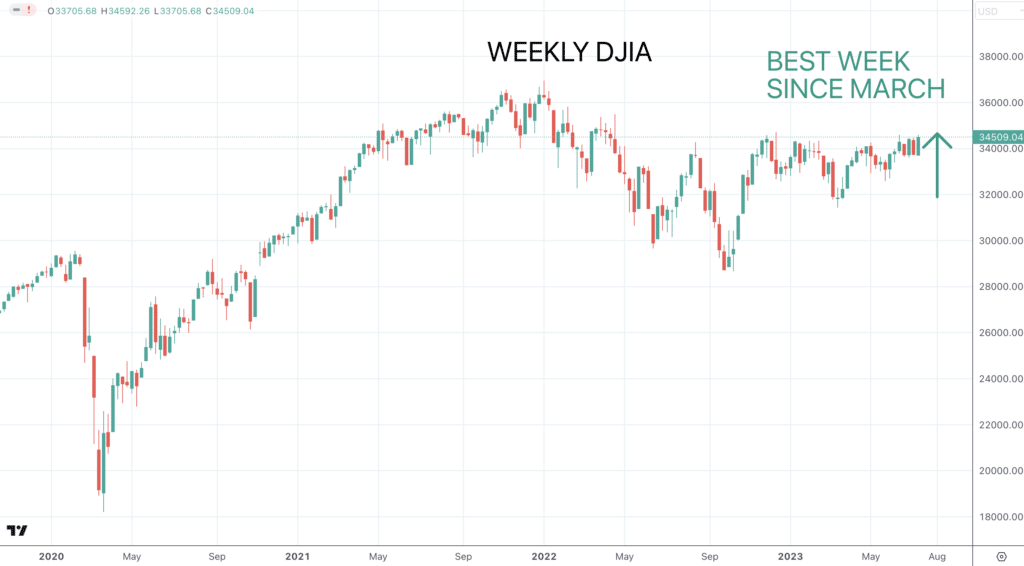

- The major US stock averages were significantly higher last week, as were European and Asian indices.

- The S&P 500 and Nasdaq markets hit multi-month highs, at their highest levels since April. The Stoxx Europe 600 Index and the Dow Jones Industrial Average (DJIA) posted their best weeks since March.

- US and European Bond saw yields very aggressively reverse the prior week’s breakout from the upper end of consolidation ranges, retreating to lower yields from multi-month yield highs.

- The US Dollar Index aggressively plunged to multi month lows.

- Gold rebounded further to secure a basing pattern, aiming higher.

- Oil built on the prior week’s breakout to the upside, now to a new multi-month high.

Key this week

- Central Bank Watch: The Central calendar is extremely light with the FOMC Blackout Period now in place until after the Wednesday July 26 Meeting, we just get the Reserve Bank of Australia (RBA) Meeting Minutes released on Tuesday.

- Macroeconomic data: Industrial Production & Retail Sales for both China and the US are out Monday, whilst we get CPI for Canada, New Zealand and the UK Tuesday and Wednesday.

- Microeconomic/ earnings data: US earnings will likely be in the headlines with the big banks, Bank of America, Morgan Stanley and Goldman Sachs reporting Tuesday and Wednesday, and with Netflix and Tesla out on Wednesday too.

| Date | Key Macroeconomic Events |

| 07/17/2023 | China GDP, Industrial Production & Retail Sales; US Empire State Manufacturing |

| 07/18/2023 | Canadian CPI inflation; US Retail Sales & Industrial Production; New Zealand CPI inflation |

| 07/19/2023 | UK CPI inflation; US Building Permits & Housing Starts |

| 07/20/2023 | Australian Unemployment; US Weekly Jobless Claims, Philly Fed Manufacturing, Existing Home Sales; Eurozone Consumer Confidence |

| 07/21/2023 | UK Retail Sales; Canadian Retail Sales |

| Date | Key Earnings Events |

| 07/17/2023 | n/a |

| 07/18/2023 | Bank of America, Morgan Stanley |

| 07/19/2023 | Goldman Sachs, International Business Machines, Netflix, Tesla |

| 07/20/2023 | Johnson & Johnson, Newmont, Philip Morris International |

| 07/21/2023 | American Express |