Macroeconomic/ geopolitical developments

- Global financial markets reacted to ongoing fears of more hawkish monetary policy in the US, alongside concerns around the spread of the COVID-19 Delta variant globally.

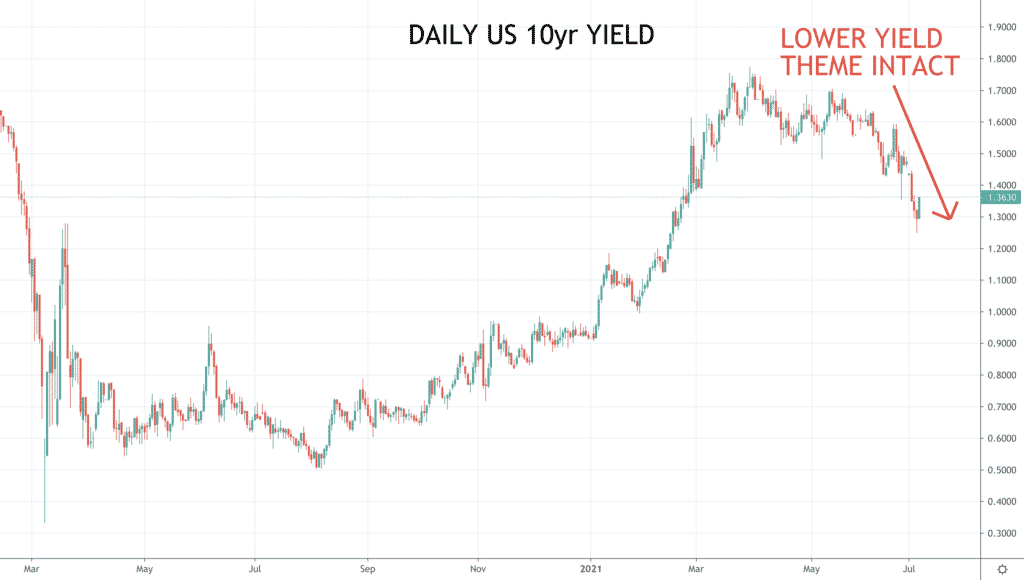

- As we will look at below, this is sent global bond markets higher (to lower yields, led by the US), whilst world stock averages sold off and rebounded.

- Global Markit Services and Composite PMI were broadly better than expectations, but although still at a very positive level, the US ISM Services PMI missed expectations.

- We got the Fed Minutes this week, but this did little to alter the march in US Treasures (and global bond markets) to lower yields.

- Still no agreement on oil production among OPEC+ as the United Arab Emirates continued to object to a deal, leaving Oil prices strong.

Global financial market developments

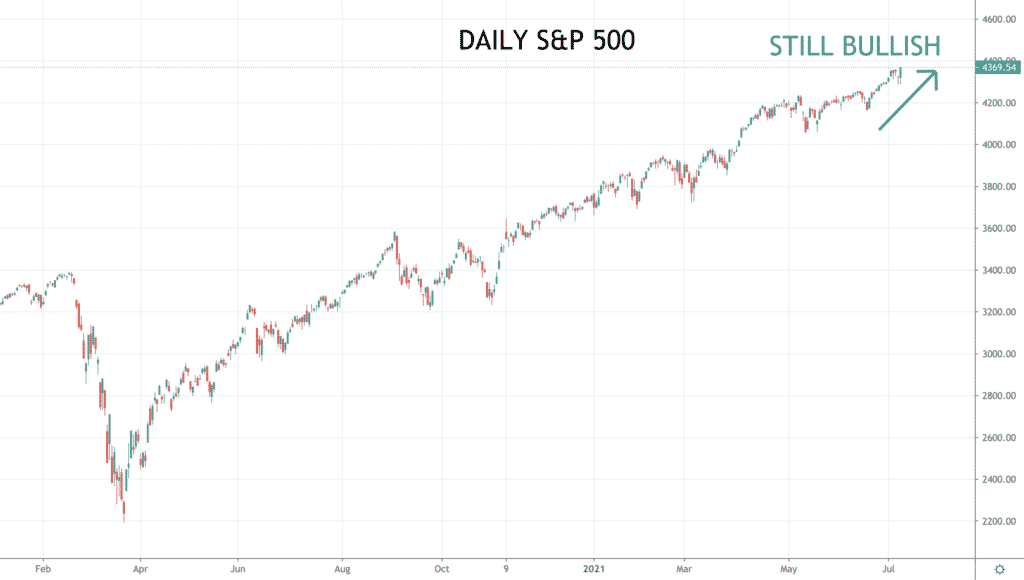

- Global stock averages were erratic, selling off and rebounding through the week, but stayed broadly firm with the US indices making new record highs.

- Global bond markets rallied to lower yields, helped by “risk off” concerns around the Delta variant impact on the global reopening.

- The US Dollar Index was hesitant as it gained then setback last week, highlighting cautioun.

- EURUSD and GBPUSD rebounded from weakness.

- Gold has rallied with the US Dollar weakening.

- Oil dipped and rebounded after its earlier July extension to another new multi-year high.

- Copper was sideways last week but is still trying to base and bounce.

Key this week

- Geopolitics:

- Monitoring the global spread of cases of the COVID-19 Delta variant.

- Watching for lockdown easings in Europe.

- Central Bank Watch: We get the Reserve Bank of New Zealand (RBNZ) and the Bank of Canada (BoC) interest rate decisions and statements on Wednesday. On Thursday, FOMC Chairman Powell testifies to Congress. The Bank of Japan (BoJ) interest rate decision and statement is on Friday.

- Macroeconomic data: Data standouts this week are the Chinese trade data and GDP, inflation (CPI) data from Germany, the US, UK and EU and US Retail Sales.

- Microeconomic data/ earning season: Earning season kicks off in earnest in the US next week with the financial sector, stand outs being Goldman Sachs, Bank of America, Wells Fargo, Citigroup and Morgan Stanley

| Date | Key Macroeconomic Events |

| 12/07/21 | Eurogroup meetings |

| 13/07/21 | China trade data; German CPI; US CPI |

| 14/07/21 | RBNZ interest rate decision and statement; UK CPI; US PPI; BoC interest rate decision and statement |

| 15/07/21 | Australia Employment report; China GDP, Industrial Production and Retail Sales; FOMC Chairman Powell testifies to Congress |

| 16/07/21 | BoJ interest rate decision and statement; EU CPI; US Retail Sales; Michigan Consumer Sentiment Index |