Macroeconomic/ geopolitical developments

- There is a divergence in central banks starting to form. The recent flash PMI data has underscored the issues facing the European economies. Slowing activity data, also weighing on services activity suggests that the restrictive monetary policy is working. This is weighing on the expectations of further hikes by the ECB and Bank of England.

- This lies in contrast with the Federal Reserve which is retaining a hawkish bias in the face of positive activity data. As inflation “remains too high” (Fed Chair Powell at Jackson Hole”) the potential for another rate hike – not yet priced in – is growing, with Treasury yields higher and a USD rally continuing to develop.

- The fallout from the death of Yevgeny Progozhin (Wagner Group leader) is yet to be seen. It could either help to reinforce President Putin or could embolden any ideas of a mutiny. Watch this space!

Global financial market developments

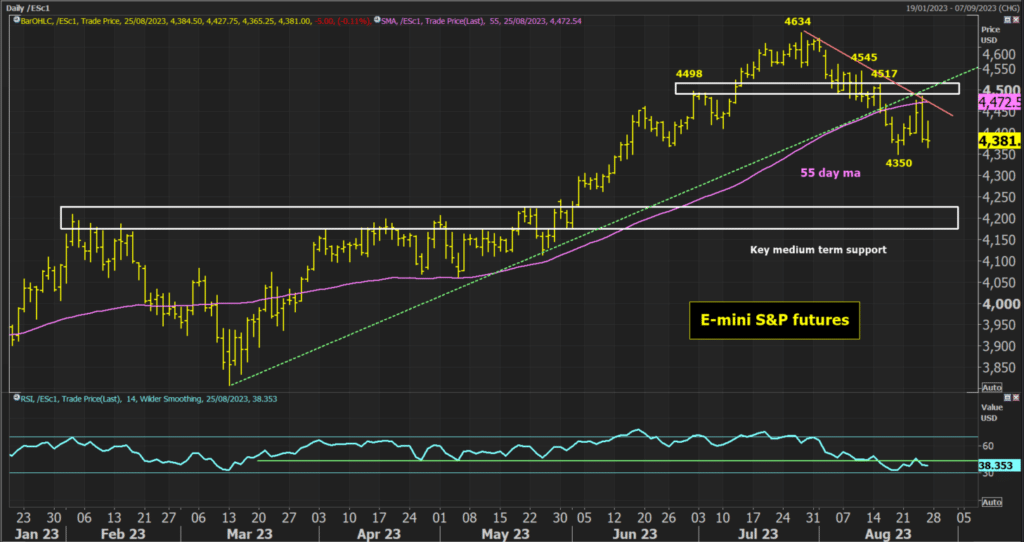

- US Index futures saw a rally in front of Nvidia results fizzle out. The stellar results initially induced a jump in the shares and index futures, but these moves quickly retraced and suggest that rallies in index futures, which have struggled to sustain over recent weeks, remain a chance to sell.

- Key resistance has been left on the e-mini S&P 500 futures at 4485 and opens pressure back on support at 4350. The e-mini NASDAQ 100 futures have a key high at 15418 and the support at 14609 has come back into view.

- The rise in the US 10-year Treasury yield may have retraced from a 15-year high of 4.366% but there is still a sense that yields have further to go higher. The 2-year Treasury yield is back above 5.00% at 8-week highs, and above 5.12% would be a 15-year high.

- The rally in the US Dollar Index has moved decisively above 104.00 and is at its highest since the May high of 104.70.

- Gold futures have seen a rebound from $1884 rolling over around $1920 as the strengthening USD has weighed once more.

- NYMEX Oil futures have fluctuated lower in the past couple of weeks. A rally late last week seems to be faltering once more. If another lower high is left under $82.47 it would put pressure on the $77.62 support. A top pattern threatens a retreat towards $72/$73.

Key this week

- Central Bank Watch: Nothing formal for central banks this week, but Fed speakers will still be eyed, whilst traders will be watching for any signs that the doves are gathering on the ECB Governing Council.

- Macroeconomic data: US Nonfarm Payrolls will be the big focus on Friday, along with the ISM Manufacturing. Eurozone HICP inflation on Thursday could help to determine whether the ECB hikes or not at the September meeting.

| Date | Key Macroeconomic Events |

| 08/28/2023 | n/a |

| 08/29/2023 | US Consumer Confidence, JOLTS Jobs Openings |

| 08/30/2023 | Australian CPI inflation; German prelim CPI; ADP Employment Change, US Prelim GDP, Pending Home Sales |

| 08/31/2023 | China Official PMIs; Eurozone Flash HICP inflation and Unemployment, ECB Monetary Policy Meeting Accounts; US Core PCE and Weekly Jobless Claims |

| 09/01/2023 | China Caixin Manufacturing PMI; Eurozone and UK final Manufacturing PMIs; Canadian GDP (monthly); US Employment Situation (Nonfarm Payrolls and Average Hourly Earnings), US ISM Manufacturing |