- In today’s report we are going to take a technical analysis look at the FAANG shares, Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Google (GOOG, Alphabet).

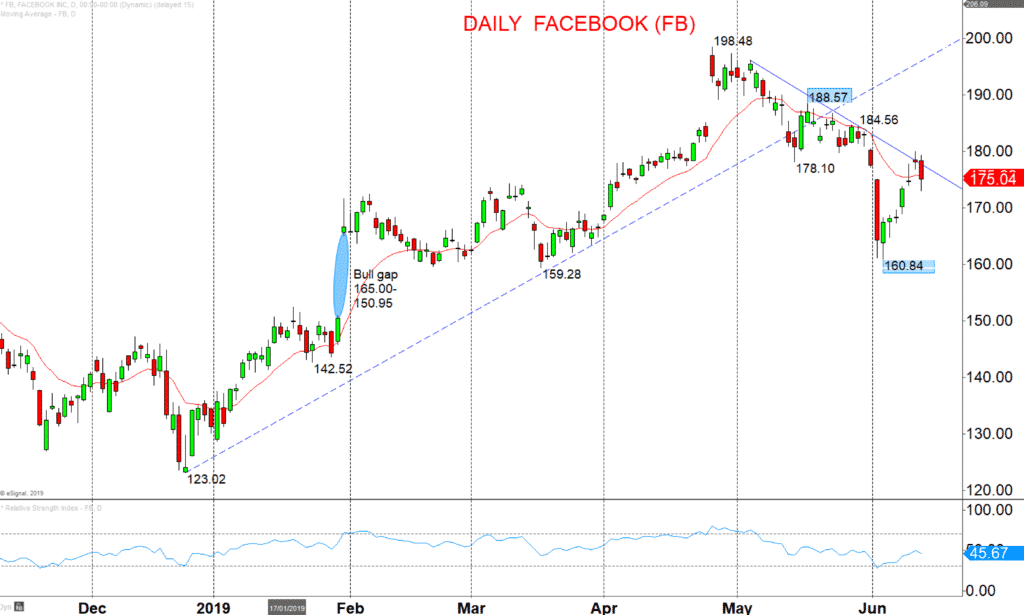

Facebook (FB)

A firm June rebound from above a key March support at 159.28 (from 160.24) has neutralised the intermediate-term bear trend that was set up with the May surrender of the bull trend line from late 2018 and through 178.10.

This leaves an intermediate-term range we see as 188.57 to 160.84, BUT with the June risks skewed towards an intermediate-term bullish shift above 188.57.

Intermediate-term Range Breakout Parameters: Range seen as 188.57 to 160.84.

- Upside Risks: Above 188.57 sets a bull trend to aim for 198.48, 200.00 and the record high at 218.62.

- Downside Risks: Below 160.84 sees a bear trend to quickly target 159.28 and 150.95, then 142.52 and maybe 123.02.

Daily Facebook (FB) Chart

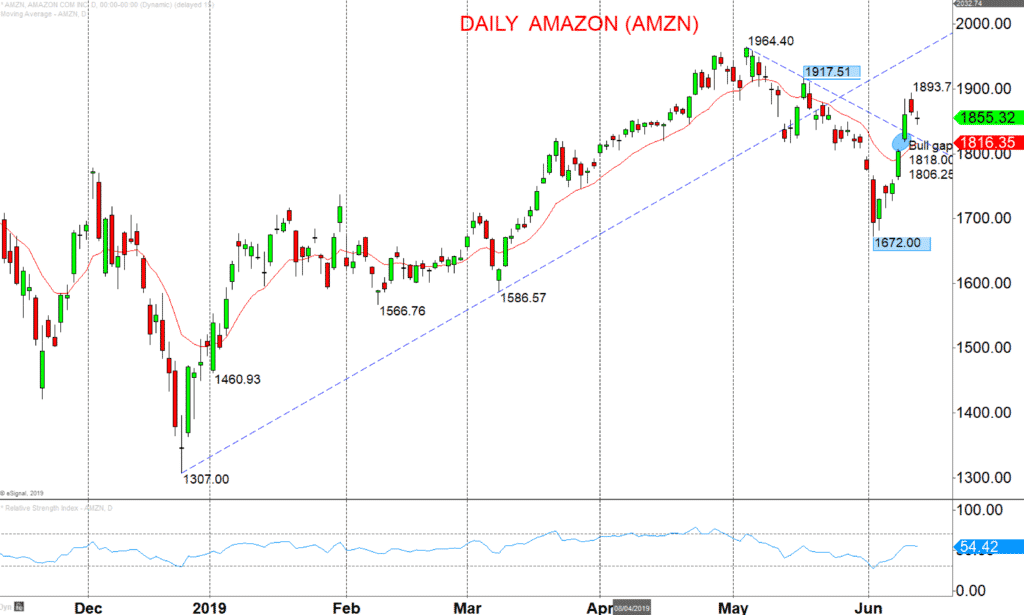

Amazon (AMZN)

A bull gap into mid-June to overcome the down trend line from the May record peak, to neutralise the intermediate-term bear trend that was set by the May plunge through multiple supports from April and March, plus the up trend line from late 2018.

This leaves an intermediate-term range we see as 1917.51 to 1672.00, BUT with the June risks skewed towards an intermediate-term bullish shift above 1917.51.

Intermediate-term Range Breakout Parameters: Range seen as 1917.51 to 1672.00.

- Upside Risks: Above 1917.51 sets a bull trend to aim for 1964.40, 2000.00 and the record peak at 2050.50.

- Downside Risks: Below 1672.00 sees a bear trend to target 1586.57/1566.76, 1460.93 and maybe 1307.00.

Daily Amazon (AMZN) Chart

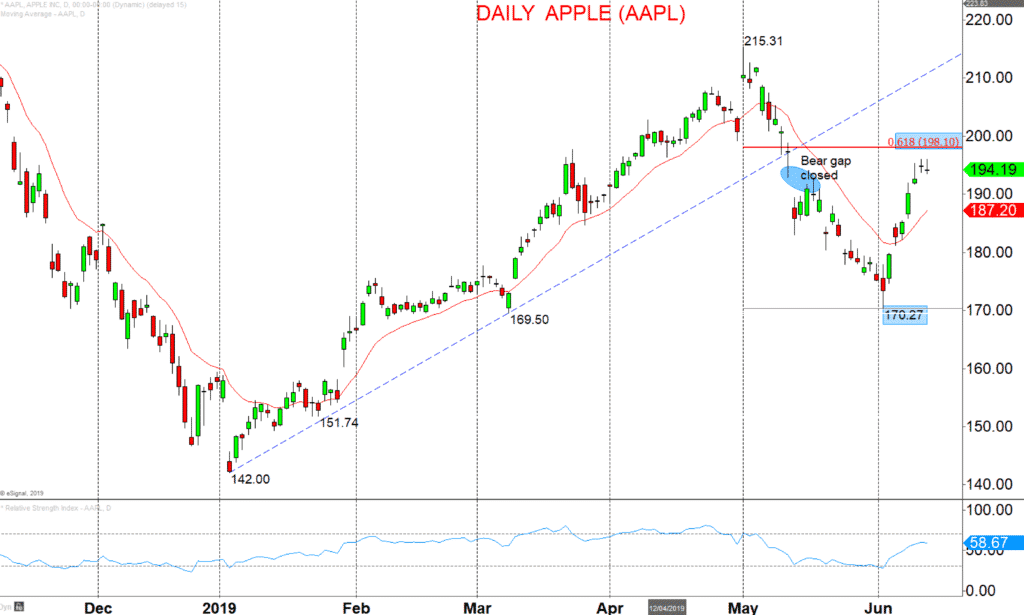

Apple (AAPL)

A strong June rally driven by bullish gaps, to close the early May runaway bear gap, building on the defence of the key March swing low at 169.50, bouncing from 170.27 in early June.

This recovery activity in June has neutralises the intermediate-term bear theme from the May plunge through the 2019 bull trend line and other supports from April/March.

This leaves an intermediate-term range we see as 198.10 to 170.27, BUT with the June risks skewed towards an intermediate-term bullish shift above 198.10.

Intermediate-term Range Breakout Parameters: Range seen as 198.10 to 170.27.

- Upside Risks: Above 198.10 sets a bull trend to aim for 215.13, the all-time high at 233.37 and maybe towards 260.75.

- Downside Risks: Below 170.27 sees a bear trend to target 151.74 and 142.00.

Daily Apple (AAPL) Chart

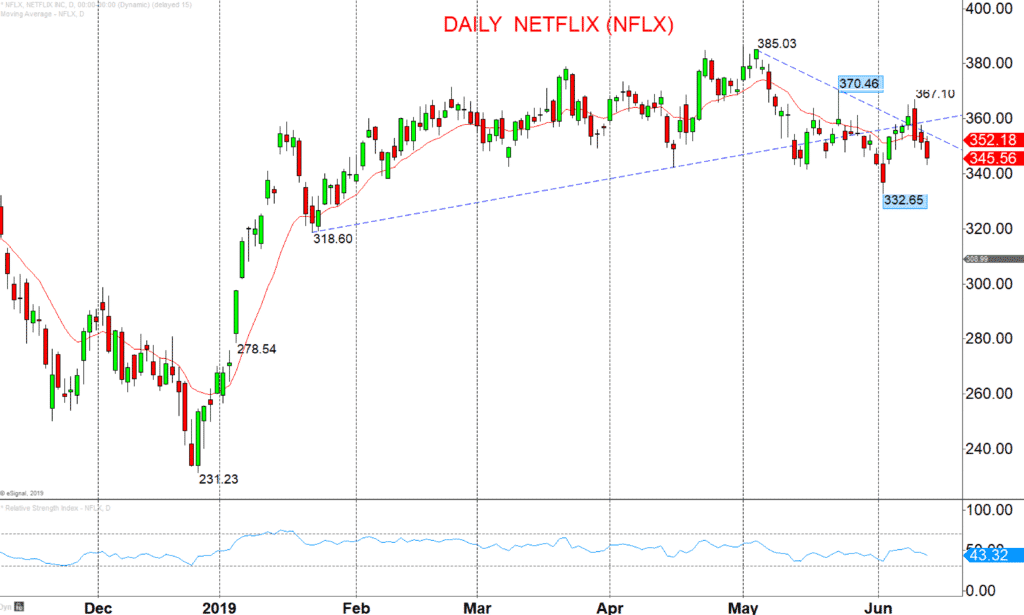

Netflix (NFLX)

An erratic consolidation theme has developed from mid-May since the reversal below the tentative topping trend line from early 2019.

This leaves an intermediate-term range we see as 370.46 to 332.65, BUT with the June risks skewed towards an intermediate-term bullish shift above 370.46.

Intermediate-term Range Breakout Parameters: Range seen as 370.46 to 332.65.

- Upside Risks: Above 370.46 sets a bull trend to aim for 385.03, the record high at 423.21 and 450.00.

- Downside Risks: Below 332.65 sees a bear trend to target 318.60, 278.54 and maybe 231.23.

Daily Netflix (NFLX) Chart

Google, Alphabet (GOOG)

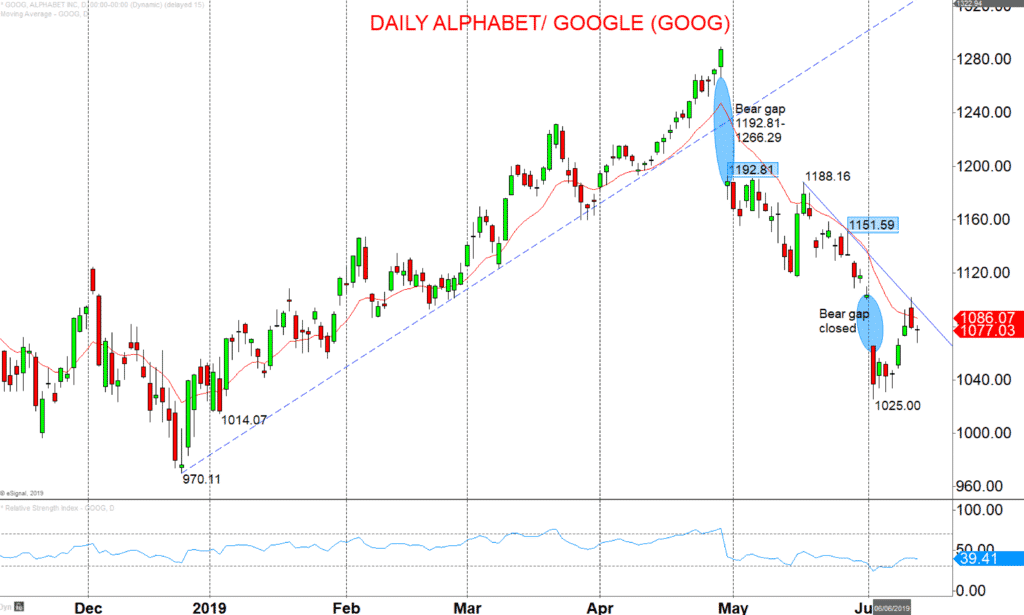

A very aggressive bear gap at the end of April at 1192.81 to 1266.29 (due to disappointing Q1 revenue numbers) through the bull trend line from December 2018 and then in May through various Q1 supports, to establish a bear trend.

Although the June rebound has somewhat eased the intermediate-term bear forces, a move above 1151.59 is required to neutralise this bear theme.

Intermediate-term Outlook – Downside Risks: Whilst below 1151.59 see a downside risk back to 1025.00.

- Lower targets would be 1014.07 and 970.11.

- What Changes This? Above 1151.59 shifts the intermediate-term outlook back to neutral; above 1192.81 is needed for an intermediate-term bull theme.

Daily Alphabet, Google (GOOG) Chart