Macroeconomic/ geopolitical developments

- Last weekend, UBS agreed to buy Credit Suisse after increasing its offer to more than 3 billion Swiss Francs, just over $3 billion.

- But this included Swiss authorities writing off $17 billion worth of Credit Suisse’s Additional Tier 1 (AT1) debt, but markets did not appreciate this development and Banking Bonds and stocks plunged on the Asian and European openings last Monday, despite the UBS/ Credit Suisse rescue.

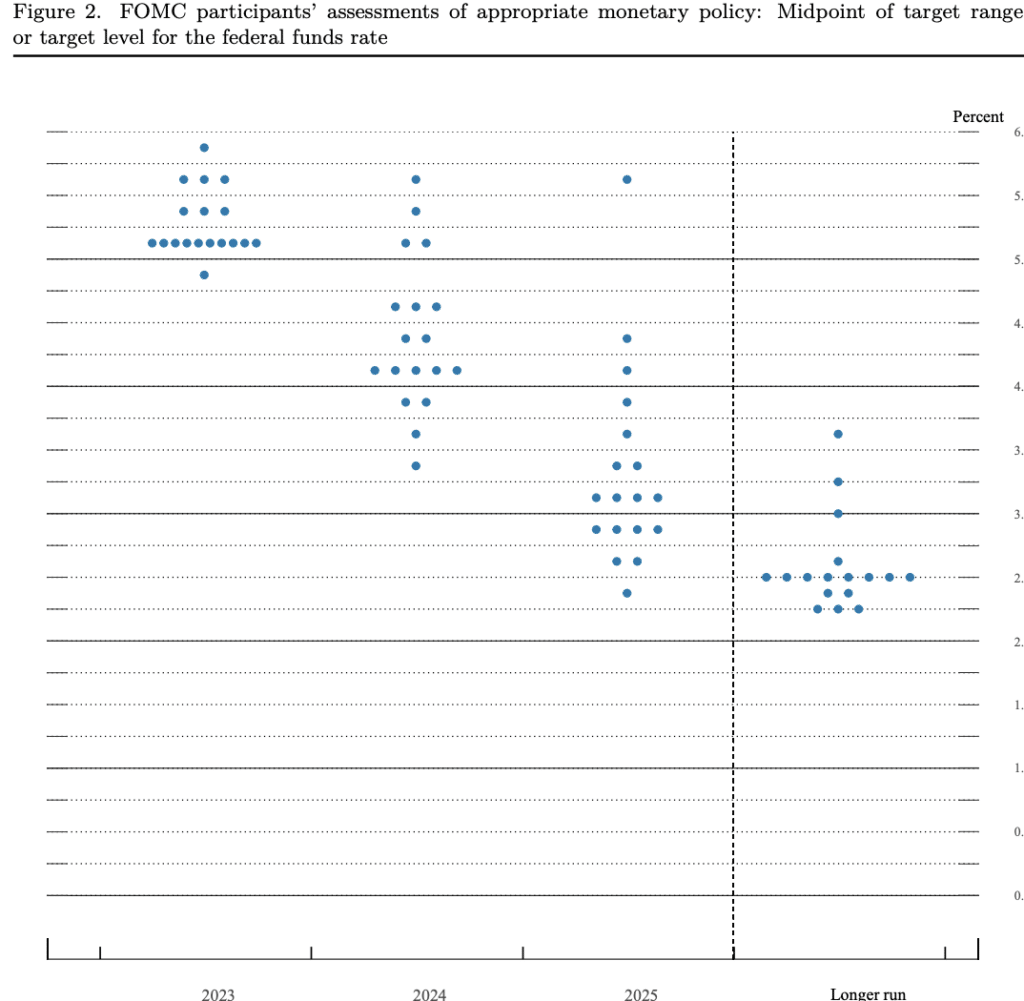

- The Fed raised rates by 0.25%, and the “dot plot” chart indicated that officials expected to stop raising rates after one more hike in May. But Jerome Powell seemed to rule out rate cuts in 2023, stating that Fed officials “don’t see rate cuts this year—they just don’t.”

- However, the CME FedWatch tool continues to show futures and interest rate markets are still pricing in significant rate cuts this year, particularly after the market movements on Friday (see below).

- The Bank of England raised interest rates for the 11th consecutive time, increasing from 4.00% to 4.25% after earlier in the week UK YoY CPI rose to 10.4% in February, significantly above the consensus expectation.

- S&P Global’s eurozone composite Flash PMI hit a 10-month high in March at of 54.1, up from 52 in the previous month and notably higher than the consensus forecast of 51.9.

- Deutsche Bank shares plunged Friday after already falling through the week, after a spike in Credit Default Swaps (CDS) in the German bank, which are the cost of insuring against its default.

- This sent the entire banking credit and equity markets into a tailspin on Friday, pulling European averages lower and seeing a broad move into safe havens and “risk off” sentiment dominated.

Global financial market developments

- The major US stock averages rebounded further last week, despite the turmoil in the banking sector.

- European indices were extremely choppy last week, but actually end the week higher; despite the notable losses to the banking sector Friday.

- US and European Bond surged to higher prices and lower yields in the wake of banking crisis fears, with the US and German 10yr yield hitting multi month yield lows.

- Forex markets saw increased volatility last, with the US Dollar initially weakening, but then recovering as a safe haven at the end of the week.

- The Japanese Yen has been the strong currency for the past three weeks as the ultimate flight to quality currency.

- Gold push still higher to a 2023 and multi-month high, as the ultimate safe haven!

- Oil pushed to another 2023 and multi-month low, as fears continue to grow for a slowdown in the global economy in the wake of the financial sector worries.

Key this week

- Geopolitical: Shift to Daylight Saving Time in the UK and EU on 26/03, the UK/ Europe are now back to the usual time differences to the US.

- Central Bank Watch: Nothing of note, but watching for Fed Speakers

- Macroeconomic data: A light data week, with the main data loaded towards the end of the week, we get German CPI, US GDP and PCE on Thursday and then Japan CPI; China PMI; UK GDP; German Retail Sales and Unemployment; EU CPI; US PCE; Michigan Consumer Sentiment Index on Friday.

| Date | Key Macroeconomic Events |

| 27/03/23 | Shift to Daylight Saving Time in the UK and EU on 26/03/23; German IFO |

| 28/03/23 | Australian Retail Sales |

| 29/03/23 | Australian CPI |

| 30/03/23 | EU Consumer Confidence; German CPI; US GDP and PCE |

| 31/03/23 | Japan CPI; China PMI; UK GDP; German Retail Sales and Unemployment; EU CPI; US PCE; Michigan Consumer Sentiment Index |