Macroeconomic/ geopolitical developments

- Four weeks now since the March banking crisis without any notable contagion, as fears of a more protracted, deeper financial meltdown continue to ease.

- But, as the banking crisis has eased, this has subsequently pulled yields higher across the US Treasury curve, notably at the front end

- Interest rate markets as highlighted by the CME FedWatch tool are shifting closer to views implied by Fed speakers, which is for “one and done”, another rate hike in May and then a pause, with no further hikes for the year.

- However, the interest rate markets continue to price in rate cuts later in 2023.

- Key data last week were the global Flash PMIs from S&P Global, which continue to show an improving trend, with April Service data surprising to the upside, although Manufacturing data disappointed.

- On the earnings side, initial optimism from the banks has waned, as last week saw some significant companies disappointing, notably Tesla, announcing a sixth price cut already this year.

Global financial market developments

- The major US stock averages marked time last week, but with an underlying positive theme from the March rally.

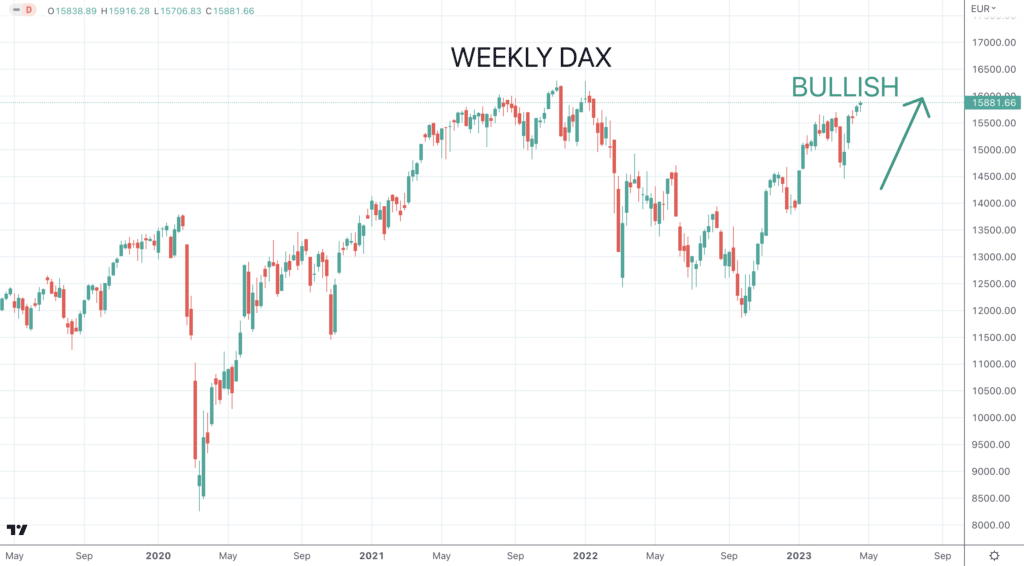

- European indices probed higher, building on the March recovery.

- US and European Bond pushed to higher yield territory, sustaining a higher yield bias.

- The US Dollar Index was sideways but remains vulnerable after hitting a multi-month low in mid-April.

- Gold sold off from another new 2023 and multi-month high in mid-month, rejecting an immediate challenge to record levels.

- Oil prices sold off from a multi-month high in mid-April, pushing into the bull gap from the early April surge, after the announcement of supply cuts by OPEC+.

Key this week

- Central Bank Watch: The Fed moves into its blackout period, the Bank of Japan (BoJ) interest rate decision Friday is the only significant central bank event this week.

- Macroeconomic data: US data focus is on Consumer Confidence and Durable Goods Tuesday and Wednesday, then GDP and Personal Consumption Expenditure (PCE) Thursday and Friday.

- Earnings Season: US earnings season continues to unfold with standouts being GE, Alphabet, Microsoft, Boeing, Meta, Caterpillar and Intel.

| Date | Key Macroeconomic Events |

| 24/04/2023 | German IFO Survey |

| 25/04/2023 | US Consumer Confidence, US New Homes Sales |

| 26/04/2023 | Australian CPI, US Durable Goods |

| 27/04/2023 | EU Consumer Confidence, US Advance GDP and PCE |

| 28/04/2023 | Bank of Japan interest rate decision and statement, German Unemployment, GDP and HICP (inflation), US Core PCE, Canada GDP |