Macroeconomic/ geopolitical developments

- A third successive week with an absence of any notable developments or contagion from the March banking crisis, as fears of a more protracted or deeper financial meltdown have eased further.

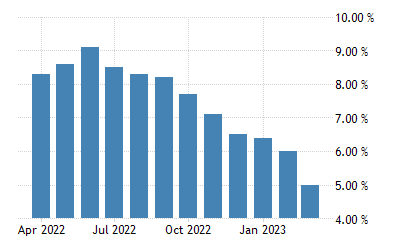

- Key data last week was the US CPI inflation numbers released on Wednesday, which printed at 0.1% for March, with expectations for 0.2%, taking the year-over-year rate to 5.0%, the slowest pace since May 2021.

- The main Central Bank event was also on Wednesday after the CPI data when the FOMC Minutes were released. The Minutes showed that the Fed now expects that the recent banking crisis will cause a US recession in 2023, but that still higher rates are required to combat inflationary forces.

- US earnings season kicked off in earnest on Friday with the financial sector, JP Morgan, Wells Fargo, BlackRock and Citigroup all reported, predominantly beating consensus estimates.

Global financial market developments

- The major US stock averages were notably higher last week, reinforcing a positive theme from the March rally.

- European indices higher too, building on the March recovery with the French benchmark index, the CAC 40 hitting a new record peak.

- US and European Bond pushed to higher yield territory, setting a higher yield bias.

- The US Dollar weakened again, hitting a multi-month low.

- Gold pushed up to another new 2023 and multi-month high, edging towards record levels.

- Oil prices probed higher after a week of consolidation to a multi-month high, building on the early April surge, after the announcement of supply cuts by OPEC+.

Key this week

- Geopolitical events: Easter Monday holiday on 10th April, UK and European bond and stock markets are closed, US markets are fully open.

- Central Bank Watch: Tuesday we get the Reserve Bank of Australia (RBA) Minutes released, Thursday brings the People’s Bank of China (PBoC) interest rate decision and we have various Fed speakers through the week.

Macroeconomic data: US data is light the coming week, but we do get Canada, UK and EU CPI, plus China GDP, UK Employment and Retail Sales, but standout data for the week is probably the global Flash PMI from S&P Global on Friday

- Earnings Season: US earnings season continues to unfold with J&J, Bank of America, Netflix, Goldman Sachs, Tesla, ASML, Morgan Stanley, and P&G all reporting.

| Date | Key Macroeconomic Events |

| 17/04/23 | Nothing of note |

| 18/04/23 | RBA Minutes; China GDP; UK Employment report; German ZEW Survey; Canada CPI |

| 19/04/23 | UK CPI; EU CPI |

| 20/04/23 | PBoC interest rate decision |

| 21/04/23 | UK Retail Sales; global Flash PMI from S&P Global; Canada Retail Sales |