The AIM index has always been a poor performer. It’s the star players you need to keep an eye on.

As a long-term investor in small cap FTSE AIM shares, I would say that sentiment on the UK’s growth index feels a tad negative. Maybe it’s just me?

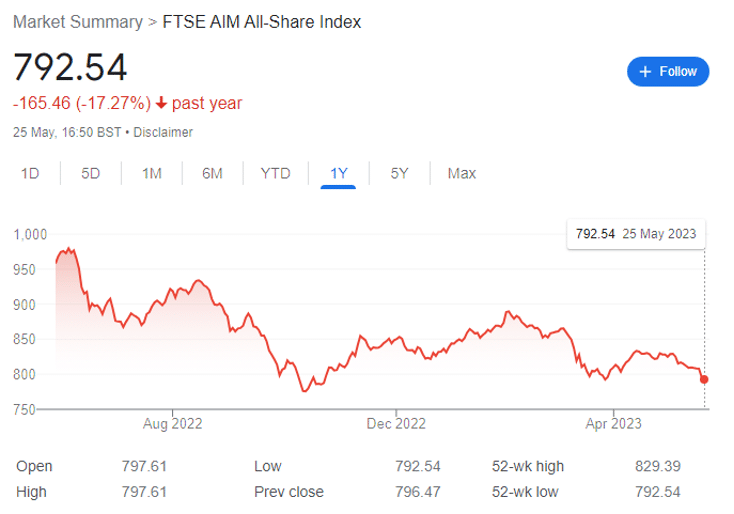

The index is down 17.3% over the past year, 6.9% in the past six months, 5.5% year-to-date, 3.6% over the past month, and 2.4% over the past five days. That’s not a pretty picture.

Meanwhile, the blue chips are having a wonderful 2023.

The FTSE 100 is slightly up even after distributing all those wonderful dividends, while the S&P 500 is up 8.6% — mostly because Nvidia is operating in a bubble of epic proportions. The ASX 200 is up 2.8%, the CAC 40 9.6% (thank fashion), the DAX is 12.3% up, and the Nikkei 225 has risen by an epic 19.8% as investors pile into Japan without considering the ramifications of the eventual central bank pivot when the ultraloose monetary policy starts to turn toxic.

But essentially, unless you invested in the Hang Seng — which would have required specifically not researching a thing — any investment made at the start of this year in a blue chip index is up.

I’ve noted before that the S&P 500 alone has delivered circa 10% annual returns since its inception in 1957. The question, therefore, for would-be investors is whether the high-risk, high-reward AIM market is worthwhile. Bear in mind, that this is all subjective opinion and not financial advice.

I’d contend that even now, there are some serious gains to be made. You just have to pick the right stocks. When you can buy thousands of shares for pennies, you get the chance to see explosive growth. And picking the right stocks isn’t hard if you have the time to research them properly — which I do.

In fact, it’s one of the biggest advantages on AIM; blue chips are covered by dozens of analysts such that gaining an informational advantage is essentially impossible. AIM shares like PREM, HARL, BOIL etc are barely covered anywhere. This means when the shares are trading low, I can conduct the research, buy in, and simply wait for the rise.

Of course, it’s a little more complicated than that. Let’s take my top four AIM picks for 2023.

This year:

- PREM —high 1p, low 0.49p, current 0.58p

- AVCT — high 185p, low 107p, current 108p

- BOIL — high 0.25p, low 0.09p, current 0.09p

- HARL — high 20.6p, low 12.75p, current 14.14p

Now as a deep value investor, I bought shares in all four of these companies a long time ago when shares were changing hands for far less. But I could have sold near the top and I haven’t.

Why?

Because AIM isn’t about trying to make 100% returns. If you want high-risk, high-reward and your mindset is limited to doubling your investment, then it’s far easier to walk into any casino and bet it all on black. But if you do this more than a couple of times, you will almost certainly lose. AIM offers the chance to generate far more sizeable returns — and crucially, the best AIM shares don’t come with a timescale. You simply don’t know when the rocket might be lit.

PREM might sell ZULU at any time. AVCT could be bought out at any time. BOIL could be bought out at any time. And HARL — why HARL appears fundamentally undervalued by a sleepy market.

This means that unless you’re trading the AIM market on leverage — which I contend is close to gambling and very tax-inefficient — you have to buy and hold with conviction. My SIPP is where I get my reliable blue chip investments, but AIM is where I might get to retire early.

100% returns bore me. 200% returns aren’t going to get me to where I want to be. 1,000% is where it starts to get interesting, and you won’t see this level of return in a blue chip. They simply don’t have the capacity for growth.

But you pay for this potential growth, because if you diversify into every AIM share by buying an AIM index tracker, you are almost guaranteed to lose money — the polar opposite of blue chip indices. It’s actually quite simple to understand; if the AIM index is down more than 17% in the past year and yet some stocks have seen fivefold returns, then those doing badly are doing seriously badly.

Now is investing in the AIM market particularly awful in 2023? Not really. Look at the performance, even over the past five years. The index itself is a disaster — but individual companies can still be the meal ticket to generating serious wealth.

Of course, high risk, high reward cuts both ways. If you are serious about serious returns, you must be prepared to accept sizeable losses. I offset this through stable SIPP contributions — and I also have more discretionary income than most people.

The key point is that if you’re in, you need to stay in. And if you can’t do that, you should stay out altogether.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.