Macroeconomic/ geopolitical developments

- Increasing worries of global inflationary pressures and fears of even higher interest rates from the major Central Banks have seen a more aggressive shift to a “risk off” phase through mid-January.

- These concerns have been heightened by the threat of conflict as Russia continues to amass troops on the Ukrainian border.

- These worries have transitioned from higher yields in global bond markets, to a more aggressive sell off in growth stocks in the U.S., now to the broader equity markets globally.

- Earnings season has continued in the U.S. with some stocks from the financial sector slightly disappointing, whilst Netflix suffered a big miss on projected subscriptions into Q1 2022.

Global financial market developments

- Global stock averages plunged lower last week, led by the US indices and in particular the tech sector.

- Higher yield pressures from early January were initially extended, then eased, with US (and global) Bond markets pushing to new multi-year high yields.

- The US Dollar and Japanese Yen strengthened in the “risk off” environment.

- Commodity currencies, the Australian, New Zealand and Canadian Dollars were notably weaker versus the greenback.

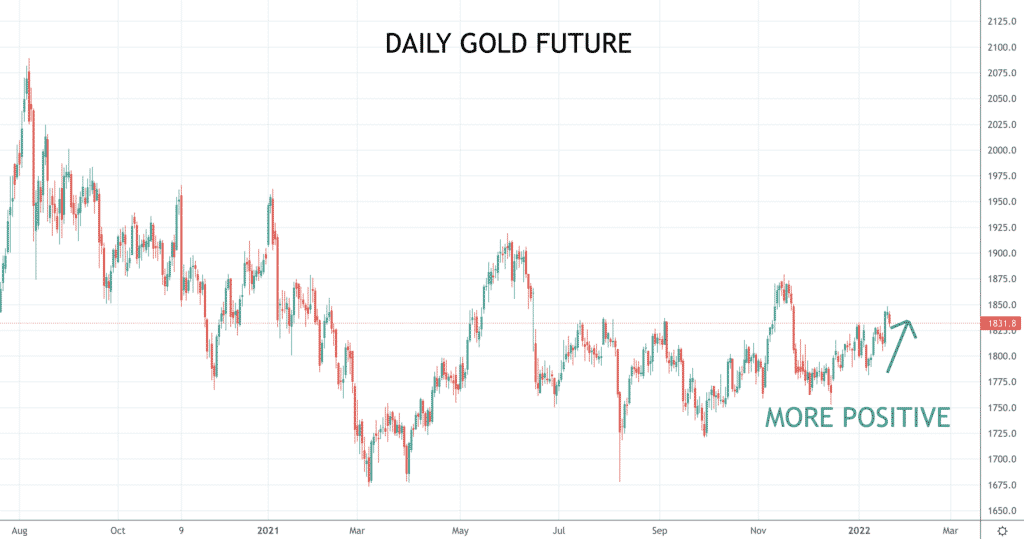

- Gold set a more negative tone, despite by the stronger US Dollar.

- Oil further extended its late 2021 rally into 2022, but then setback from a multi-year high.

- Copper retains a positive tone within a broader range.

Key this week

- Geopolitical focus:

- Watching the potential for military developments on the Ukrainian/ Russian border.

- Still monitoring the economic impact of the Omicron variant of COVID-19.

- Central Bank Watch: We get the Bank of Canada (BoC) and US Federal Open Market Committee (FOMC) interest rate decisions, statements and press conferences on Wednesday, and the Peoples Bank of China (PBoC) interest rate decision on Thursday.

- Macroeconomic data: Global Markit Flash PMI is released Monday, other standouts are US Consumer Confidence, GDP and Durable Goods.

- Earnings data: US earnings season continues with standouts being IBM, Microsoft, J&J, Tesla, Boeing and Apple.

| Date | Key Macroeconomic Events |

| 24/01/22 | Global Markit Flash PMI |

| 25/01/22 | Australian CPI; German IFO; US Consumer Confidence |

| 26/01/22 | Bank of Canada interest rate decision, statement and press conference; FOMC interest rate decision, statement and press conference |

| 27/01/22 | US GDP and Durable Goods |

| 28/01/22 | German GDP; US Personal Consumption Expenditure (PCE) |