There has been a huge rally in the NASDAQ in 2023. However, notably, there has been a disconnect with other equity markets in recent weeks. Whilst the tech-laden NASDAQ has continued to post strong gains, elsewhere the rallies have fallen over and some are turning corrective. So is NASDAQ an outlier and set to be followed, or is it about to befall the same fate as other markets?

- The drag on broader markets.

- NASDAQ has been driven higher by earnings and the debt ceiling

- NASDAQ has been ignoring the path of US yields

- Technicals also suggest a pullback

Factors driving huge NASDAQ outperformance

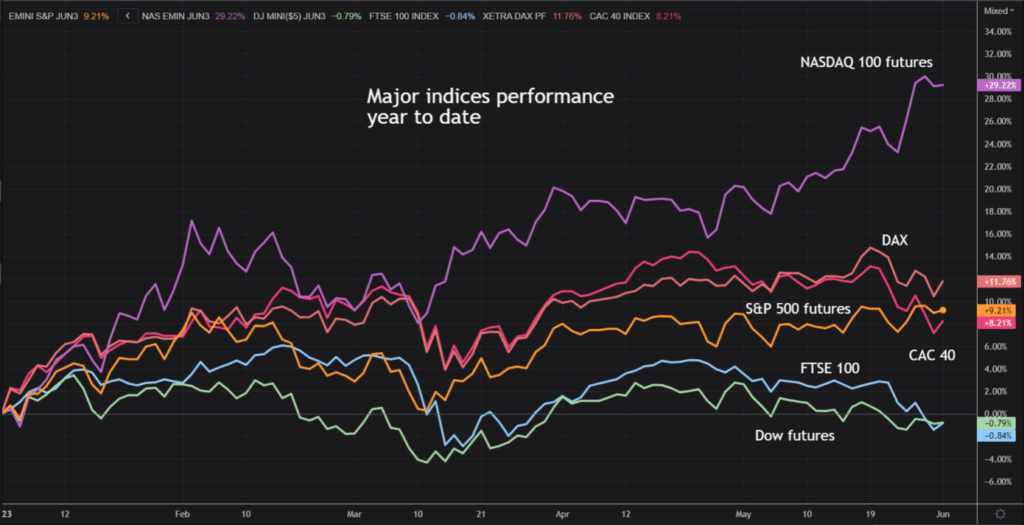

The NASDAQ has been a stellar performer amongst major markets in 2023. The e-mini NASDAQ 100 futures have rallied over 29% in the first five months of the year. From a US perspective, the e-mini S&P 500 futures have added just 9%, with the Dow futures a significant laggard with a loss of almost -1%. Other indices such as the German DAX, French CAC and especially the FTSE 100 have also fallen over recently.

It is interesting to see that the gains (and the divergence) have ramped up in recent weeks. This is coming as a result of two factors:

- Huge rallies on tech stocks from quarterly earnings

- Safe haven flow surrounding the debt ceiling

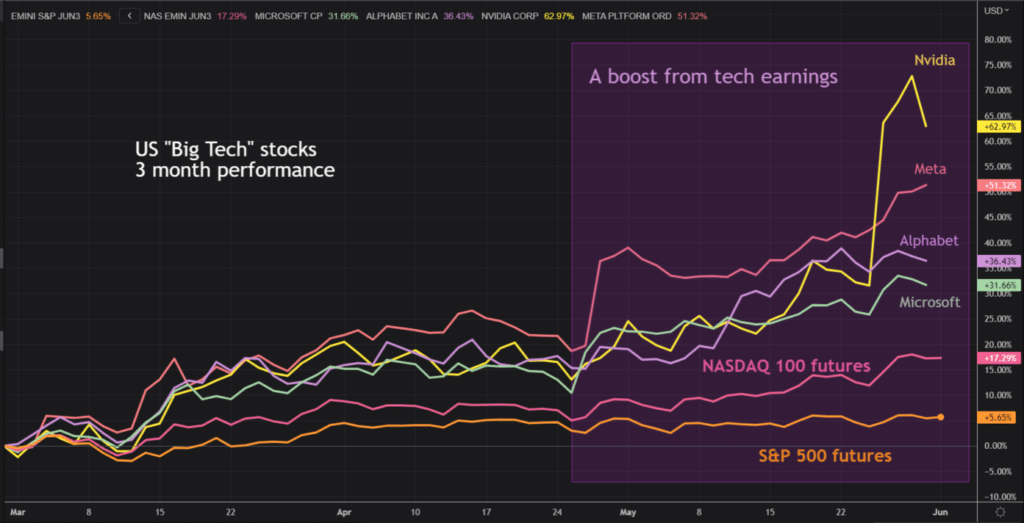

Firstly, there have been some huge boosts to tech stocks in the wake of earnings season. The chart below shows the huge performances of the big tech stocks such as Meta, Alphabet, Microsoft and of course, Nvidia have taken hold.

The share prices took off pretty much from the moment that the tech earnings were announced in late April. This massive outperformance have significantly added to the ability for the e-mini NASDAQ 100 futures to continue to push higher.

The tech weighting is slightly lower in the S&P 500 (it is balanced out with the older economy, value stocks. This has meant that whilst the S&P 500 has held up well, it has been unable to break higher in the way that the NASDAQ has.

The second factor contributing to the outperformance of the NASDAQ futures has been the debt ceiling uncertainty. Investors have been unsure how the debt ceiling will play out. The uncertainty has driven appetite for safe havens. Now, given the impressive earnings, this has driven safe haven flow into the tech stocks.

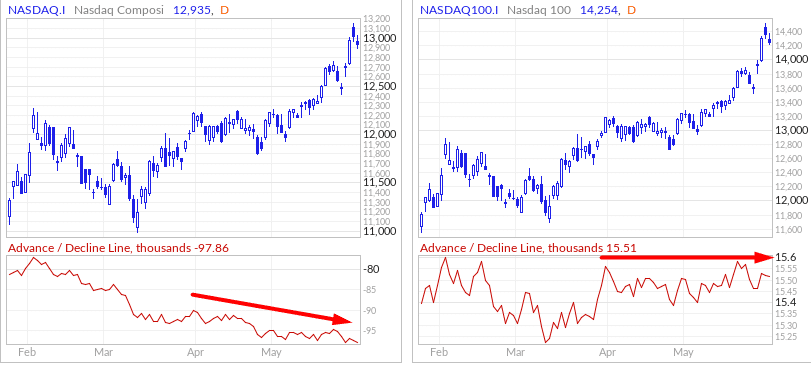

However, what is also clear is that the flow is coming mostly into the larger tech stocks. Look at the Advance/Decline line of the NASDAQ 100 (the biggest 100 stocks) versus the NASDAQ Composite (the broader market). The composite index is showing the Advance/Deline consistently falling. Even then, the Advance/Decline line of the largest 100 stocks is fairly flat. It would appear that only the very large, heavy-weighting stocks are driving the market.

Now, it does seem as though Congress is on the path to pushing the debt ceiling limit out into 2025 (although nothing is guaranteed). This may begin to see some of the flow into safe havens of big tech begin to reverse. Furthermore, the

NASDAQ rallying despite higher US bond yields

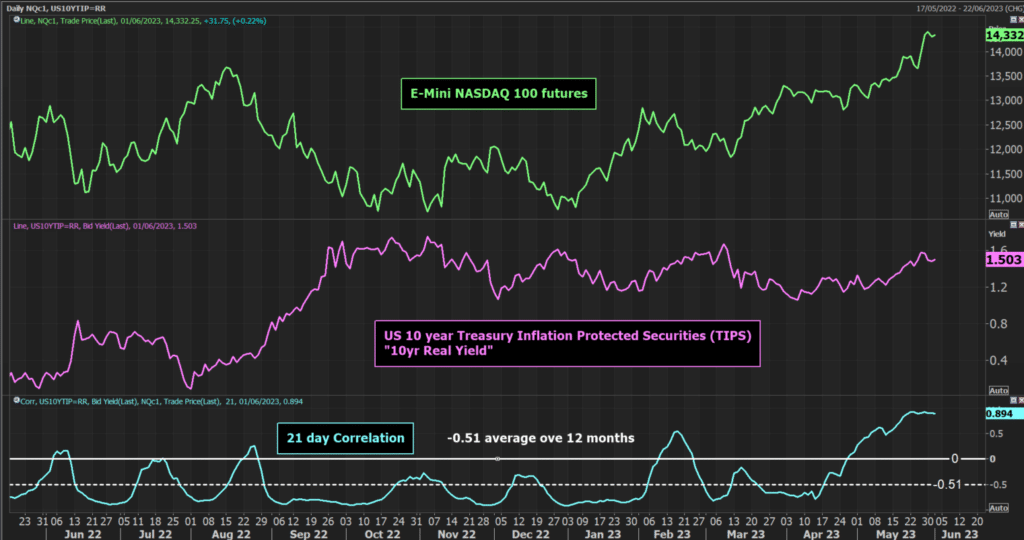

Another interesting factor is that NASDAQ has been rallying at the same time that US bond yields have been pushing higher. This is not a situation that has historically been sustainable for very long.

The chart below shows that the correlation has become very positively aligned between “real” US bond yields and the NASDAQ futures.

Historically, over the past 12 months, this relationship has averaged a very strong negative -0.51. This would suggest that this positive correlation currently being felt is highly unlikely to last for long.

US yields have pushed higher due to pricing in for another rate hike from the Federal Reserve. Yields are unlikely to be falling much in the coming weeks. This suggests that if anything is to give, it is likely to be the bull run on the NASDAQ futures.

NASDAQ futures technicals point towards a pullback

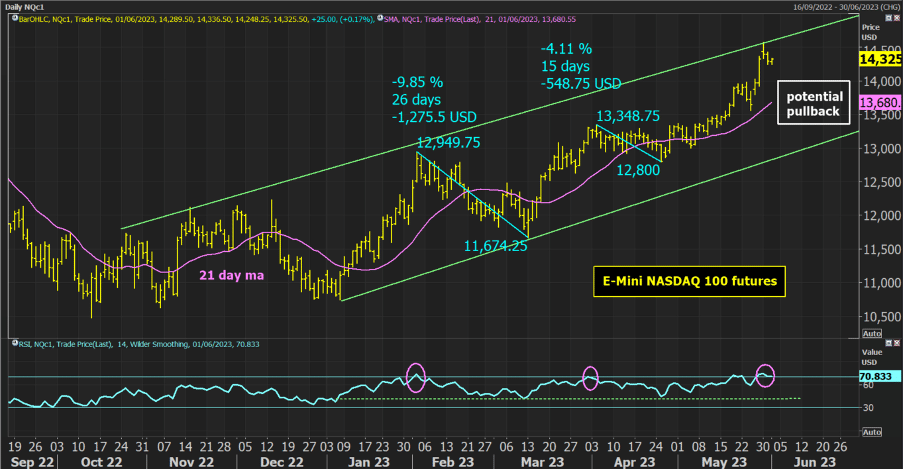

So will the NASDAQ begin to fall away, just as other markets have done so in recent weeks? Looking at the technical analysis, there is also an argument to say “yes”.

The rally within an uptrend channel has been strong. However, once more it is towards the top of the channel. In itself, this is not negative, but it may induce a consolidation (arguably already one has been seen in the past day or so).

However, what is more notable, is the stalling on a stretched RSI above 70. The last two times this has been seen have induced a near-term pullback. Unwinding corrections in February and April have ranged from -4% to -10% over a few weeks. This would bring a move below 14000 and perhaps as much as the support of the old April highs around 13350. We could also point to corrective signals on other indicators such as the Stochastics and an exhaustion signal on the Bollinger Bands.

So whilst the bull run on the NASDAQ 100 futures has been impressive, there are signs that the move may be about to see a profit-taking pullback. However, with such an impressive uptrend channel, I would still be looking for any weakness in building support as a chance to open some new long positions.