Macroeconomic/ geopolitical developments

- The focus last week stayed on the US earnings season, which is seeing mixed results.

- Microsoft indicated a slowdown in its Azure cloud-based computing business, which was a disappointment.

- Tesla shares jumped after posting solid earnings and strong forward guidance

- Intel stock plunged after very poor results and also weak guidance.

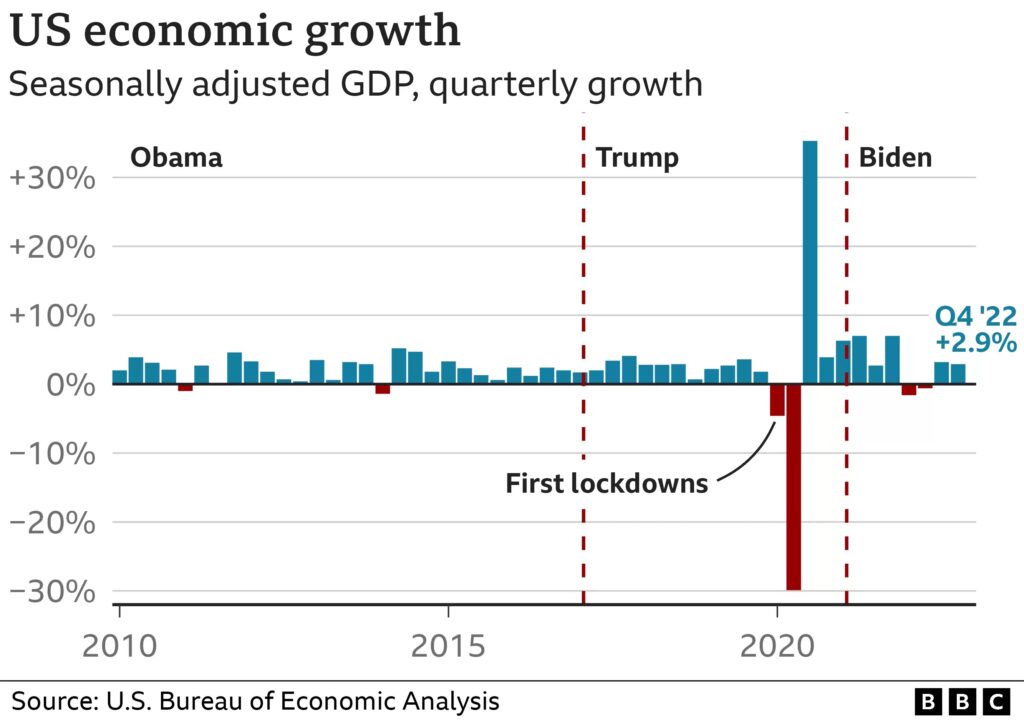

- On the macroeconomic front, however, the strong US GDP and Durable Goods data, alongside a lower-than-expected inflation read from the Fed’s preferred inflation measure, the Personal Consumption Expenditure data, all helped fuel further gains in risky assets.

- Fed speakers have continued to indicate a slowing pace in rate hikes, with hopes growing of a soft landing in 2023, avoiding a recession in the US and potentially in the major, global economic centres.

Global financial market developments

- The major US, European and Asian stock averages were all in positive territory for the week.

- Growth stocks were again the leaders with the Nasdaq posting a fourth successive week of gains.

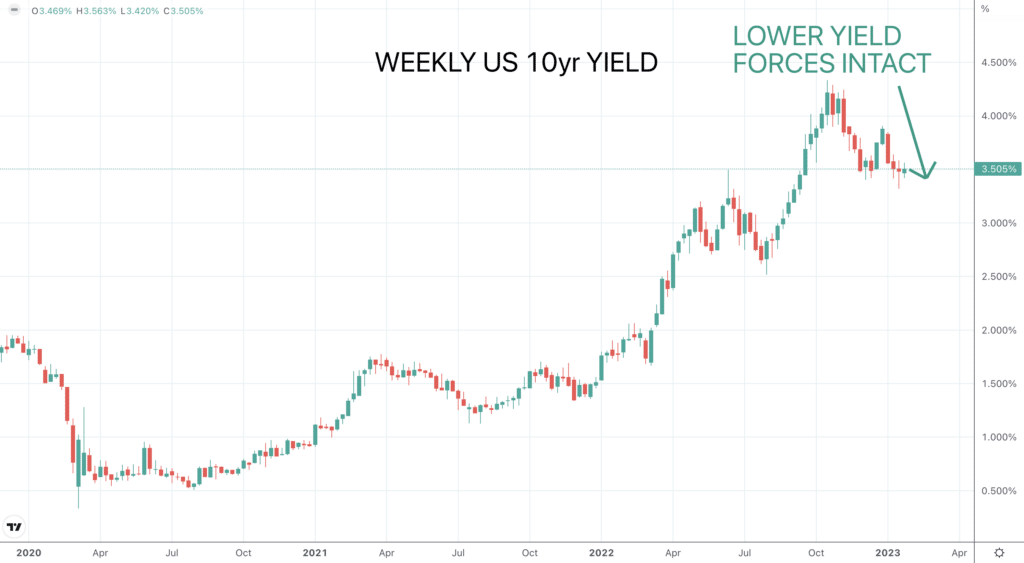

- US and European Bond yields went sideways.

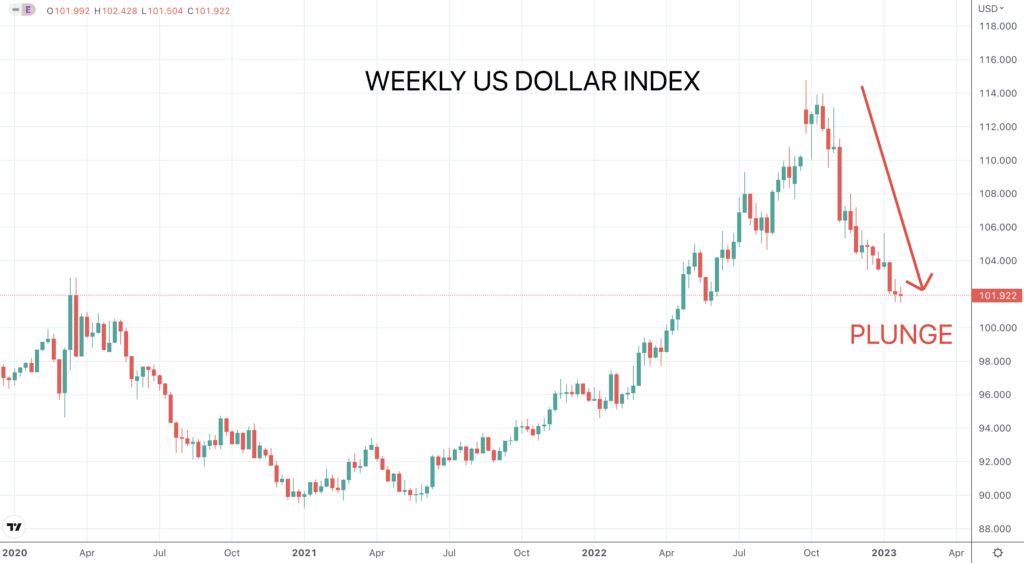

- The US Dollar Index marked time too, just nudging lower as the US currency remains weak across the Forex board, close to multi-month lows in many places.

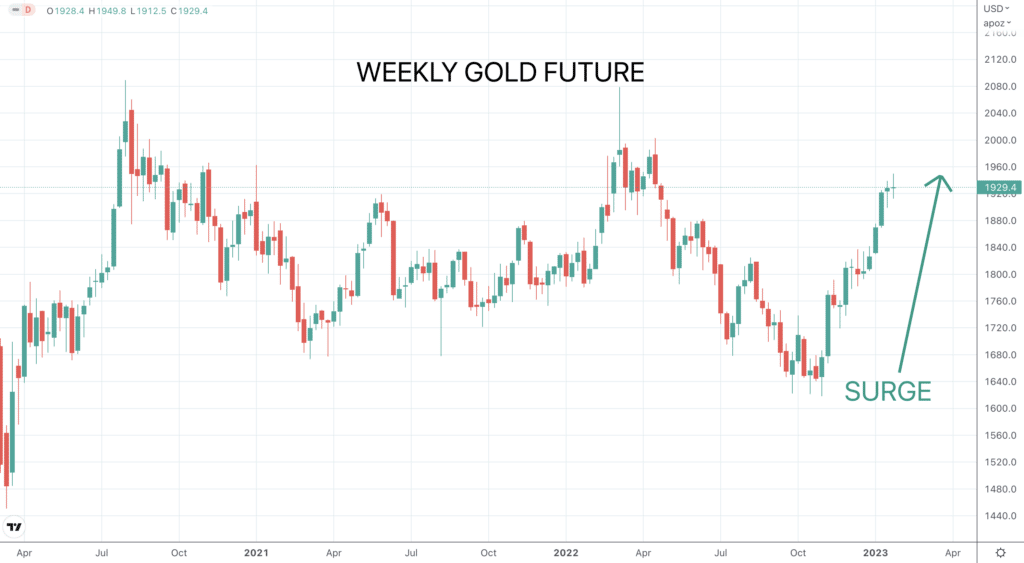

- Gold pushed higher again to build on the 2023 surge, to hit another new multi-month high.

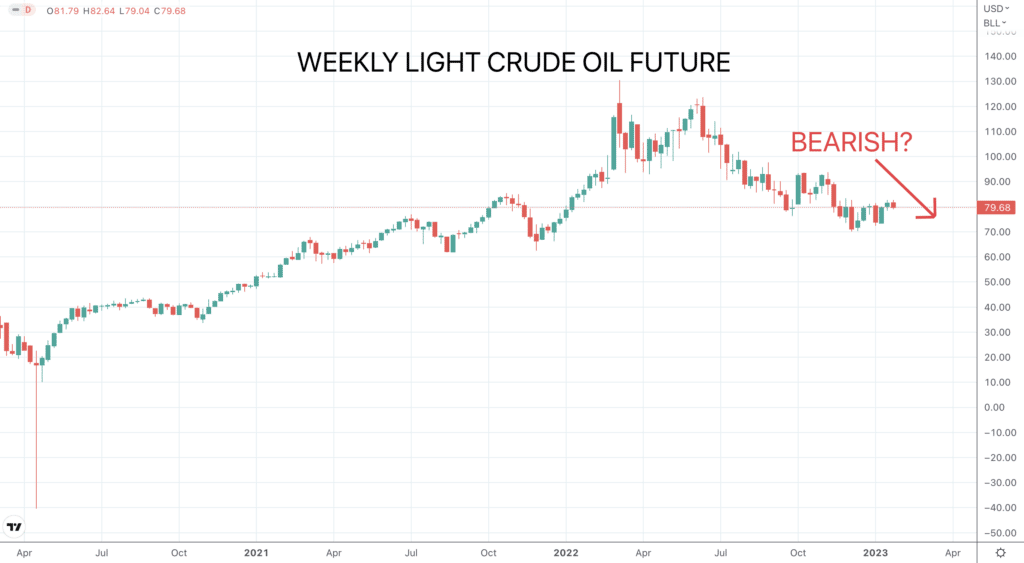

- The January Oil rally stalled as the market went sideways through the week.

- Copper was also sideways, staying close to multi-month highs.

Key this week

- Central Bank Watch: Focus this week will be on the FOMC interest rate decision on Wednesday, and the same from the Bank of England (BoE) and European Central Bank (ECB), both on Thursday.

- Macroeconomic data: A big week for data; German GDP and EU Consumer Confidence are out Monday, German Retail Sales, German CPI and US Consumer Confidence are released Tuesday, Wednesday and Friday sees global Manufacturing, Services and Composite PMI from S&P Global, plus US ISM and Services Manufacturing PMI, and the US Employment report is out on Friday too.

- Earnings data: Q1 earnings season continues with a big week in the US, with the focus on Exxon Mobil, Pfizer, Caterpillar, Meta, Apple, Alphabet and Amazon.

| Date | Key Macroeconomic Events |

| 30/01/23 | German GDP; EU Consumer Confidence |

| 31/01/23 | China PMI; German Retail Sales; EU GDP; German CPI; US Consumer Confidence |

| 01/02/23 | EU CPI; global Manufacturing PMI from S&P Global; US ISM Manufacturing PMI; FOMC interest rate decision |

| 02/02/23 | BoE interest rate decision; ECB interest rate decision |

| 003/02/23 | Global Services and Composite PMI from S&P Global; US Employment report; US Services Manufacturing PMI |