It has been a while since I could say anything even remotely interesting about oil. However, oil has finally broken the shackles of a two-month trading range. The move has largely come on hope rather than anything more concrete in terms of the oil market. Hope that oil demand remains strong, and hope that a series of macro factors will help to support the oil market. Oil has broken to a two-month high. Add in confirmation on the technicals and the outlook is looking more positive.

- An upbeat OPEC has given oil upside momentum

- Macro factors such as a potentially less hawkish Fed and possible Chinese stimulus also help

- Improving technical indicators suggest a test of the April high could be on

Upbeat OPEC demand forecast gives oil momentum

Oil began to pick up a couple of weeks ago. However, the move has accelerated in the past week. This move coincided with the news that OPEC would be remaining upbeat about the prospects for oil demand growth for 2024.

Sources close to OPEC suggested that when the cartel releases its outlook on oil demand growth for next year, the demand growth could be between 1.5m barrels per day (bpd) and 1.7bpd. Whilst this is below the current expected growth in demand for 2023 at 2.4m bpd, this is still a positive assessment for a global economy that is widely expected to be hit by recessionary forces for several major economies. Furthermore, the assessment by OPEC is far more upbeat than that of the International Energy Agency, which is looking for demand growth of just 860,000 bpd.

Furthermore, the supply side remains restrictive. OPEC+ countries such as Saudi Arabia are still looking to reduce supply and Russian oil output is also falling. This has given positive momentum to the rally in oil, at least for the near term.

Macro factors also drive oil higher

Other factors have been ushering oil futures higher too. Markets are increasingly questioning the prospect that the Fed will be willing to hike twice more this year. The previously hawkish comments from Fed Chair Powell may not play out. A tepid Nonfarm Payrolls report last Friday has now been followed by a second downside surprise in two months on the US CPI.

The CPI data shows that US inflation is falling decisively now and markets are reacting. Treasury yields have retreated sharply in the past week. The 10-year yield has retreated by more than -25 basis points. The 2-year yield is over -40bps lower. According to CME Group FedWatch, a +25bps rate hike is still highly likely this month (c. 92% probability) but markets are struggling to price for any further hikes. Furthermore, the resumption of rate cuts is being brought forward, with now a 74% probability of a cut in March.

If the Fed does not need to be so aggressive from here, markets are having to re-price. This is giving a boost to risk appetite and higher risk assets such as oil are rallying.

Furthermore, traders are also looking at the data out of China. Inflation continues to undershoot and economic activity indicators suggest the economy has lost the momentum it had coming out of the zero-COVID lockdown. Traders are surmising that this will push Chinese authorities to stimulate the economy. This would further boost the prospects for oil demand.

The technicals are confirming a breakout

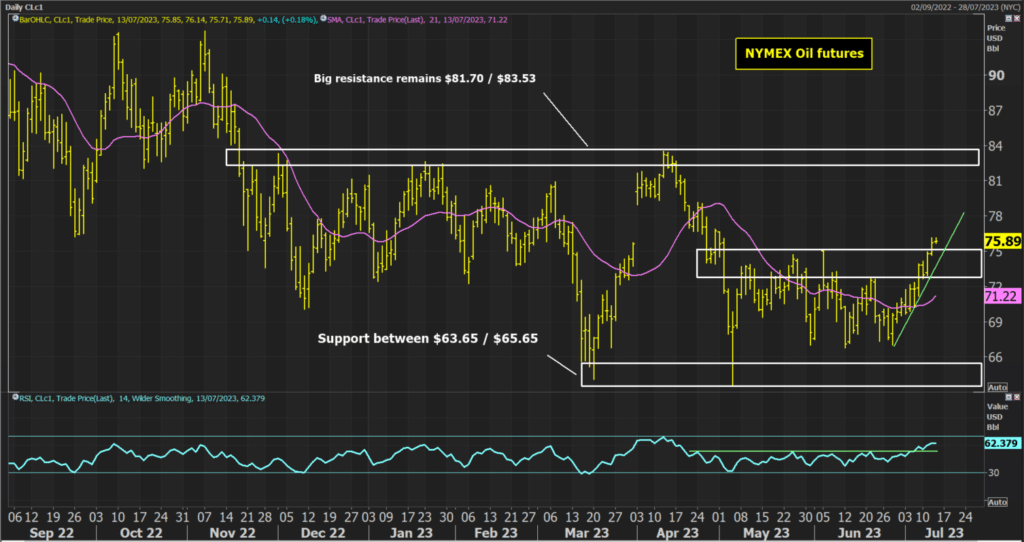

I have been waiting a while to be able to write this, but finally, there is a breakout in oil futures. The price of NYMEX oil futures has closed decisively above the resistance of the June high at $75.06. This puts oil at a two-month high. This is a clear break to complete a two-month range that now becomes a measurable reversal pattern.

Oil has been stuck in a broad trading range since the end of last year. However, this break higher is a move above a mid-range pivot resistance around $75 and opens the upper limits of the multi-month trading band around $82.40/$83.50. The implied upside target of the two-month base pattern suggests that there could now be a move towards the key April high around $83.50.

Technical indicators confirm the improvement too. The move is being confirmed by strengthening momentum, with the Relative Strength Index rising to a twelve-week high above 60. The price has also been in an uptrend for the past two weeks. This suggests that near-term weakness is a chance to buy. There is good support now between $72.72/$75.06 to look for opportunities to continue to play the recovery.