Macroeconomic/ geopolitical developments

- Back-to-back weekly gains for the major US stock averages in a holiday shortened week, saw the S&P 500, DJIA and Nasdaq all add over 2% on the week. In addition, the S&P 500 hit a new all-time high close on Thursday. Strong Netflix numbers and a pro-economy Trump agenda assisted global stock markets higher.

- President Donald Trump’s Davos address, urging lower interest rates, reduced oil prices, and a softer stance on tariffs, sparked optimism in equity markets, with the S&P 500 hitting an all-time high amid pro-growth policy initiatives.

- Netflix shares soared 13% to a record high after surpassing 300 million subscribers and posting a 102% earnings increase in Q4, driven by hit content, live events, and price hikes, solidifying its dominance in the streaming industry.

- January’s PMI showed manufacturing returned to slight growth at 50.1 while services slowed sharply to 52.8, with inflationary pressures rising and overall business activity moderating amid persistent optimism about future growth.

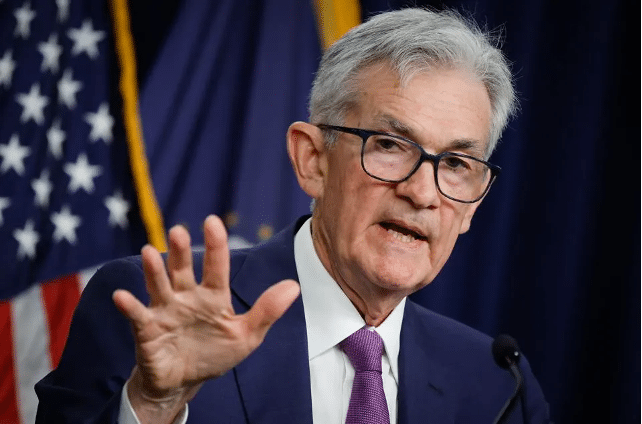

- Markets await the Federal Reserve’s policy decision and Chair Jerome Powell’s remarks, with rates expected to remain steady.

- We also get the Bank of Canada Interest Rate Decision, Monetary Policy Statement and Press Conference on Wednesday, plus the same from the European Central Bank (ECB) on Thursday.

- While key macroeconomic data, including US GDP and PCE inflation are released, the main US Q4 earnings releases this week are from five of the Magnificent Seven with Microsoft, Meta Platforms and Tesla releasing their earnings on Wednesday and Apple and Amazon on Thursday.

Global financial market developments

- US and global equity averages extended notably higher, the S&P 500 hitting a new record level.

- US and European bonds were little changed on the week.

- The US Dollar Index retreated lower from early 2025, multi-year highs.

- Gold futures rallied, breaking from a multi-week range, and eyeing the all-time-high.

- Oil futures saw a notable pullback lower, from a multi-month high.

Key this week

Central Bank Watch: The main central bank activity this week is the Federal Reserve Interest Rate Decision, Monetary Policy Statement and Press Conference on Wednesday. Other releases of note are Bank of Japan Monetary Policy Meeting Minutes on Wednesday, the Bank of Canada Interest Rate Decision, Monetary Policy Statement and Press Conference also on Wednesday, and the same from the European Central Bank Thursday.

Macro Data Watch: The main macro data releases this week are the US PCE numbers on Thursday and more notably Friday. Some other releases of note are the German, EU and US GDP on Thursday and Japanese and German CPI on Friday.

Earnings Watch: The main US Q4 earnings releases this week are from five of the Magnificent Seven with Microsoft, Meta Platforms and Tesla releasing their earnings on Wednesday and Apple and Amazon on Thursday.

| Date | Major Macro Data |

| 01/27/2025 | Chinese PMI; German IFO Reports |

| 01/28/2025 | US Durable Goods Order and Consumer Confidence |

| 01/29/2025 | BoJ Monetary Policy Meeting Minutes; German Consumer Confidence; BoC and US Fed Interest Rate Decisions, Monetary Policy Statements and Press Conferences |

| 01/30/2025 | German GDP; EU GDP, Consumer Confidence and Unemployment Rate; ECB Monetary Policy Statement and Press Conference; US GDP and PCE (QoQ) |

| 01/31/2025 | Japanese CPI, Unemployment Rate and Retail Trade; German Retail Sales, Unemployment Report and CPI; Canadian GDP; US PCE (MoM and YoY), Personal Income and Spending |

| Date | Major Earnings Data |

| 01/27/2025 | AT&T |

| 01/28/2025 | Louis Vuitton ADR; SAP ADR; Rtx Corp; Boeing; Starbucks |

| 01/29/2025 | Microsoft; Meta Platforms; Tesla; ASML ADR; T-Mobile US; ServiceNow Inc; IBM; Alibaba ADR; Caterpillar; Qualcomm; Danaher |

| 01/30/2025 | Apple; Amazon; Visa A; Mastercard; Blackstone; Thermo Fisher Scientific Inc |

| 01/31/2025 | Exxon Mobil; AbbVie; Chevron |