Macroeconomic/ geopolitical developments

- Moderating inflation pressures and falling growth data helped global stock indices secures gains and technical bases last week.

- Global S&P Flash PMI on Thursday were not only lower than for May, but also below expectations in many instances, with the US services data hitting its lowest level since January.

- In addition, long term yields have been moving to lower yield territory since the mid-June Fed rate hike, and last week this activity extended as Fed Chair Powell testified before Congress that inflation expectations seemed to remain anchored.

- Short-term interest rates as measured by the Eurodollar futures market are now pricing in the chance of a less aggressive rate hike at the July meeting and that peak rates may occur sooner than expected, with a first rate cut now being priced in for May-June 2023.

- UK inflation for May accelerated to a record 9.1%, but even this report showed some optimistic signals of potentially moving towards peak inflation.

Global financial market developments

- The major US stock averages rebounded, securing short-term bases and with the S&P 500 moving out of bear market territory, having the prior week registered a fall of over 20% from the early 2022 record high.

- European and Asian equity indices also posted significant gains, with European averages also posting positive, short-term bottoming signals.

- US 10yr yields moved lower in yield to reinforce the prior week’s move that produced a surged through the May high yield peaks and reverses to significantly lower yields after the FOMC meeting, signaling a blow-out yield top.

- The US Dollar Index went sideways, having the prior week posted a strong advance up through the May peak, then a reversal back lower after the Fed decision for a bullish failure.

- Gold was set in a narrow range, still trying to form a base.

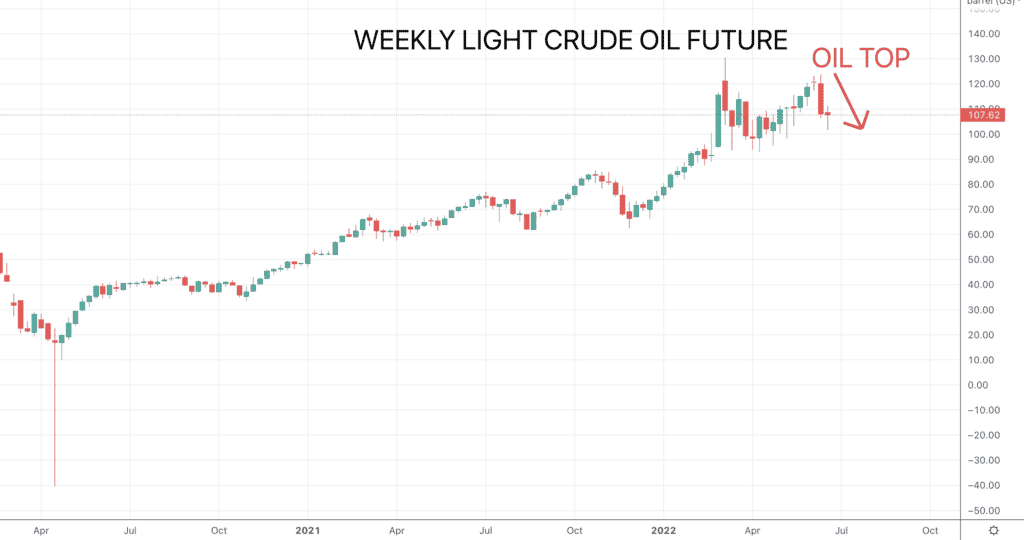

- Oil plunged lower again to reinforce the prior week’s short-term top, keeping risks lower.

- Copper plunged again to reinforce the prior week’s break below the May low, to its lowest level since February 2021.

Key this week

- Geopolitical focus:

- Still monitoring the war in Ukraine

- OPEC+ meet Thursday.

- Central Bank Watch: A quiet week for Central Banks, although we do get multiple Central Banks speakers on Wednesday at the European Central Bank (ECB) Forum on Central Banking 2022, from Sintra, Portugal.

- Macroeconomic data: On the data front we get US Durable Good and Consumer Confidence on Monday and Tuesday respectively, Wednesday brings German CPI and US GDP plus Personal Consumption Expenditure (PCE) QoQ, then we get UK GDP Thursday along with German Retail Sales and further US PCE data (MoM and YoY) and end the week with US ISM PMI data Friday.

| Date | Key Macroeconomic Events |

| 27/06/22 | US Durable Goods |

| 28/06/22 | US Consumer Confidence |

| 29/06/22 | Japan Retail Sales; German CPI; ECB Forum on Central Banking 2022, from Sintra, Portugal; US GDP and PCE (QoQ) |

| 30/06/22 | UK GDP; German Retail Sales; US PCE (MoM and YoY); OPEC+ Meeting |

| 01/07/22 | Japan CPI and Employment reports; US ISM PMI |