Macroeconomic/ geopolitical developments

- US Stocks rallied early in the week along with Japanese stocks posting the largest weekly gain since March 2022, reaching the highest point in decades. The positive momentum followed a week of losses in the first week of 2024.

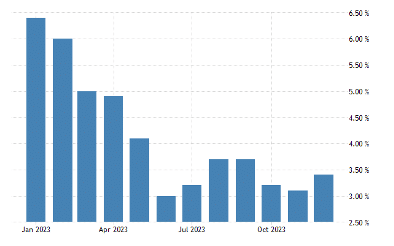

- US CPI slightly hotter than expected with the annual CPI increasing by 3.4% and a monthly uptick of 0.3% in December. This surpassed both November’s figures of 3.1% and 0.1%, and economist expectations of 3.2%

- The US earnings season kicked off with financial corporations releasing their figures. The six major banks who reported this week all exceeded expectations with their earnings.

- Oil rallied as Middle Eastern tensions remained raised, triggered by US and UK strikes on Houthi targets in Yemen. This comes after oil prices saw a sharp decline on Monday, as Saudi Arabia decided to lower its official selling prices for February exports.

- European Central Bank President Christine Lagarde expressed a dovish tone, indicating optimism in saying the most challenging phase of the battle against inflation is likely behind us. She indicated that interest rates have reached their peak and would consider cutting them if inflation stabilises at the 2% level.

- The SEC approved Bitcoin ETFs. These physically hold Bitcoin rather than trading in futures contracts and are expected to attract investors who had previously kept a distance from cryptocurrencies.

- The Davos 2024 World Economic Forum is in the spotlight this coming week, with the overarching theme, ‘Rebuilding Trust,’ having discussions on security, growth, AI, and climate.

- The MLK US holiday is on Monday, meaning equity and bond markets will be closed.

Global financial market developments

- US and global equity index futures rebounded, reversing the plunge lower that started 2024.

- US yields saw moves back lower, to partially undo the significant higher yield moves to start 2024. European yields, however, moved still higher, though did shift back lower at the end of the week, after the aforementioned comments from ECB President Christine Lagarde.

- The US Dollar Index consolidated in a holding pattern..

- Gold futures sold off further, then bounced, in an intermediate-term range.

- Oil futures rallied again, with still heightened tensions in the Middle east.

Key this week

Central Bank Watch: Nothing of note from Central banks this coming week, but as ever we will be watching Fed speakers in the final week before they enter their blackout period.

Macro Data Watch: The World Economic Forum in Davos runs all week from 15th-19th January. Monday is the US MLK Holiday, US equity and bond cash markets are closed, futures markets are shortened hours/ Standout data will be German, Canadian, EU, UK and Japanese inflation reports, and from the US the Retail Sales data on Wednesday.

Earnings Watch: US earnings season gets into full swing, with standouts this coming week Morgan Stanley, Goldman Sachs, Prologis, Charles Schwab and Schlumberger.

| Date | Major Macro Data |

| 01/15/2024 | US MLK Holiday, US equity and bond cash markets are closed, futures markets are shortened hours; 54th World Economic Forum (all week); EU Industrial Production; |

| 01/16/2024 | German CPI; UK Employment report; EU and German ZEW Survey; Canada CPI |

| 01/17/2024 | China GDP, Industrial Production and Retail Sales; UK inflation report incl. CPI; EU CPI; US Retail Sales and Industrial Production |

| 01/18/2024 | Australian Employment report |

| 01/19/2024 | Japan CPI data; UK Retail Sales; Michigan Consumer Sentiment |

| Date | Major Earnings Data |

| 01/15/2024 | Nothing of note |

| 01/16/2024 | Morgan Stanley; Goldman Sachs |

| 01/17/2024 | Prologis; Charles Schwab |

| 01/18/2024 | Truist Financial Corp |

| 01/19/2024 | Schlumberger; Travelers; State Street |