Macroeconomic/ geopolitical developments

- US Retail Sales data for March came in extremely strong on Thursday, beating expectation with a rise of 9.8% MoM.

- Earnings season has kicked off in earnest in the US, with the Banks and Financials leading the way, in most instances beating expectations.

- The European vaccine rollout has improved, although it still lags the US and UK, which continue at a high pace.

- European nations have in some instances started to lift some lockdown measures.

Global financial market developments

- US yields have continued their retreat from multi-year yield highs posted in very early April.

- This has seen growth stocks improve their relative performance to value stocks, with many Big Tech shares hitting multi-week highs.

- The Nasdaq 100 and Composite averages have extended their early April upside breaks, now joining the S&P 500 and DJIA posting record highs.

- Global stock averages hit yet new record and multi-month highs with European averages taking over leadership from the US late in the week.

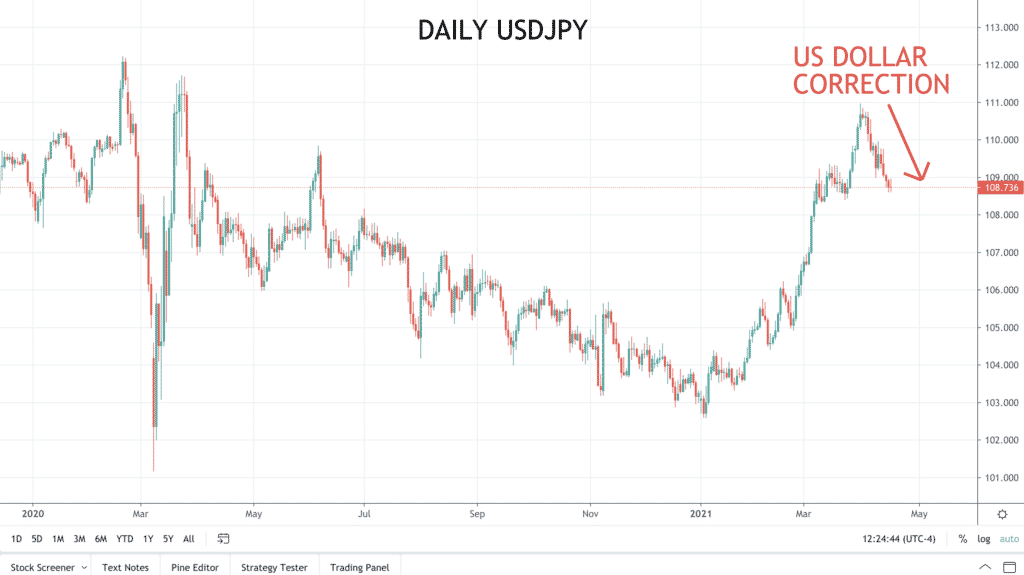

- The US Dollar has weakened further within G3, versus the Japanese Yen and against the Euro, which has seen the Dollar Index slide still lower into mid-April.

- The “risk currencies” (the Australian, New Zealand and Canadian Dollars) have also now performed well versus the US Dollar into mid-month.

- Oil has broken higher with a “risk on” theme and weaker US Dollar.

- Copper also gained, helped by the US Dollar wakening.

- Gold has rallied further too (with broadening US Dollar losses), reinforcing the early April chart base (Double Bottom).

Key this week

- Geopolitics:

- As always, traders need to monitor COVID-19 cases, hospitalisations and deaths globally (notably in Europe).

- Also watching for possible lockdown easings, particularly in Europe.

- Central Bank Watch: The Reserve Bank of Australian (RBA) Meeting Minutes are released Tuesday; the Bank of Canada (BoC) and European Central Bank (ECB) interest rate decisions and statements are on Wednesday and Thursday respectively.

- Macroeconomic data: This week sees notable data from the UK, including the Employment report, inflation data (incl. the Consumer Price Index, CPI) and Retail Sales. Plus, we get Australian Retail Sales, Canadian CPI and Global Markit Flash Purchasing Managers Index (PMI) data. See the table below for details.

- Microeconomic data: Earning season continues in the US this coming week with Coca-Cola, IBM, J&J, Netflix, Verizon and Intel.

| Date | Key Macroeconomic Events |

| 19/04/21 | Japanese Industrial Production |

| 20/04/21 | RBA Meeting Minutes; UK Employment report |

| 21/04/21 | Australian Retail Sales; UK inflation data (incl. CPI); Canadian CPI; BoC interest rate decision and statement |

| 22/04/21 | ECB interest rate decision and statement |

| 23/04/21 | UK Retail Sales; Global Markit Flash PMI data |