Macroeconomic/ geopolitical developments

- Global stocks tumbled, with the S&P 500 and Nasdaq experiencing their worst weeks in months, while bond yields dropped amid growing concerns of an economic hard landing and potential Federal Reserve missteps.

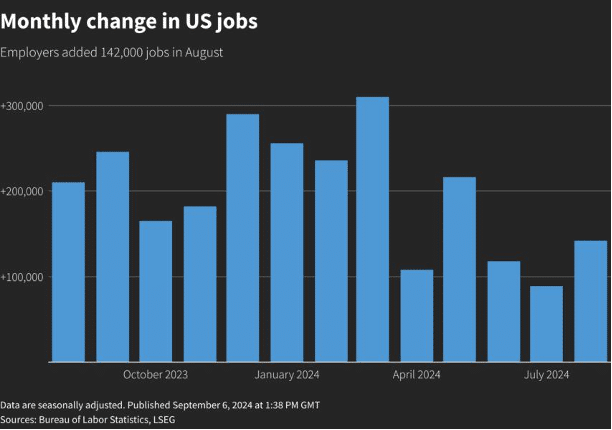

- The August employment report showed a slowdown in job growth with only 142,000 jobs added, missing expectations and signalling a weakening labour market, as the Federal Reserve prepares for a potential interest rate cut in September.

- The U.S. Treasury yield curve has un-inverted for the first time since mid-2022, with the 10-year yield now exceeding the 2-year yield, driven by falling yields and expectations of upcoming Federal Reserve rate cuts amid a softening economy.

- CPI data this week is expected to show modest price increases, with markets anticipating a Federal Reserve rate cut on September 18, likely between 0.25% and 0.5%, as inflation cools and focus shifts to labour market conditions.

Global financial market developments

- US and global equity averages plunged lower.

- US and European bonds rallied, with yields moving significantly lower.

- The US Dollar Index pushed back lower, back close to recent multi-year lows.

- Gold futures rallied and retreated, in a multi-week range, but near the record high.

- Oil futures sold off to a multi-year low.

Key this week

Central Bank Watch: The main central bank activities this week is the European Central Bank Monetary Policy decision, statement and press conference on Thursday.

Macro Data Watch: The main macro data release this week is the US CPI data on Wednesday. Some other releases of note are the UK Employment report and Chinese Trade report on Tuesday, and German and Chinese CPI data.

Politics Watch: The US Presidential election debate will be held on Tuesday, September 10 at 9pm ET, live on ABC and streamed to ABC News Live, the ABC app and ABC website.

| Date | Major Macro Data |

| 09/09/2024 | Japanese GDP; Chinese CPI, PPI; EU Investor Confidence |

| 09/10/2024 | Chinese Trade Report; German CPI; UK Employment Report; US Presidential election debate |

| 09/11/2024 | UK GDP, Industrial Production; US CPI |

| 09/12/2024 | ECB Monetary Policy Statement; US PPI |

| 09/13/2024 | French CPI; EU Industrial Production; US Michigan Consumer Sentiment Index |