Macroeconomic/ geopolitical developments

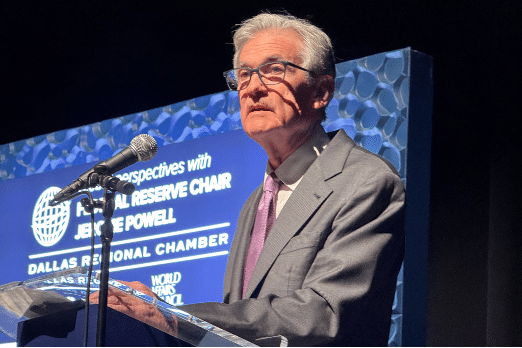

- U.S. and global stocks declined this week as initial optimism over Trump’s pro-business policies faded, with investors cautious after Fed Chair Powell’s indication of delayed rate cuts and concerns over trade tensions impacting international markets.

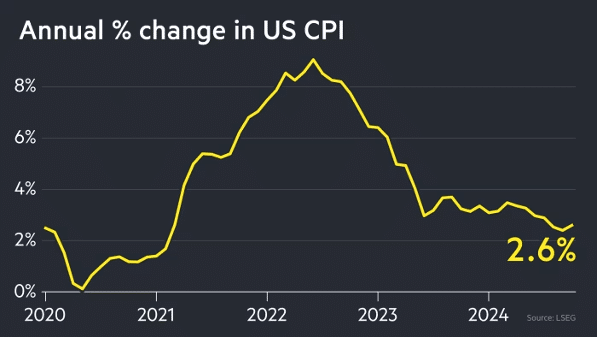

- The October CPI report matched forecasts with headline inflation rising to 2.6% annually and core inflation at 3.3%, likely leaving the Fed on track with its current rate cut plans while keeping a close watch on persistent shelter cost pressures.

- Federal Reserve Chair Jerome Powell emphasised the central bank’s cautious approach to rate cuts, citing a strong economy and the need to ensure inflation remains on track toward the 2% target before adjusting monetary policy.

- U.S. retail sales rose by 0.4% in October, surpassing forecasts, driven by strong consumer spending on vehicles and electronics, tempering hopes of a Fed rate cut despite moderating inflation ahead of the holiday season.

- Nvidia is set to release its third-quarter earnings, with analysts anticipating an 84% revenue increase driven by AI infrastructure demand, while investors focus on guidance for its new Blackwell AI chips amid reported overheating challenges.

Global financial market developments

- US and global equity averages pulled back lower

- US yields were slightly higher on the week, whilst European bonds were little changed

- The US Dollar Index pushed to a new multi-year high

- Gold futures continued to sell off with US Dollar strength

- Oil futures sold off to the lower end of a broader consolidation range.

Key this week

Central Bank Watch: The main central bank activities this week are Reverse Bank of Australia Meeting Minutes on Tuesday and People’s Bank of China Interest Rate Decision on Wednesday.

Macro Data Watch: The main macro data released this week are the global Flash PMI on Thursday and Friday. Some other releases of note are the EU, Canadian, UK and Japanese CPI throughout the week and German GDP on Friday.

Earnings Watch: The main US Q3 earnings releases this week are Nvidia Wednesday, Target also Wednesday and prior to that, Walmart on Tuesday. This will be the last week we cover the US Q3 earning releases.

| Date | Major Macro Data |

| 11/18/2024 | Nothing of note |

| 11/19/2024 | RBA Meeting Minutes; EU and Canadian CPI |

| 11/20/2024 | PBoC Interest Rate Decision; German PPI; UK CPI, PPI and RPI |

| 11/21/2024 | US Flash PMI; EU Consumer Confidence |

| 11/22/2024 | Japanese CPI; UK Consumer Confidence; German GDP; UK and Canadian Retail Sales; EU, UK and German Flash PMI; US Michigan Consumer Sentiment Index |