Macroeconomic/ geopolitical developments

- U.S. stocks ended the week higher, with the Dow up 1.2%, the S&P 500 rising 0.5%, and the Nasdaq gaining 0.2%, while global markets saw mixed results as European and Japanese equities advanced, but Chinese stocks declined amid investor caution.

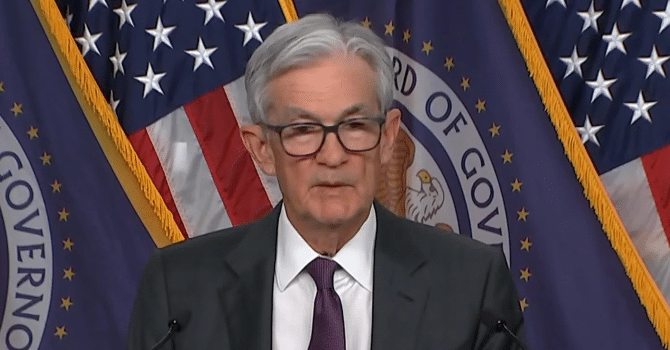

- The Federal Reserve maintained interest rates at 4.25%-4.50%, citing economic uncertainty and inflation concerns, while signaling cautious easing with two expected rate cuts in 2025 and a long-term commitment to balancing growth, employment, and price stability amid trade and fiscal challenges.

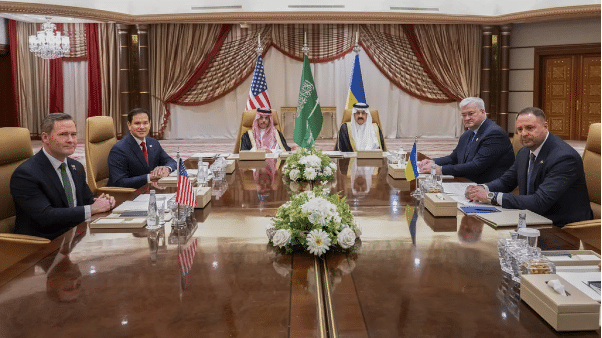

- Talks on a limited Ukraine-Russia ceasefire have gained momentum following U.S. President Donald Trump’s negotiations with Vladimir Putin and Volodymyr Zelensky, but key disagreements remain over its scope, enforcement, and long-term peace terms, with both sides skeptical of each other’s commitments.

- The coming week, investors will closely watch global Flash PMI data for economic activity signals on Monday, while the U.S. PCE inflation report on Friday is expected to show persistent price pressures, which could influence Federal Reserve policy.

Global financial market developments

- US and global equity averages rebounded, after week’s of losses.

- US bond yields were little changed on the week.

- The US Dollar Index marked time in consolidation, but just up from multi-month lows.

- Gold futures rallied to a new all time high.

- Oil futures rebounded modestly from a new multi-month low.

Key this week

Central Bank Watch: There are no significant central bank events this week, only the Bank of Japan Monetary Policy Meeting Minutes on Tuesday. But Fed speakers will need to be monitored as ever.

Macro Data Watch: The main macro data release to monitor this week is the US PCE inflation data on Thursday and more notably Friday. Other releases of note are the Global Flash PMI data on Monday, and the US Consumer Confidence data on Tuesday.

| Date | Major Macro Data |

| 03/24/2025 | Global Flash PMI |

| 03/25/2025 | BoJ Monetary Policy Meeting Minutes; US Consumer Confidence and Housing Price Index |

| 03/26/2025 | UK CPI and RPI; US Durable Goods Order |

| 03/27/2025 | US GDP and PCE (QoQ) |

| 03/28/2025 | Japanese CPI; German Consumer Confidence and Unemployment Report; UK GDP and Retail Sales; EU Consumer Confidence; Canadian GDP; US PCE (YoY) (MoM) and Michigan Consumer Sentiment Index |