Macroeconomic/ geopolitical developments

- Global stock indices hit/close in on all-time highs as investor optimism soared following the U.S. Federal Reserve’s interest rate cut, with the S&P 500 and Dow Jones setting new records, while European and Asia-Pacific markets posted mixed but largely positive gains.

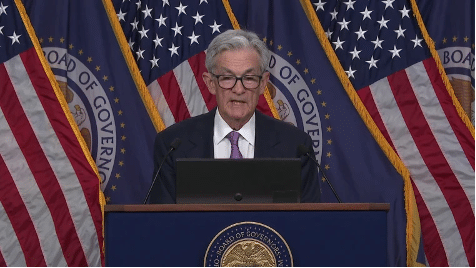

- The Federal Reserve lowered its key interest rate by 0.5 percentage points to 4.75%-5.00%, an aggressive move aimed at preventing further economic slowdown while balancing inflation control and sustained low unemployment, with Chair Jerome Powell expressing confidence in achieving a “soft landing.”

- Both the Bank of England held its interest rate at 5% and the Bank of Japan kept its rate at 0.25%, with each central bank adopting a cautious approach amid inflationary concerns and market uncertainty, while signaling potential future adjustments depending on economic conditions.

- Investors will watch global Flash PMI data for economic growth insights, Fed Chair Powell’s Thursday speech for policy clues, and Friday’s release of the US PCE Price Index to assess inflation progress and potential future rate cuts.

Global financial market developments

- US and global equity averages extended higher

- US and European bond were little changed, slightly higher on the week

- The US Dollar Index also marked time in consolidation mode, but was slightly weaker..

- Gold futures rallied, breaking to another record level.

- Oil futures rebounded from multi month lows.

Key this week

Central Bank Watch: The main central bank activities this week are the Reserve Bank Australia Interest Rate Decision and Rate Statement on Tuesday and the same from the Swiss National Bank (SNB) on Thursday, along with the Bank of Japan Monetary Policy Meeting Minutes and Powell’s speech on Thursday.

Macro Data Watch: The main macro data release this week is the Global Flash PMI on Monday and US PCE (MoM) (YoY) on Friday.

| Date | Major Macro Data |

| 09/23/2024 | Global Flash PMI |

| 09/24/2024 | RBA Interest Rate Decision and Rate Statement; Germans IFO |

| 09/25/2024 | Australian CPI |

| 09/26/2024 | BoJ Monetary Policy Meeting Minutes; SNB Interest Rate Decision and Statement; US PCE (QoQ), Durable Goods and GDP; Powell’s speech |

| 09/27/2024 | Japanese CPI; Canadian GDP; German Employment Report; US PCE (MoM) (YoY) |