Macroeconomic/ geopolitical developments

- U.S. stock indexes extended their gains to record highs amid strong earnings reports, while the 10-year Treasury yield rose for the fourth week in a row, driven by inflation data and tempered interest rate cut expectations.

- Hurricane Milton tore through Florida as a Category 3 storm, causing significant damage with 27 tornadoes, widespread power outages, and 10 fatalities, but the feared catastrophic storm surge did not occur, leaving overall destruction less severe than anticipated.

- Minutes from the Federal Reserve’s September meeting revealed a divided stance among policymakers, leading to increased market expectations of a 25-basis-point cut in November, with an 83% likelihood, as members favoured a more cautious approach contingent on economic data.

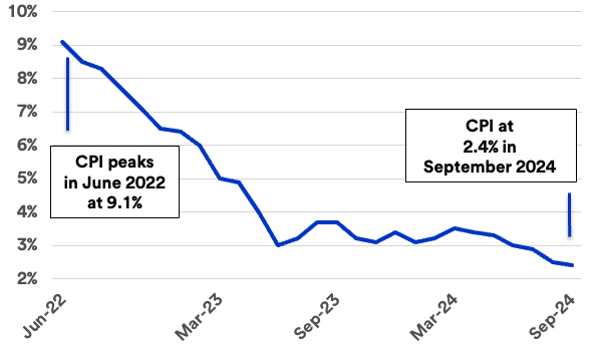

- The U.S. Consumer Price Index for September rose slightly more than expected, with core inflation increasing to 3.3% year-over-year, driven by rising costs in medical care and transportation, while declines in energy prices eased overall inflation but added uncertainty to future Federal Reserve rate cuts.

- The third-quarter U.S. earnings season began with strong results from JPMorgan Chase and Wells Fargo, with reports from major financial and tech giants like Bank of America, Citigroup, and Netflix expected next week.

Global financial market developments

- US and global equity averages extended slowly higher.

- US and European bonds edged to higher yields.

- The US Dollar Index extended gains from the beginning of October.

- Gold futures dipped and bounced, near to record highs.

- Oil futures were choppy,l, having spiked to a new multi-month peak.

Key this week

Central Bank Watch: The main central bank activities this week are the European Central Bank Monetary Policy Statement and Bank of England Monetary Policy Report Hearing on Thursday.

Macro Data Watch: The main macro data releases this week are the Chinese, UK and Japanese CPI, US Retail sales on Thursday and Chinese GDP on Friday.

Earnings Watch: The US Q3 earnings season continues having kicked off on Friday with the financial institutions, with further large financial sector companies reporting early in the week, including Goldman Sachs, Bank of America, Citigroup and Morgan Stanley, then we get the first of the tech giants Netflix and Taiwan Semiconductor on Thursday.

| Date | Major Macro Data |

| 10/14/2024 | Chinese CPI, PPI and Trade Report |

| 10/15/2024 | UK Employment Report; German and EU ZEW Surveys; EU Industrial Production; Canadian CP |

| 10/16/2024 | UK CPI, PPI and RPI |

| 10/17/2024 | Australian Employment Report; EU CPI; ECB interest rate decision, Monetary Policy Statement,and press conference; US Retail Sales and Industrial Production |

| 10/18/2024 | Japanese CPI; Chinese GDP, Retail Sales and Industrial Production; UK Retail Sales |

| Date | Major Earnings Data |

| 10/14/2024 | Nothing of note |

| 10/15/2024 | UnitedHealth; J&J; Bank of America; Goldman Sachs; Citigroup |

| 10/16/2024 | ASML ADR; Abbott Labs; Morgan Stanley |

| 10/17/2024 | Taiwan Semiconductor; Netflix |

| 10/18/2024 | P&G; American Express |