Macroeconomic/ geopolitical developments

- Markets saw sharp swings last week as U.S. equities rebounded strongly on shifting tariff signals, while Treasury yields spiked and global stocks faltered amid persistent trade tensions and economic uncertainty.

- A sharp sell-off in Treasuries and surging yields spurred recession fears and ultimately forced President Trump to pause most tariffs, as mounting pressure from the bond market signaled serious risks to fiscal and economic stability.

- U.S. stocks swung sharply this week as markets reacted to shifting tariff developments, with a surprise 90-day reprieve sparking a tech rally before renewed China tensions reignited volatility.

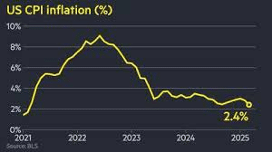

- Key signals of slowing inflation and Fed caution were overshadowed by intensifying tariff tensions, which stoked inflation fears, undermined consumer sentiment, and muted market reactions to otherwise pivotal economic data.

- Major banks, tech giants, and healthcare firms are set to report earnings, with investors closely watching for signs of economic strain and tariff-related fallout.

Global financial market developments

- US and global equity averages rebounded higher during a whipsaw week.

- US and European bond yields were significantly higher on the week

- The US Dollar Index plunged to a new multi-month low.

- Gold futures bounced and rallied to a new all time high.

- Oil futures chopped in a low-level consolidation, near multi month lows.

Key this week

Central Bank Watch: The main central bank activities this week are the Bank of Canada Interest Rate Decision and Monetary Policy Statement on Wednesday and the same from the European Central Bank on Thursday.

Macro Data Watch: The main macro data releases this week are the Canadian, UK, EU and Japanese CPI data, plus Chinese GDP and US Retail Sales, both released on Wednesday.

Earnings Watch: The main US 2025 Q1 earnings releases this week are the Banks at the start of the week and then UnitedHealth and Netflix on Thursday.

Many global markets including US cash and futures markets are closed on Friday due to the Good Friday holiday.

See cacro and earnings data tables on the next page

| Date | Major Macro Data |

| 04/14/2025 | Chinese Trade Report; UK Retail Sales |

| 04/15/2025 | UK Employment Report; EU Industrial Production; Canadian CPI |

| 04/16/2025 | Chinese GDP, Industrial Production and Retail Sales; UK CPI, PPI and RPI; EU CPI; US Retail Sales; BoC Interest Rate Decision and Monetary Policy Statement |

| 04/17/2025 | German PPI; Japanese CPI; ECB Interest Rate Decision and Monetary Policy Statement |

| 04/18/2025 | Nothing of note (US and many global markets closed for Good Friday) |

| Date | Major Earnings Data |

| 04/14/2025 | Goldman Sachs |

| 04/15/2025 | J&J; Bank of America; Citigroup |

| 04/16/2025 | ASML ADR; Abbott Labs; Progressive |

| 04/17/2025 | UnitedHealth; Netflix; Charles Schwab; Marsh McLennan; Blackstone |

| 04/18/2025 | Nothing of note (US equity market closed due to Good Friday) |