Macroeconomic/ geopolitical developments

- Last week began where the prior week left off, building on the “risk on” moves in the wake of the release of the US Employment report on 4th November, which saw more jobs added than market consensus.

- Markets further reacted with a “risk on ” bias early in the week in the anticipation of a Republican victory in the midterm elections, minimally in the House of Representatives and possibly in the Senate too.

- This is due to riskier markets viewing political paralysis (a split in power between the executive, the Presidency, and the legislature, Congress), as positive for corporations and the economy.

- The Republicans did seize control of the House of Representatives, though the Democrats retained control of the Senate.

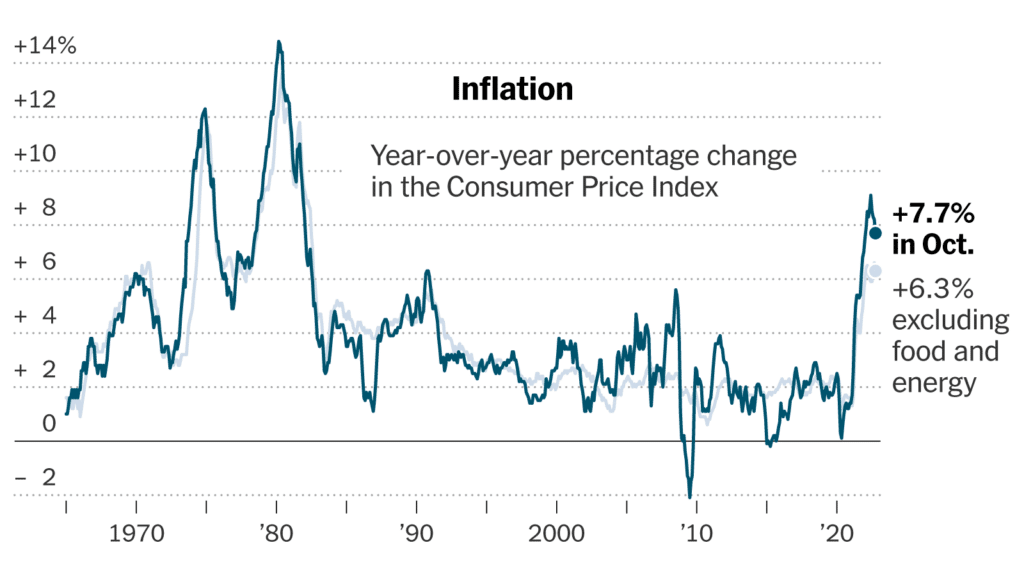

- The US inflation data release on Thursday saw the headline Consumer Price Index (CPI) increase 0.4% in October, below consensus expectations of around 0.6% with the year-over-year (YoY) increase at 7.7%, above the Federal Reserve’s target, but the slowest rise since January.

- In addition, YoY core data (which is less food and energy), fell back to 6.3% from a 40-year high in September at 6.6%.

- Comments from Fed speakers subsequent to the inflation data regarding a slowdown in the pace of interest rate hikes, reinforced the earlier November Fed statement on a less aggressive view on monetary policy going forward.

Global financial market developments

- The major US stock averages surged higher last week after the US CPI release, with the S&P 500 up over 5% on Thursday, its best day since 2020 and the Nasdaq adding over 7%.

- European and Asian equity indices were significantly higher too.

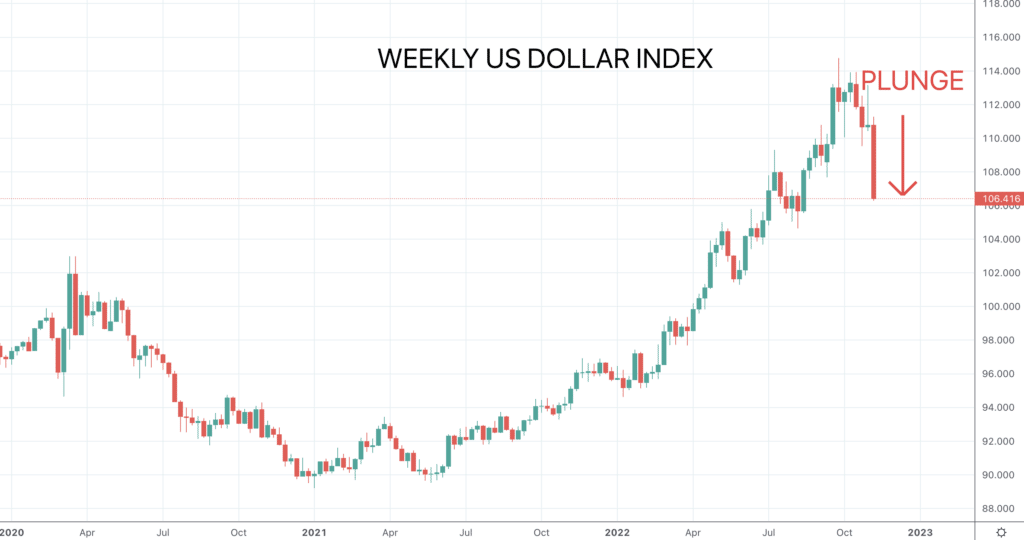

- US 10yr yields plunged lower.

- The US Dollar plunged too, as DXY posted its worst day on Thursday since during the 2009 Great Financial Crisis.

- Gold surged from a new multi-month low to a multi-week high to reject negative pressures and set a more bullish technical outlook.

- Oil prices dropped from a multi week high and then rallied but to close lower on the week.

- Copper surged after a breakout from a wide consolidation range, to a new multi-month high.

Key this week

- Central Bank Watch: A quiet week, the Reserve Bank of Australia (RBA) Minutes are released on Tuesday.

- Macroeconomic data: UK, Canadian and EU CPI are all released this week, as well as China, US and UK Retail Sales, plus the UK and Australia Employment reports.

| Date | Key Macroeconomic Events |

| 14/11/22 | Nothing of note |

| 15/11/22 | RBA Minutes; China Retail Sales; UK Employment; EU GDP; German ZEW Survey; US PPI |

| 16/11/22 | UK inflation report (including CPI); US Retail Sales; Canada CPI |

| 17/11/22 | Australia Employment; EU CPI |

| 18/11/22 | UK Retail Sales |