Macroeconomic/ geopolitical developments

- US stock averages reached new highs, driven by optimism over potential Fed rate cuts and a notable shift from growth to value stocks despite mixed bank results and stronger-than-expected inflation data.

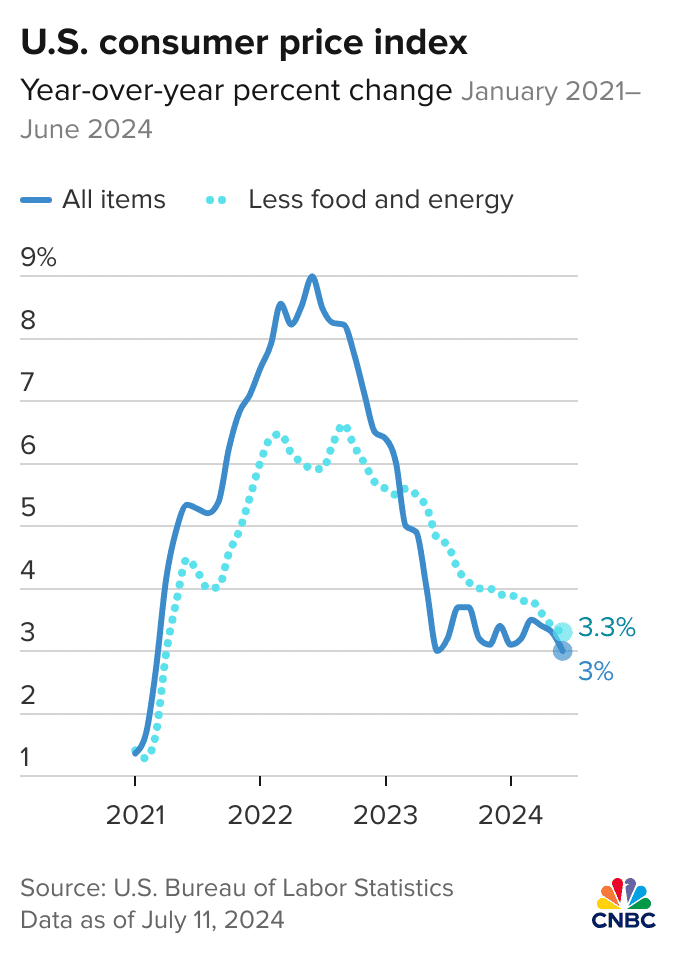

- In June, US inflation slowed significantly, with prices rising 3% annually—the slowest increase in a year—prompting hopes for a Federal Reserve rate cut in September as lower petrol prices and moderating rents ease financial pressures on households.

- US Treasury bond yields dropped sharply following a surprise decline in inflation, reinforcing expectations that the Federal Reserve might start cutting interest rates by September.

- The US earnings season started with mixed results from major financial institutions, as JPMorgan Chase, Wells Fargo, Citigroup, and Bank of New York Mellon reported second-quarter figures, highlighting varied performances and investor concerns.

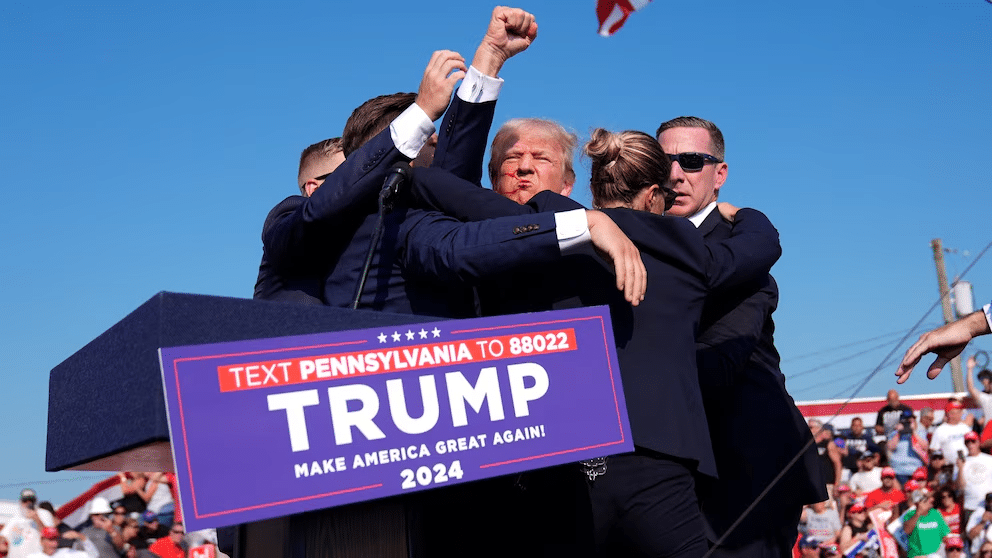

- An assassination attempt left Donald Trump injured but defiant at a Pennsylvania rally, while President Joe Biden’s gaffe during a NATO summit, confusing Ukrainian President Zelenskyy with Russian President Putin, raised concerns about his age and leadership.

Global financial market developments

- US and global equity averages extended higher, with many markets hitting record levels

- US and European bond pushed significantly lower on the week, to multi-week lows

- The US Dollar Index also pushed significantly lower from Thursday to multi-week lows.

- Gold futures rallied, pushing to the upper end of a multi-week range.

- Oil futures stayed in consolidation mode, dipping and bouncing.

Key this week

Central Bank Watch: Central bank focus will be on the ECB Interest Rate Decision and Monetary Policy Statement on Thursday.

Macro Data Watch: The main macro data releases this week are inflation data from the UK, EU, Canada and Japan, Retail Sales from China, Germany and Canada, plus US and UK, US Industrial Production on Wednesday and the UK Employment Report on Thursday.

Earnings Watch: The US Q2 earnings season continues having kicked off on Friday with the financa, with further large financial sector companies reporting early in the week, including Goldman Sachs, BlackRock, Bank of America and Morgan Stanley, then we get the first of the FANG stocks, Netflix on Thursday.

| Date | Major Macro Data |

| 07/15/2024 | Chinese Industrial Production, Retail Sales and GDP; German Retail Sales; EU Industrial Production |

| 07/16/2024 | German ZEW Survey; Canadian CPI; US Retail Sales |

| 07/17/2024 | UK Inflation Report (including CPI); EU CPI; US Industrial Production |

| 07/18/2024 | Japanese Trade Report; Australian Employment Report; UK Employment Report; ECB Interest Rate Decision and Monetary Policy Statement |

| 07/19/2024 | Japanese CPI; UK Retail Sales; Canadian Retail Sales |

| Date | Major Earnings Data |

| 07/15/2024 | Goldman Sachs; BlackRock |

| 07/16/2024 | United Health; Bank of America; Morgan Stanley |

| 07/17/2024 | ASML; J&J |

| 07/18/2024 | Netflix; Abbott Labs |

| 07/19/2024 | American Express |