- Copper has been moving higher since November 1

- The research whilst mixed, has a bullish bias

- The need for infrastructure rebuilding and electrification of the auto space bodes well

- Look for prices to test U.S. Dollars 3.62/lb

“… Even the old folks never knew

Why they call it like they do

I was wondering since the age of two

Down on Copperline …”

“Copperline” ~ James Taylor

Looking at the charts and sentiment of any asset tells a story. The lines one can find when it comes to copper are quite fascinating. However, before I explain my take on the current scenario, allow me to make a brief recap.

On November 7, 2020 I published a paper on this site that recommended a buy of copper.

“…Money To Made Down Copperhead Road…”

I set a stop loss at USD3.09/lb that thankfully was never activated and my first two upside targets were set conservatively at 3.21 and 3.26.

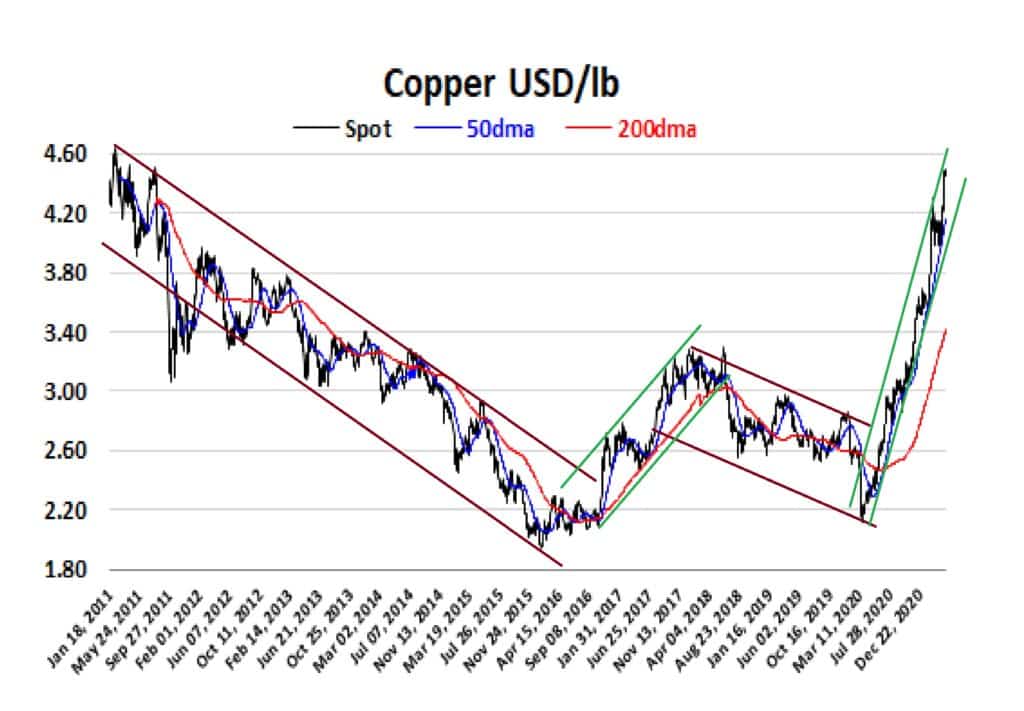

Figure 1: Copper USD/lb from 2012 Source: www.investing.com , Spotlight Ideas

A long history chart shows current prices are locked inside a narrow impulsive channel that look determined to break the high of that period at USD 4.641/lb booked on February 14, 2011.

Mixed Market Minds

The market is heavy with mixed reports on the prospects for copper. For example, BMO Capital Markets suggest copper will endure a heavy tumble in the second half of 2021. They point to reduced copper (and other raw materials) demand in China.

In contrast metals analysts at StoneX forecasts copper demand in 2021 will rise by 5% YoY and thus will outrun supply, which they see growing by just 2.3% YoY. If this forecast proves to accurate it implies the global copper supply will move from a small surplus in 2020 to a deficit of more than 200,000 tonnes of copper this year.

To support this I note that copper inventories in London Metal Exchange (LME)-registered warehouses as of February 19 were trading at 75,700 tonnes, close to a 15-year low of 75,550 tonnes in September 2020. This did expand to 155,100 tonnes at the end of April, but this figure has fallen by 10% over the past two weeks. Another bullish factor is the fact that cancelled warrants, i.e. metal earmarked for delivery, at 53% indicate more copper will soon be leaving LME warehouses.

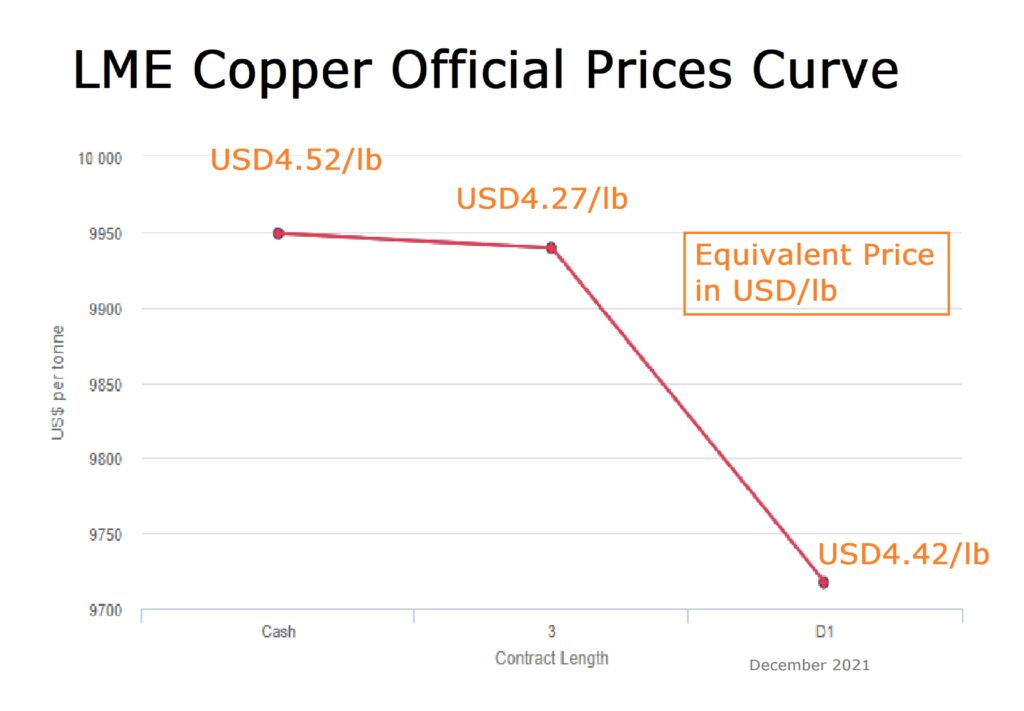

This has fuelled worry about supplies on the LME market and created a premium for the cash over the three-month contract .

Figure 2: LME Copper Official Prices Curve April 30, 2021 Source: LME

Staying with an upbeat tone, Goldman Sachs are bullish having called copper “…the new oil…” in its mid-April release on the metal. They have even suggested a price of USD15,000/tonne which equates to USD6.82/lb over the next four years.

Driving Demand

On February 11, Reuters reported that the European Automobile Manufacturers’ Association (EMMA) said the EU should target one million charging points for electric vehicles by 2024, and three million by 2029 to support the electrification of the car industry in Europe.

These are ambitious targets and underline the direction of travel in the auto industry and gives European EV activity the potential to be one of the fastest-growing areas globally over the coming years. With it will be the need for tremendous investment in accompanying charging infrastructure to add to the 225,000 public charging points at present.

So, what about the “Copperline” that was mentioned at the beginning? Figure 3 shows the One-Week view so that any interested short-term traders can grasp a perspective within the overall seemingly bullish picture.

Figure3: Copper One-Week Chart and Time Technical Sentiment Source: www.investing.com , Spotlight Ideas

There is sentiment for a little buying at the start of trading before selling may creep in with support at 4.42. Then as one pushed out to the weekly and monthly perspective the upside will prevail and the current sharp impulsive channel should enjoy confirmation.

I have metal exposure but if flat would be willing to buy here and set initial targets at USD4.62 as my objective. If buying here, set stops at 4.40, however, I am highly positive on copper as a long-term play.