US and UK inflation beat expectations => Risk On extends

Macroeconomic/ geopolitical developments

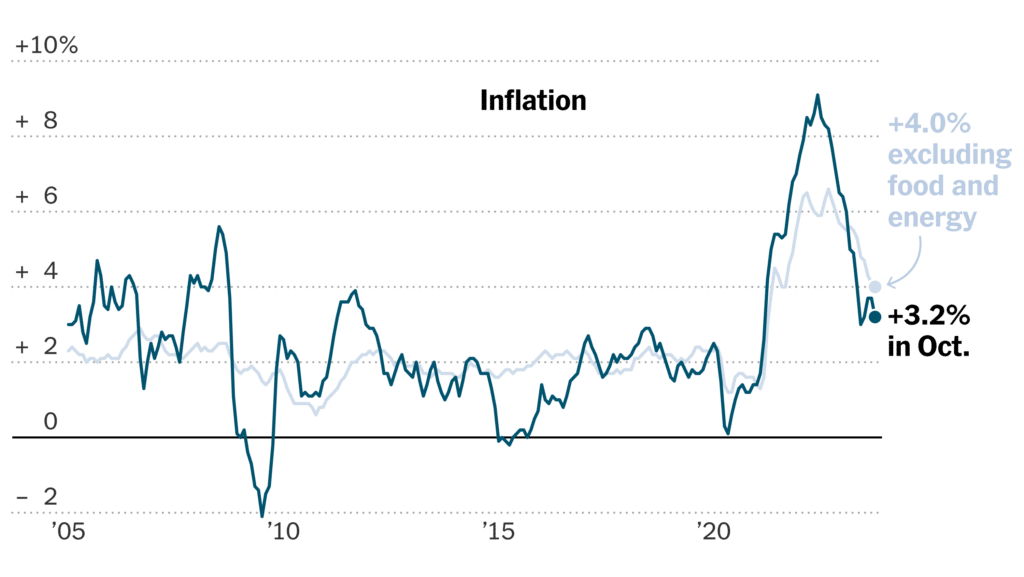

- US CPI beat expectations, with inflation slowing further to 3.2% year-over-year. This makes rate hikes less likely, with bonds and stocks responding with a rally.

- US PPI and retail sales also bested consensus numbers. Retail sales saw a year-over-year increase of +2.5%, while PPI saw a significant drop to -0.5% from the prior month’s +0.4%, well below the expected +0.1%.

- UK CPI also cools to 4.6%, the lowest in two years, surpassing the 4.8% expectations.

- US-Sino summit uneventful but positive with the two leaders agreeing to resume high-level military communication.

- Target soars, surpassing Wall Street’s sales and earnings expectations, with shares rising nearly 18%. Walmart exceeded Q3 estimates, but their stock fell following a softer outlook in the earnings call.

- US Senate approves stop-gap spending measure, averting an imminent shutdown crisis, but leaving the path for a long-term government spending agreement uncertain.

Global financial market developments

- US and global equity index futures surged even further last week, now fully in bull mode.

- US and global yields significantly moved lower yet again, with USTs hitting new multi-week yield lows.

- The US Dollar Index plugged lower last week after the US CPI data, reinforcing weakness from early November and fully in bear mode now.

- Gold futures rallied to reverse early November losses and are aiming back towards multi-month highs.

- Oil futures sold off even further through still more notable supports last week, setting even more bearish forces.

Key this week

- General: It is US Thanksgiving on Thursday, financial markets are mostly closed Thursday with a partial day Friday. US futures are operating shortened trading hours.

- Central Bank Watch: We get the People’s Bank of China (PBoC) Interest Rate decision on Monday, then both the Reserve Bank of Australia (RBA) and US Federal Open Market Committee (FOMC) Meeting Minutes on Tuesday.

- Macro Data Watch: The key focus for the week will be the global Flash PMI from S&P Global released Thursday and the same for the US out on Friday. We also get US Durable Goods and Michigan Consumer Sentiment on Wednesday and from the UK, the Autumn Forecast Statement on Thursday.

| Date | Major Macro Data |

| 11/20/2023 | PBoC Interest Rate decision |

| 11/21/2023 | RBA Meeting Minutes; Canada CPI; US FOMC Meeting Minutes |

| 11/22/2023 | US Durable Goods; Michigan Consumer Sentiment |

| 11/23/2023 | US Thanksgiving holiday; global Flash PMI from S&P Global; UK Autumn Forecast Statement |

| 11/24/2023 | US Thanksgiving holiday, early closes; Japan CPI; German GDP and IFO Survey; US Flash PMI from S&P Global |