Macroeconomic/ geopolitical developments

- Earnings season continued in the US last week, with positive earnings surprises across sectors, reinforcing solid results from the financial sector the prior week.

- But Snapchat parent Snap did disappoint on Friday, dragging the tech sector and Nasdaq lower to end the week.

- Fiscal stimulus hopes also helped the “risk on” theme with positive soundings regarding the progress of Joe Biden’s proposed social infrastructure bill.

- These factors saw an extension of the October “risk on” theme seen across global financial markets.

Global financial market developments

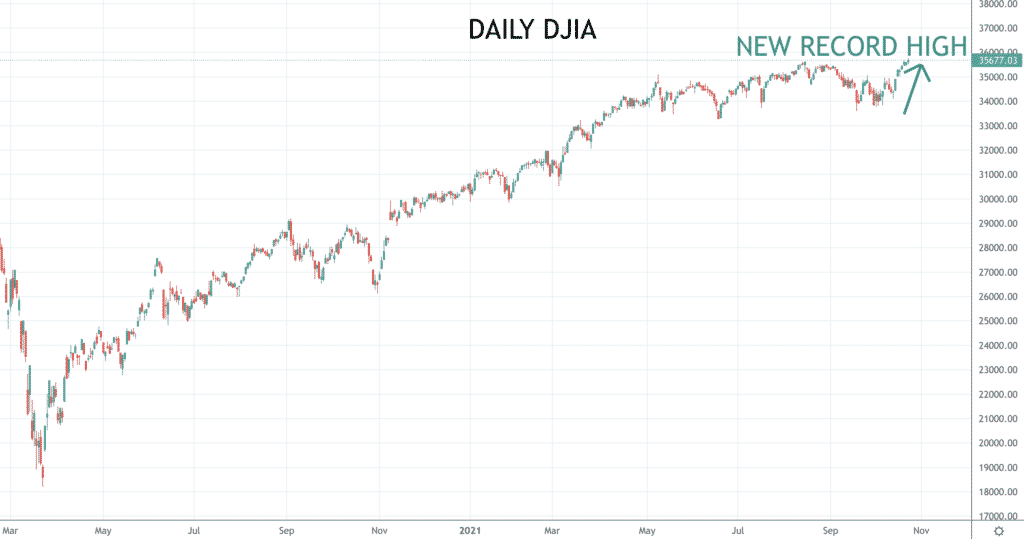

- Global stock averages pushed higher into latter October, neutralising the significant September sell offs.

- US indices led global markets higher with the S&P 500 and DJIA hitting new record levels.

- US (and global) yields pushed to new multi-month yield highs last week, extending higher yield moves evident since the September Federal Open Market Committee (FOMC) meeting.

- The US Dollar dipped even lower last week despite rising US yields.

- EURUSD pushed higher and completed a small base consolidated, rejecting short-term vulnerability.

- GBPUSD posted another solid rebound sustaining an upside bias

- Gold spiked higher to extend the recovery effort from September and sets a positive tone within a broader sideways, range.

- Oil further extended its extremely strong advance from August.

- Copper rallied last week and then setback from its highest level since May, having broken out the prior week from the sideways range.

Key this week

- Geopolitics: Monitoring the progress of Biden’s proposed social infrastructure bill.

- Central Bank Watch: TheBank of Canada (BoC) interest rate decision, statement and press conference is on Wednesday and we get the same from the Bank of Japan (BoJ) and European Central Bank (ECB) on Thursday.

- Macroeconomic data: The data standouts this week are the German IFO Business Climate Survey, and US Consumer Confidence, Durable Goods and GDP.

- Microeconomic data: Earnings season continues in the US with Facebook, Microsoft, Google, Boeing, Apple, and Amazon the standouts.

| Date | Key Macroeconomic Events |

| 25/10/21 | German IFO Business Climate Survey |

| 26/10/21 | US Consumer Confidence |

| 27/10/21 | Australian inflation report (including CPI); US Durable Goods Orders; BoC interest rate decision, statement and press conference |

| 28/10/21 | BoJ and ECB interest rate decisions, statements and press conferences; US GDP and PCE |

| 29/10/21 | Japan Industrial Production; Australian Retail Sales; German GDP; EU GDP and CPI; US PCE; Canadian GDP |