What to Expect from the US Employment Report

As anticipation builds for the release of the US Employment Report, economists and market analysts are closely scrutinising various indicators to gauge the health of the labour market and broader economy. Here’s what to expect from the upcoming report based on recent data and expert forecasts.

Economists are forecasting an addition of 200,000 jobs in February, a notable decline from January’s robust figure of 353,000. Despite the expected slowdown, this level of job creation would still signify ongoing labour market expansion and economic resilience.

Analysts are projecting a monthly increase of 0.3% in average hourly earnings for February, following a 0.6% rise in the previous month. On a year-over-year basis, average hourly earnings are expected to show a 4.4% increase, slightly lower than January’s 4.5%. Wage growth remains a crucial metric for assessing the purchasing power of workers and inflationary pressures in the economy.

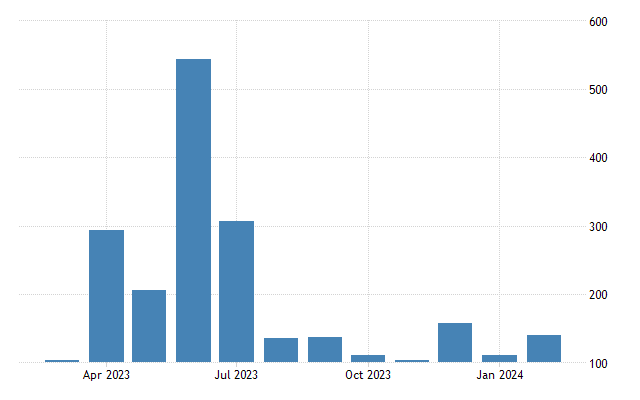

Insights from the recent US ADP Employment Report released Wednesday, provide additional context for interpreting the upcoming employment figures. The moderate pace of hiring observed in February, with private payrolls increasing by 140,000, suggests ongoing demand for workers across various industries. While this figure fell slightly short of expectations of 150k, it still indicates solid job gains, above last month’s 111k and reflects a resilient labour market.

Key Observations:

- Job creation remains solid, albeit at a slightly slower pace compared to previous months.

- Wage growth is showing signs of moderation, particularly for workers who stayed in their jobs, although it remains above the rate of inflation.

- Broad-based gains in employment across sectors such as leisure and hospitality, construction, and trade and transportation underscore the widespread nature of job opportunities.

The upcoming employment report is expected to offer valuable insights into the trajectory of the labour market and its implications for broader economic conditions. While a potential slowdown in job gains is anticipated, the overall trend remains positive, highlighting the resilience of the US economy amidst ongoing challenges.

What is the US Employment Report

The US Employment Report, released monthly by the Bureau of Labor Statistics (BLS), provides a comprehensive overview of the current state of employment in the United States. This report is widely regarded as one of the most crucial economic indicators due to its profound impact on financial markets, policymaking, and overall sentiment regarding the health of the economy.

Components of the Employment Report:

Nonfarm Payrolls: This figure represents the total number of paid workers in the U.S., excluding farm workers, government employees, private household employees, and employees of nonprofit organisations. It is a key measure of economic health and is closely watched by analysts and investors.

Unemployment Rate: The unemployment rate indicates the percentage of the total labor force that is unemployed and actively seeking employment. A lower unemployment rate suggests a healthier job market and overall economic growth.

Average Hourly Earnings: This metric tracks the average hourly wages of nonfarm workers, providing insights into changes in wage levels and purchasing power. Rising average hourly earnings may indicate inflationary pressures and increased consumer spending.

Labor Force Participation Rate: The labour force participation rate measures the proportion of the working-age population that is either employed or actively seeking employment. Changes in this rate reflect shifts in the willingness or ability of individuals to participate in the labour market.

Importance of the US Employment Report:

Indicator of Economic Health: The employment report serves as a barometer of the overall health of the economy. Positive trends, such as increasing nonfarm payrolls and declining unemployment rates, signal economic expansion, while negative trends may indicate contraction or stagnation.

Monetary Policy Implications: Central banks, including the Federal Reserve, closely monitor employment data to assess the need for monetary policy adjustments. Strong employment figures may prompt policymakers to consider tightening monetary policy to prevent overheating, while weak employment data may warrant accommodative measures to stimulate economic growth.

Market Reaction: Financial markets, including stocks, bonds, and currencies, often experience significant volatility in response to the release of the employment report. Positive employment data can boost investor confidence and drive equity markets higher, while negative surprises may lead to sell-offs and increased demand for safe-haven assets.

Consumer Sentiment and Spending: Employment trends directly influence consumer sentiment and spending patterns. Rising employment and wages typically translate to increased consumer confidence and discretionary spending, which are vital drivers of economic growth.