Macroeconomic/ geopolitical developments

- The global Market and US Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) reports were out on Thursday and were broadly better than expected.

- The US Employment report for March was released on Friday and the Non-Farm Payroll data far exceeded the anticipated number of 675K, posting at 916K, whilst the Unemployment rate came in as expected, falling to 6%.

- European markets and the US stock market were closed for the Easter Good Friday holiday when the US Employment report was released (though the US bond market was open, and US stock futures markets operated shortened hours).

- The European vaccination program continues to rollout, but still lags the rollouts in the US and the UK.

- The number of COVID-19 hospitalisations and deaths in the UK continues to fall, with negligible uptick in new cases since the reopening of schools.

Global financial market developments

- Global stock indices managed to hit yet new record and multi-month highs to end the quarter and start Q2, led by European averages, notably the DAX.

- US averages also saw a broad rally in late March that has already extended into early April, with the S&P 500 and Dow Jones Industrial Average posting new record highs.

- The underperforming Nasdaq 100 and Composite averages have rebounded, building bases, signalling a more positive tone, easing the more negative themes evident through March.

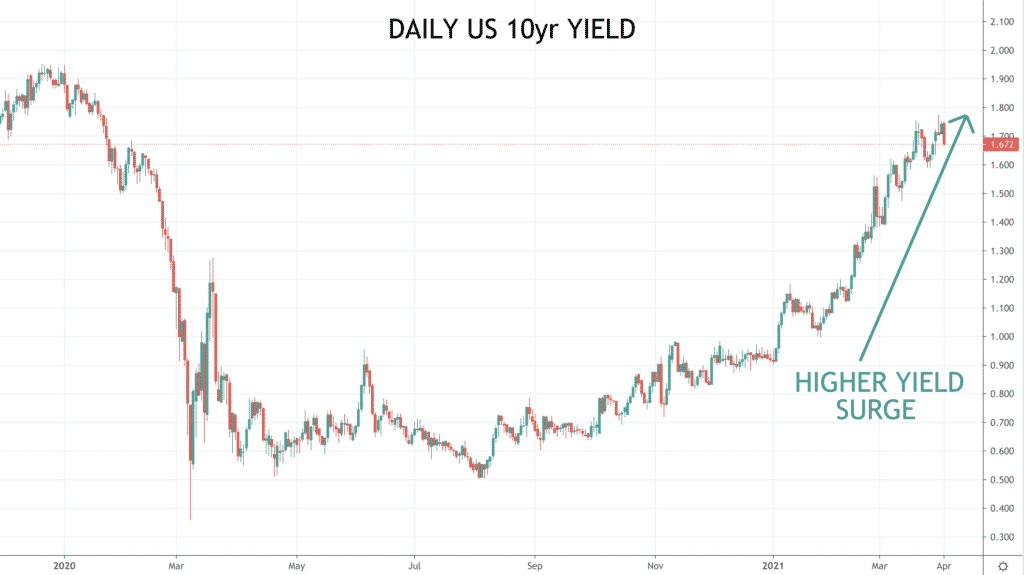

- The global bond market sell off resumed last week, led by US bond markets which extended to new multi-year yield highs.

- The US Dollar resumed its positive trend evident through 2021, with the US Dollar Index hitting multi-month highs.

- EURUSD has extended its bear theme, at its lowest level last week since November 2020.

- GBPUSD did rebounded trough the turn of quarter, but the negative corrective bias from late February remains intact for now.

- The “risk currencies” corrected positively against the US Dollar into the end of Q1, but March losses leave the Australian, New Zealand and Canadian Dollars all vulnerable versus the greenback.

- Oil was again choppy and sideways last week.

- Copper has stayed sideways since its mid-Q1 correction lower from a multi-year high.

- Gold has been choppy, initially vulnerable last week then bouncing from the early March low.

Key this week

- Geopolitics:

- Easter Monday is on 5th April 2021 with European markets and other global markets closed for the Easter holiday, whilst US markets are open.

- As always, we will be watching COVID-19 cases, hospitalisations and deaths globally (notably in Europe).

- And monitoring for possible new lockdown restrictions, particularly in Europe.

- Central Bank Watch:

- The Reserve Bank of Australia (RBA) interest rate decision and statement is on Tuesday, the Federal Open Market Committee (FOMC) Meeting Minutes are released on Wednesday and Fed Chairman Powell speaks on Thursday.

- Macroeconomic data: Key this week will be the US Institute of Supply Management (ISM) Services Purchasing Managers Index (PMI) report out on Monday, then the global Markit Services PMI on Wednesday.

| Date | Key Macroeconomic Events |

| 05/04/21 | Easter Monday, European, UK and other global markets closed; US ISM PMI |

| 06/04/21 | RBA interest rate decision and statement; EU Unemployment rate |

| 07/04/21 | Global Markit Services PMI; FOMC Meeting Minutes |

| 08/04/21 | German Factory Orders; Fed Chairman Powell speaks |

| 09/04/21 | Chinese Consumer Price Index (CPI); Canadian Employment report |