Macroeconomic/ geopolitical developments

- A quiet week in financial markets with muted central bank activity and a relatively light data calendar.

- The standout on Wednesday was a more hawkish tone from the Reserve Bank of New Zealand (RBNZ).

- This helped the New Zealand Dollar post firm gains across the Forex board.

- Cryptocurrencies remained volatile, with Bitcoin unable to hold onto rebounds since the May plunge.

Global financial market developments

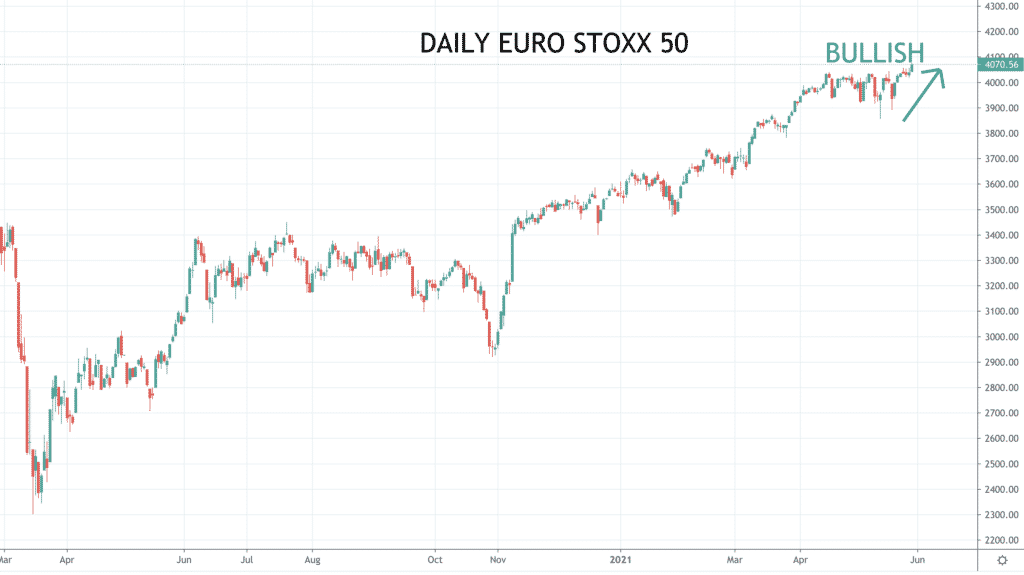

- European averages have taken the lead from their US counterparts in the past week, with the EURO STOXX 50 hitting a new cycle high.

- Global stock averages also pushed higher, but US averages are still capped below record and multi-month highs.

- Big Tech is starting to rebound, and the Nasdaq probed back higher.

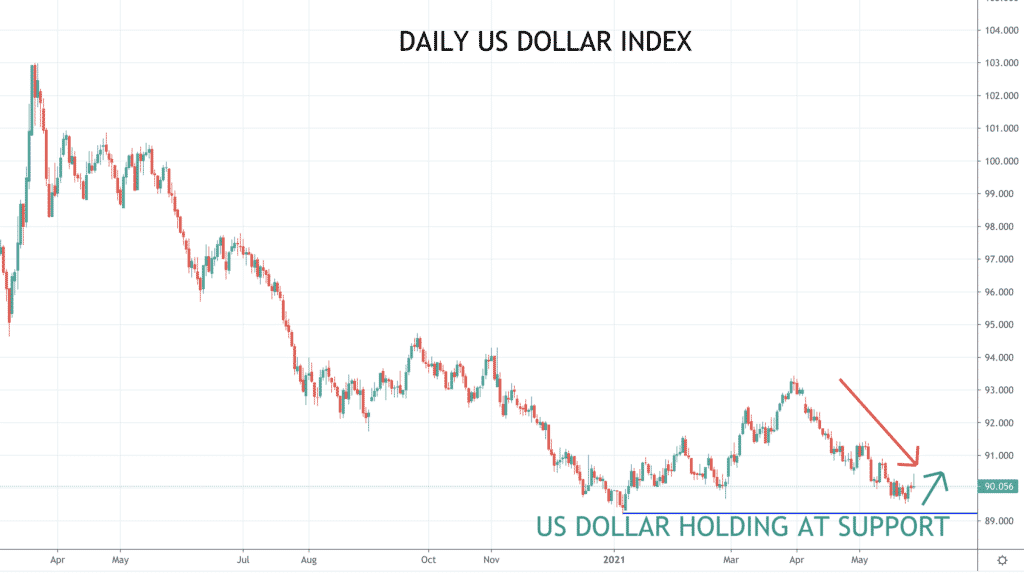

- The US Dollar Index has AGAIN, held above key support.

- The Euro is still indecisive, with EURSD capped below key resistance.

- USDJPY is strengthening.

- NZDUSD reacted positively to the more hawkish tone from the RBNZ (as above).

- Gold pushed higher again, sustaining an upside bias.

- Oil has bounced and extended higher.

- Copper bounced too, aiming back at the recent multi-year peak.

Key this week

- Geopolitics:

- A holiday in the UK and US on Monday, local markets are closed.

- Still looking for further easing of lockdown measures, particularly in Europe.

- Monitoring COVID-19 cases, hospitalisations and deaths globally, alongside the spread of the Indian variant in the UK and Europe.

- Central Bank Watch: A quiet week for central banks, with the Reserve Bank of Australia (RBA) interest rate decision and statement on Tuesday.

- Macroeconomic data: A busy data week with global Markit Manufacturing, Services and Composite PMI, plus the US ISM Manufacturing and Services PMI on Tuesday and Thursday, with the US Employment report on Friday.

| Date | Key Macroeconomic Events |

| 31/05/21 | UK and US holidays, these markets closed; China PMI; German CPI |

| 01/06/21 | RBA interest rate decision and statement; global Markit Manufacturing PMI; German Unemployment; EU CPI and Employment; US ISM Manufacturing PMI |

| 02/06/21 | Australian GDP; German Retail Sales |

| 03/06/21 | Global Markit Services and Composite PMI; US ISM Services PMI |

| 04/06/21 | US Employment report; Canadian Employment report |