Macroeconomic/ geopolitical developments

- US President Biden announced a potentially significant increase in Capital Gains Tax (CGT) rates, which had a negative impact on US (and global) risk assets.

- Earnings season has continued with mostly positives, though Netflix missed the expectations of analysts on new subscribers, which was a broader negative for new media/ big tech.

- The Bank of Canada (BoC) Meeting announced a tapering of their bond buying program and moved up the timeline for a possible interest rate hike.

- Although this BoC move was somewhat expected, the confirmation has highlighted global Central Banks are maybe looking at exiting from the current super easy monetary policy positions.

- The European vaccine rollout continues to improve, although it still lags the US and UK, which continue at a strong pace.

- European nations have in some places started to lift some lockdown measures, although in some nations the concerns and cases remain elevated.

- Surging Covid cases, hospitalisations and deaths in India are upsetting, but outside of Indian markets have had little impact on core financial markets.

Global financial market developments

- Global stock averages hovered near new record and multi-month highs with US averages taking back leadership from Europe late in the week, with the S&P 500 hitting a new record level on Friday

- US yields have reinforced their retreat to lower yields, from multi-year yield highs

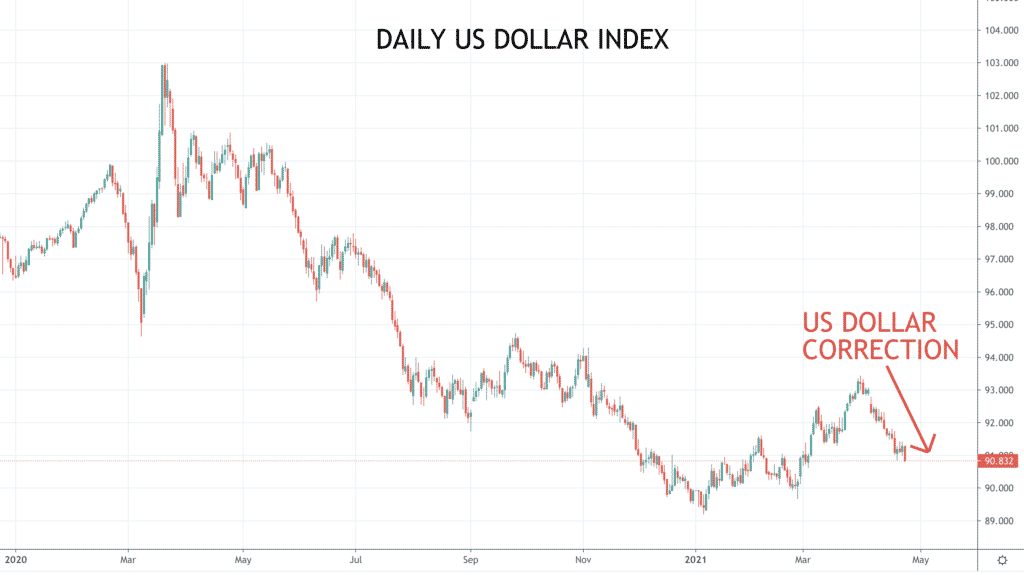

- The US Dollar has broadly weakened, which has seen the Dollar Index slide still lower into late April.

- The Canadian Dollar rallied after the Bank of Canada Meeting (slightly more hawkish with tapering and possible change in the interest rate hike timeline), setting USDACAD lower.

- Gold has rallied further too (with broadening US Dollar losses), reinforcing the early April chart base (Double Bottom).

- Oil has broken higher with a “risk on” theme and weaker US Dollar.

- Copper also gained, helped by the US Dollar wakening.

Key this week

- Geopolitics:

- As always, traders need to monitor COVID-19 cases, hospitalisations and deaths globally (notably in Europe).

- Also watching for possible lockdown easings, particularly in Europe.

- There is an OPEC+ Meeting on Wednesday.

- Central Bank Watch: The Bank of Japan (BoJ) and the US Federal Open Market Committee (FOMC) interest rate decisions and statements are on Tuesday and Wednesday respectively. European Central Bank (ECB) President Christine Lagarde speaks on Wednesday too.

- Macroeconomic data: A big week for data, with German IFO, unemployment and Consumer Price Index (CPI), plus US Durable Goods Orders, Gross Domestic Product (GDP) and Personal Consumption Expenditure (PCE). See the table below for details.

- Microeconomic data: Earning season continues in the US this coming week with some big tech names reporting including Tesla, Microsoft, Google (Alphabet), Apple, Facebook, Boeing, Amazon and Exxon Mobile.

| Date | Key Macroeconomic Events |

| 26/04/21 | German IFO Business Climate Survey; US Durable Goods Orders |

| 27/04/21 | BoJ interest rate decision and statement |

| 28/04/21 | OPEC+ Meeting; Australian CPI; ECB President Christine Lagarde; Canadian Retail Sales; FOMC interest rate decision and statement |

| 29/04/21 | German Unemployment and CPI; US GDP |

| 30/04/21 | Chinese PMI; German GDP; EU GDP; US PCE |