General

Features

Pros

- Up to 1:500 leverage

- Multi award-winning New Zealand broker

- Institutional-grade spreads from 0.0 pips

- 26,000 Tradeable assets

- TradingView Integration

Cons

- Not regulated by the FCA

- Withdrawal fee

BlackBull Markets Review

Review Sections:

Founded in Auckland, New Zealand, in 2014, BlackBull Markets has racked up a fair amount of experience over the past six years. It is a true ECN, no dealing desk broker, looking to deliver an institutional-level trading experience to retail clients.

How does this objective translate to the real world through what BlackBull Markets offers?

- BlackBull Markets offers an excellent depth of market, as well as outstanding leverage at 1:500.

- The broker features higher execution speeds due to a proprietary system it uses to aggregate orders.

- With MT4, MT5 and TradingView in its platform lineup, the broker offers VPS access, allowing traders to take full advantage of the algorithmic trading capabilities of these platforms.

- Personal account managers provide top-notch support to traders.

Perhaps most striking about BlackBull Markets is the fact that the brokerage has an outstanding online reputation. Most online brokerages fail to secure a good reputation thanks to the inevitable mass of losing traders who are always keen to throw around various accusations. That is not to say that BlackBull Markets does not have detractors. It boasts a very diverse, and therefore credible, selection of user feedback, but its overall rating is great.

What do BlackBull Markets’ clients like most about the broker based on this feedback?

- Most traders appreciate the broker’s website, its low spreads, and its customer support.

- Others like the fact that the broker does not have liquidity- or slippage-related problems.

- Still others appreciate the quick account setup.

- Other traders like the Demo account that allows full access to real asset prices for up to30 days.

- BlackBull Markets also offers analysis through its social media pages. Many of its clients like the quality of this analysis.

Despite the good reputation and rating of the brokerage, many have complained about various aspects of the services it offers.

What do traders dislike about BlackBull Markets?

- Some would-be traders have complained that BlackBull Markets refused them service without justification.

- Other traders allege that despite advertising itself as a true ECN broker, BlackBull Markets engages in market making. Such complainers never seem to provide any proof to back their claims, however.

- Some traders have said that the broker took longer than two weeks to process the documents they had uploaded for account-opening purposes. Such issues may have occurred over a period when the broker processed several thousand client applications per week.

The company behind BlackBull Markets is Black Bull Group Ltd. In a bid to cover several jurisdictions world-over, those behind the BlackBull brand have set up three corporate entities.

- Black Bull Group Limited is a company registered and based in New Zealand. The company registration number is NZBN 9429041417799, and its address is Level 22, 120 Albert Street, Auckland 1010. This side of the operation is regulated by the Financial Markets Authority of New Zealand. It is a registered Financial Services Provider holding license #FSP403326.

- Black Bull Group UK Limited is the UK-facing side of the brokerage. This corporate entity is registered in the UK, bearing company number 9556804. The address of Black Bull Group UK Limited is 483 Green Lanes, London, Greater London, United Kingdom, N13 4BS.

- The third company backing the Black Bull brand is BBG Limited, based and licensed in Seychelles. The regulator under whose umbrella this side of the brokerage operates is the Financial Services Authority of Seychelles.

Platform and Tools

| Feature | BlackBull Markets |

|---|---|

| Virtual Trading(Demo) | |

| Desktop Platform (Windows) | |

| Desktop Platform (Mac) | |

| Web Platform | |

| Social Trading / Copy Trading | |

| Proprietary | |

| MetaTrader 4 (MT4) | |

| MetaTrader 5 (MT5) | |

| cTrader | |

| Currenex | |

| ZuluTrade | |

| MirrorTrader | |

| Charting - Drawing Tools(Total) | |

| Charting - Indicators / Studies (Total) | |

| Watchlists | |

| Order Type - Trailing Stop |

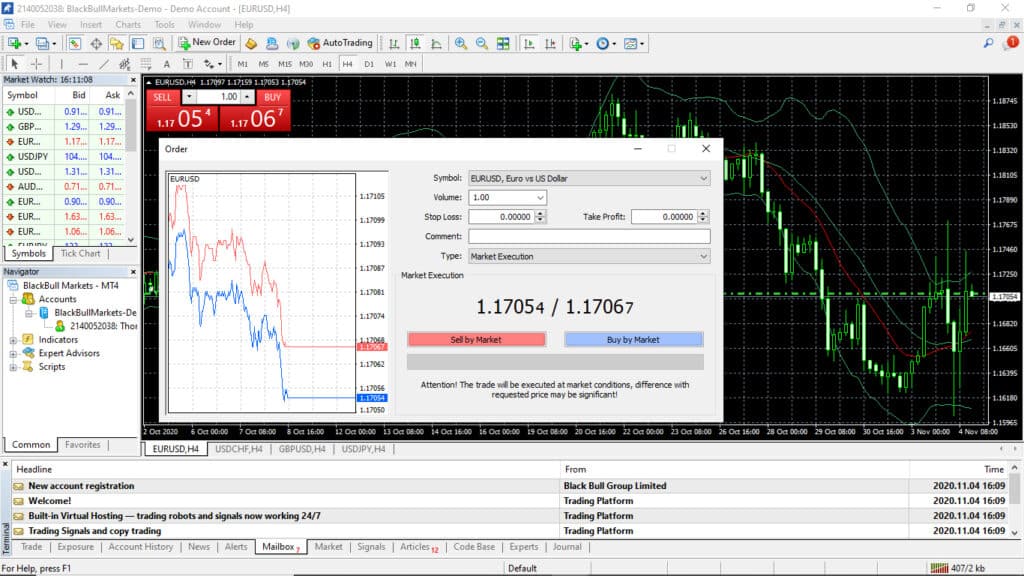

BlackBull Markets offers four trading platforms.

MT4 is a fully customizable online trading environment most traders know and love. The broker has made it available in a range of versions for Windows, Mac, iOS, and Android.

BlackBull’s version of the platform offers an institutional-grade experience. It supports EAs (Expert Advisors), and together with the VPS service the broker also offers, this sets the stage for profitable algorithmic trading.

Like most of its other features, MT4’s EAs are fully customizable. You do have to be handy with MetaScript, however, if you intend to program your custom EAs.

In addition to EAs and superb charting/technical analysis tools, BlackBull’s MT4 supports multiple order types and analysis tools. Other noteworthy features/functionalities of the platform are enhanced order execution capabilities and a market watch window.

MT5 is another popular MetaQuotes trading platform, covering slightly different needs than MT4.

MT5’s main strengths are fast order processing, support for advanced pending orders and hedging, as well as a bevy of trading tools and technical indicators.

The version available for download at the BlackBull Markets website comes equipped with more than 30 preinstalled technical indicators, covering more than 20 time frames. The platform also features an integrated economic calendar to help with fundamental analysis.

Traders looking to access MT5 need to talk with the BlackBull Markets support first and obtain permission.

The BlackBull Markets Web Trader is a simplified version of the MT4 platform. Its trading interface is intuitive, and it offers a great selection of drawing tools and technical indicators.

According to the broker, its Web Trader delivers all the benefits of MT4, in a highly compatible no-download package.

TradingView

BlackBull Markets clients can now(August 2022) trade 26,000+ instruments directly in TradingView while taking advantage of its extensive features, indicators, and social network of investors.

TradingView is used by over 30 million investors world wide, and caters to both beginner and expert traders offering a free account option to get started.

Asset Classes

The tradable asset selection of the broker includes more than 64 currency pairs, index CFDs, commodities, precious metals, and energies.

The Forex section is arguably the most popular. The leverage available on this asset class is 500:1, while the spreads start from just 0.1 pips.

The selection of index CFDs is not overly impressive. It covers the AUS200, the GER30, the US30, the SPX500, the UK100, and the JPN225.

The available leverage on commodities is 500:1 as well, across all BlackBull Markets platforms.

The precious metals section covers gold and silver. Oil and natural gas are the available energies.

Commissions and Fees

The commissions/spreads the broker charges depend on the account type the client opens.

- The ECN Standard account does not charge any commissions. Its spreads start from 0.8 pips.

- The ECN Prime account charges a $6 roundtrip commission per lot. Its spreads are much lower, however, starting from just 0.1 pips.

- Institutional clients can negotiate their commissions on the ECN Institutional account. Spreads on this special account type start from 0 pips.

The broker does not charge any fees on bank wire deposits. Any fees that depositors incur on such transfers are likely due to the bank they use.

Research and Education

| Feature | BlackBull Markets |

|---|---|

| Daily Market Commentary | |

| Forex News | |

| AutoChartist | |

| Trading Central (Recognia) | |

| Delkos Research | |

| Acuity Trading | |

| Social Sentiment - Currency Pairs | |

| Client Webinars | |

| Client Webinars (Archived) | |

| Videos - Beginner Trading Videos | |

| Economic Calendar | |

| Calendar Includes Forexcasts | |

| Economic News Sentiment | |

| Trade Ideas - Backtesting |

The trader education BlackBullmarkets offers consists of a glossary of terms and a Learn to Trade section, the purpose of which is to usher beginners into the flow of trading.

In addition to these two sections, the broker also features a decently comprehensive library of trading videos and a trading guides section. The guides cover technical- and fundamental analysis, as well as a few basic concepts and explanations of technical analysis elements.

The Trading Resources section offers information on contract expiries and specifications. Market Reviews and an Economic Calendar are also included in the trading resources package.

Customer Service

By most client accounts, the BlackBull Markets support is outstanding. The support staff is knowledgeable and it sorts out support requests on time.

The BlackBull Markets website features a Live Chat support option, available 24/6.

Other than that, traders can contact support through email (support@blackbullmarkets.com), and phone. The phone numbers are (+64) 9 558 5142 for NZ, and 0800 BB Markets also NZ, but this latter one is a free number.

Mobile

| Feature | BlackBull Markets |

|---|---|

| Android App | |

| Apple App | |

| Charting - Draw Trend Lines | |

| Charting - Can Turn Horizontally | |

| Charting - Technical Studies/Indicators | |

| Watchlist - Syncing | |

| Trading - Forex CFDs | |

| Trading - CFDs | |

| Alerts - Basic Fields |

The mobile trading options available at BlackBull Markets are the MT4 mobile apps for Android and iOS devices.

Both of these apps deliver the full functionality of MT4 in a portable, pocket-size format. The mobile apps retain the auto-trading functionalities of the original MT4 as well.

Conclusion

BlackBull Markets is an online trading operation focused on creating long-term value through client satisfaction. The brokerage aims to keep its offer simple and gimmick-free. Most of its operational components are superior to those of its competitors. It gives its traders commission-free deposit options, segregated accounts, and above all: superior trading conditions.

A great and efficient support staff underpins the outstanding reputation of the broker.

The broker’s website as well as support is available in six different languages.

BlackBull Markets has always been keen on hiring the best people in the business while nurturing a culture of continuous improvement and growth within the organization.