General

Features

Pros

- Fast withdrawal

- 0% commission on US stocks. Other Fees Apply

- Real Cryptos, Stocks

- 2000+ assets

- Copytrading

- Social Trading

- One Stop Shop

Cons

- No phone support

- There are some hidden fees even though it is advertised as zero-commission trading.

eToro Review

Review Sections:

This content does not apply to US customers.

Founded in 2006 by brothers Yoni and Ronen Assia and David Ring, eToro is based in Tel Aviv, Israel and was established with the vision of creating a financial investment platform for everyone. The company currently boasts more than 15 million users from over 170 countries, who use eToro for trading in currencies, commodities, stocks, indexes and CFDs. Their online investment platforms and trading community attract thousands of new accounts every day, making eToro one of the world’s leading social investment networks.

As far as jurisdictions and regulating bodies are concerned, eToro (Europe) Ltd. is headquartered in Limassol, Cyprus and is a Cypriot Investment Firm or CIF registered under the number HE200585. The company is also regulated by the Cyprus Securities and Exchange Commission or CySEC under license number 109/10.

In the United Kingdom, eToro (UK) Ltd. is headquartered in London with company registration number 7973792. eToro UK is authorized and regulated by the Financial Conduct Authority or FCA under the reference number 583263. Both eToro (UK) Ltd. and eToro (Europe) Ltd. comply with the Markets in Financial Instruments Directive or MiFID.

The company’s official website can be found at www.etoro.com. A screenshot of its homepage appears below:

In the United States, eToroUSA currently offer only Crypto (real crypto no CFD) so only buy with no leverage. Minimum deposit in the US is $50.

eToro is currently available in these US states:

Massachusetts, Pennsylvania, Utah, Wisconsin, Indiana, Missouri, Maryland, Michigan, Colorado, New Jersey, South Carolina, Washington, Virgina, Arizona, Ohio, Georgia, Iowa, Mississippi, Alaska, New Mexico, North Dakota, South Dakota, Arkansas, Maine, Oklahoma, Rhode Island, Kentucky, Montana, Wyoming, California, Oregon, Vermont, Alabama, Kansas, Connecticut, Washington DC, Florida, Texas, Idaho can deposit. And two territories Northern Marianas, US Minor Is.

The brokerage is registered and regulated in Australia. The local branch of the operation is represented by eToro AUS Capital Pty Ltd. It is the possessor of an ASIC license. Its AFSL number is 491139.

eToro Features

Besides their education programs and web based trading platforms, perhaps the most striking feature of eToro is its online financial trading community, which is among the world’s largest. As a leader in offering social trading networking systems, eToro has pioneered the field with its CopyTrader and InvestorFinder tools that help traders take advantage of top professionals’ trading strategies.

The company’s award winning social investment network gives traders the opportunity to benefit from the collective efforts of top traders by learning from, interacting with, and even copying other members’ trades in real time.

eToro’s social trading features allow a trader to watch live feeds of trading activity, exposing what other traders are doing in the market as the market fluctuates. A wide selection of traders is tracked through the InvestorFinder feature, which allows a user to select a particular trader or traders through the “Follow” command.

Once one or more traders to follow have been selected through the InvestorFinder or the People Discovery tool, the user can then allot a specific percentage of their funds to copy the trader(s). By clicking on “Copy”, the CopyTrader function is enabled and will proceed to copy the selected trader’s transactions automatically in real time and execute the trades in the user’s account.

In addition to copying other investor’s trades, eToro’s clients can interact with other traders, including the traders that they are following and copying through the social network. A trader can also become a “Popular Investor”, thereby allowing others to copy trades and receive rewards for recruiting copiers. Successful Popular Investors receive monthly payments, which are subject to payment eligibility.

As of April 29th 2018 eToro has moved from trading stocks as CFD to real stocks on their platform.

As of 14th of July 2020 eToro has 0% commission on stocks traded on the NASDAQ and NYSE. All other stocks are traded as CFDs and bear commission.

Deposits and Withdrawals

Since eToro only allows trading in U.S. Dollars, any deposit in another currency is converted to USD upon receipt. The minimum deposit to open a live trading account at eToro is $50, except for Israelis who need to deposit at least $10,000. Deposits can be made through credit cards including Visa, Master Card, Diners’ Club and AMEX. Electronic wallet deposits can also be made using Paypal, Neteller, Skrill (formerly Moneybookers), China Union Pay, Worldpay, Giropay, Yandex Money, Wirecard and Webmoney/Paymaster24.

Deposits have a minimum and maximum depending on the method: credit card, PayPal and Skrill deposits have a minimum of $50 and a maximum of $5,000; Neteller has a minimum of from $50 and a maximum of $10,000; while Webmoney and GiroPay have a $200 minimum and a $50,000 maximum. Bank wire transfers can also be used to fund deposits and have a $50 minimum.

For withdrawals, the user must fill out a withdrawal form in the Cashier section of the website, found by clicking on the “Withdrawal” tab. eToro will then notify the client via e-mail of the withdrawal’s initiation.

For first time withdrawals, clients must submit a clear color copy of their passport – including their written signature – as well as a clear copy of a utility bill not more than three months’ old that was mailed to your residential address. Also, if the deposit to fund the account was originally made via credit card, a clear copy of both sides of the credit card must be submitted.

Withdrawals typically take up 24-48 hours to process.

Platform & Tools

| Feature | eToro |

|---|---|

| Virtual Trading(Demo) | |

| Desktop Platform (Windows) | |

| Desktop Platform (Mac) | |

| Web Platform | |

| Social Trading / Copy Trading | |

| Proprietary | |

| MetaTrader 4 (MT4) | |

| MetaTrader 5 (MT5) | |

| cTrader | |

| Currenex | |

| ZuluTrade | |

| MirrorTrader | |

| Charting - Drawing Tools(Total) | |

| Charting - Indicators / Studies (Total) | |

| Watchlists | |

| Order Type - Trailing Stop |

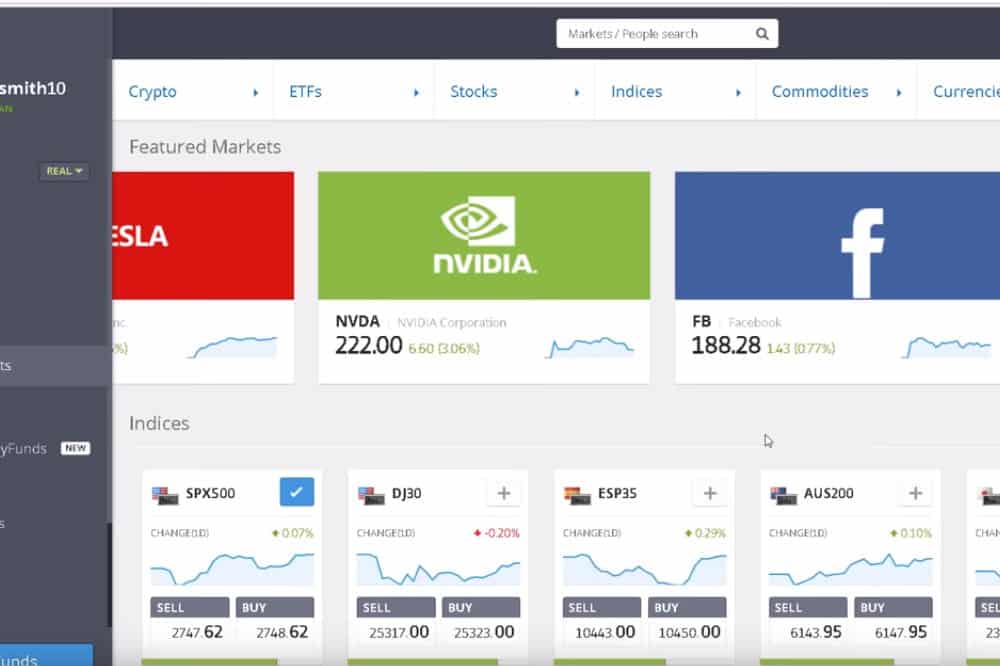

eToro has designed an original financial trading platform that incorporates graphic trading scenarios depicted as a race between currencies or a tug of war. The company also has a professional trading application called “Expert Mode”. A screenshot of the software can be viewed below.

eToro also offers customers a mobile app that can be downloaded from the Apple App Store for the iOS version and from Google Play for the Android version. The eToro platforms allow only trading in U.S. Dollars because a unified currency is required for transparency purposes on their global network.

Copy Trading is the bread and butter of the operation. At the center of the scheme stands the Copy People screen, which offers traders several ways to locate traders who match their needs/trading style. The Popular Investor section is the display case of the Popular Investor program. Through this program, the broker rewards traders who are copied, thus offering them another way to monetize their trading skills. Everyone can become a Popular Investor.

The Social Newsfeed seems to be the pride of the eToro platform. Through it, traders can interact, open discussions, follow the moves of their peers, etc.

Notifications are also fed to users on the web platform as well as mobile. Every time a followed trader makes a move or posts something, the follower is notified.

Asset Classes

eToro’s market coverage is outstanding. It covers all the major asset categories one might expect from a top online broker. Stocks, cryptoassets, commodities, ETFs, indices and a massive selection of currency pairs are all included in its selection.

As far as stocks go, they can be traded directly (by Buying them and waiting for the price to go up), or they can be traded via CFDs, in which case traders can make money when the price of a certain stock drops, by Shorting it.

While most brokers only support cryptoasset trading through CFDs, eToro actually buys and holds cryptocurrencies such as Dogecoin, Bitcoin and Ethereum on the client’s behalf. This way, direct trading of the cryptoassets is possible. These direct crypto trades are unleveraged.

eToro does not offer cryptocurrencies as a CFD product for FCA clients.

Commodity trading only really makes practical sense through derivatives. At eToro, the same goes for currency pairs. The broker apparently does not want direct involvement with the FX sector.

The selection of ETFs and indices is decent as well. Trading these asset categories through CFDs is the most straightforward option for most traders.

Commission & Fees

Expenses that traders will incur are tied to withdrawals (on which there is a $5 fee), and rollover. In addition to these overnight fees, which are asset- and leverage-dependent, an inactivity fee of $10/12 months is also charged.

As of August 11th 2024 commission fees have been added on stock trading in Australia, Denmark, Finland, Netherlands, Norway, Spain or Sweden. See image for more information:

Research & Education

| Feature | eToro |

|---|---|

| Daily Market Commentary | |

| Forex News | |

| AutoChartist | |

| Trading Central (Recognia) | |

| Delkos Research | |

| Acuity Trading | |

| Social Sentiment - Currency Pairs | |

| Client Webinars | |

| Client Webinars (Archived) | |

| Videos - Beginner Trading Videos | |

| Economic Calendar | |

| Calendar Includes Forexcasts | |

| Economic News Sentiment | |

| Trade Ideas - Backtesting |

The education section of the broker looks surprisingly summary. In addition to a Daily Market Review section, it includes a blog and a “Complete Guide to Fintech”.

The blog contains seemingly random yet useful posts about various markets and economic events. The Fintech Guide is a sort of eBook, which can be accessed for free by all comers. It teaches traders the ins and outs of trading various asset classes, offering strategies and general tips on building an investment portfolio.

It is safe to assume however that the majority of the education traders receive through the platform is delivered through the social component of the setup.

Customer Service

eToro’s support team is available via chat and e-mail 24/5. E-mail support is available to registered and unregistered users with a reply from the support team usually provided within 48 hours.

Mobile Trading

| Feature | eToro |

|---|---|

| Android App | |

| Apple App | |

| Charting - Draw Trend Lines | |

| Charting - Can Turn Horizontally | |

| Charting - Technical Studies/Indicators | |

| Watchlist - Syncing | |

| Trading - Forex CFDs | |

| Trading - CFDs | |

| Alerts - Basic Fields |

eToro’s mobile trading apps look great on Android and iOS too.

Most of the users trading through these apps seem to appreciate their capabilities and functionalities. The Android platform delivers all the social trading tools the Web based platform does, allowing its users to become a part of the crypto community on the go.

The iOS version looks similar to the Android one and it currently sports an AppStore score of 3.4 out of 5.

Both apps are available in several languages and they are both continuously updated.

Conclusion

eToro offers traders of every experience level easy to use trading platforms. These platforms have some unique features that can add a new dimension of excitement to trading and maybe even help make trading a more enjoyable endeavor. Bottom line is that 15 million users can’t be wrong.

FAQ

eToro is most definitely a legitimate online brokerage. It is the best-known and perhaps the most popular social trading platform.

It provides trading services covering cryptocurrencies, stocks, commodities, and currencies. It gives its clients zero-commission access to stocks.

It calls itself “the world’s leading social trading and investing platform” and it is indeed just that.

The best metric of a broker’s popularity is its reputation among users. This is a sensitive issue with most brokers, because:

• Traders who feel slighted are more driven to provide feedback and publicly complain.

• Scammers often use trader feedback portals to promote their dubious services.

• Beginner traders are likely to lose out in the long-run. Hence the plethora of negative feedback they tend to leave.

In eToro’s case, all these issues are present. Judging solely by user feedback, eToro is barely a decent broker. Many users call it abysmal and a scam.

Some of the complaints include:

• Spread manipulation.

• Underhanded market making.

• Profit cancelling.

• Delayed withdrawals.

• Large commissions and fees on withdrawals.

• Accounts blocked for allegedly no reason.

The size of the minimum required deposit at eToro depends on your location and deposit method.

• The minimum first-time deposit is $50. If you are located in Australia the minimum deposit is $50.

eToro is regulated and its regulatory profile is impressive.

• eToro Europe Ltd. is the EU-facing branch of the operation. Its licensing authority is CySEC and its license number is 109/10.

• eToro UK Ltd. is licensed by the UK’s FCA. Its license number is FRN 583263.

• eToro AUS Capital Pty Ltd. enjoys ASIC licensing and oversight. The license number of this branch of the brokerage is AFSL 491139.

eToro maintains several offices world-over.

• Its UK offices are at 24th floor, One Canada Square, Canary Wharf London, E14 5AB, United Kingdom.

• The US branch of the brokerage operates out of 221 River St., 9th Floor, Hoboken, NJ 07030, USA.

• The headquarters of eToro Europe Ltd. are at 4 Profiti Ilia Street, Kanika International Business Center (KIBC) 7th Floor, Germasogeia 4046, Limassol, Cyprus.

• eToro AUS Capital Pty Ltd. is based at Level 33, Australia Square, 264 George Street, Sydney NSW 2000, Australia.

Risk warning

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Cryptoasset investing is highly volatile and unregulated in some EU countries. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.