Should we be value investing or growth investing? The answer is known and obvious – yes. Which might sound like just a cute answer but it’s also true. We should be doing whichever makes us more money at the time of course, so the answer is yes. When growth is more highly valued than value then invest in growth and vice versa. The trick is to know when the switching point occurs.

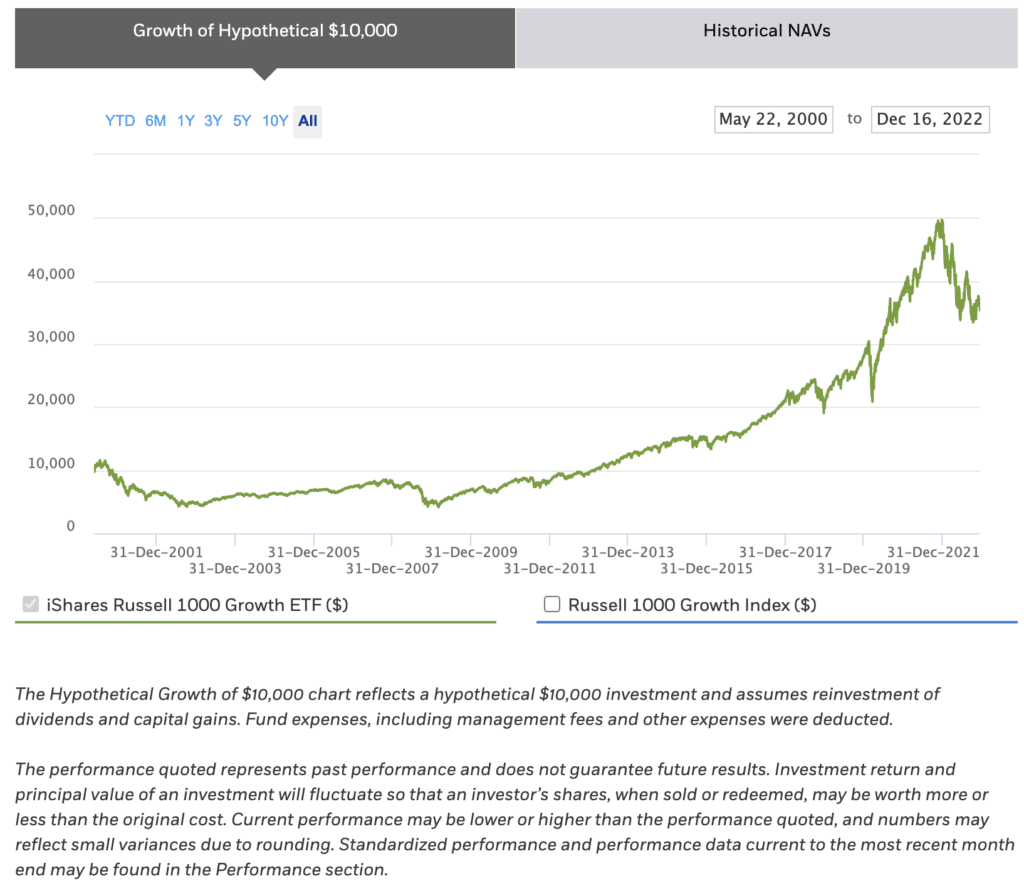

For example, we could be in a Russell 1000 Growth ETF (NYSEARCA: IWF) or a Russell 1000 Value Index Fund (NYSEARCA: VRVIX) to taste. When growth companies are more highly valued – and most importantly, continuing to be more highly valued – then we’d want to be in the one. When attentions switches to the Grahamite values of investing then we want to be in the other.

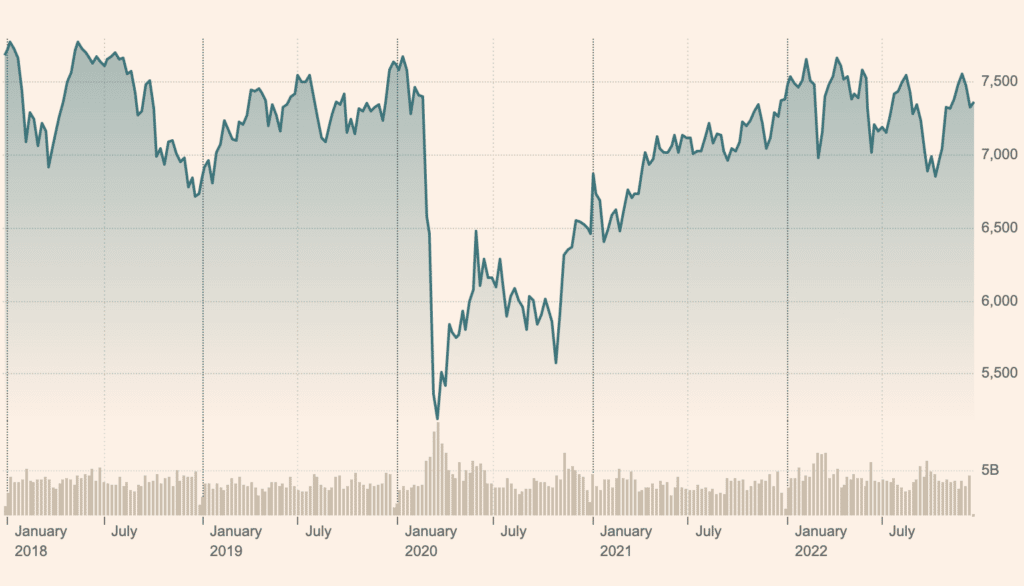

In the UK markets this might correspond to being in the growth stocks on AIM as against holding the boring dividend payers in the FTSE100.

The Telegraph tries to give us a view of this and, well, the piece isn’t quite as it could be perhaps. Because they tell us some of the point but leave the real and important one as almost a side issue.

It is entirely true that as interest rates change then future growth becomes less valuable as against money now. Simply because that’s what an interest rate is, the difference in value between money in the future and money now. So, interest rates change, values of future as against current money flows change. Shrug.

So, as interest rates rise those “growth” companies who are promising jam tomorrow become worthless relative to those who are offering what we can spread on the toast this afternoon. There is as complication here, as rising interest rates aren’t the whole of it. It’s the slightly more complex interaction of inflation and interest rates that is. This might sound a little odd even as it is true. The “real” interest rate these days is around minus 6%. 4% base rate – or whatever it is by teatime – minus the 10% inflation rate is significantly negative. That makes – weird, I know – growth stocks more valuable, not less. On exactly the same grounds that higher interest rates – but real interest rates, not just nominal – make growth stocks worth less.

But leave that complication aside. The Telegraph tells us one thing which is absolutely vital: “It’s the difference between expectation and actual outcome that counts. “Ah, now, that’s gold that is, absolute gold.

For that’s the absolute heart of trading. OK, if we want to think about it over longer periods, we can call it investing if we like. But it is the very beating heart of the matter. Here’s this valuation of this stuff – whatever that stuff is, a commodity, a future income stream, a business plan – and here’s what we think that valuation should be. We can then position ourselves for valuations to change from what they are to what they should be.

True, we’re only going to make money when we’re right and the current valuation wrong. Well, with one more proviso, that the valuation moves to what it should be. But that is that very viscera of the game. That we’ve identified something that is currently mispriced and that we can get in there before others realise it and profit from the reconsideration of that price.

Now, as traders we’re generally more interested in movements that happen in the near future, as investors about those that happen over longer times – that’s not a formal definition but one that we should find useful. But that game remains the same – what is it that others have got wrong, we got right and how do we position ourselves to benefit from that realisation?

But back to that original point of value and growth investing. Or, if we prefer, trading upon the two and looking for more immediate price moves. Then add in that point from the Telegraph. We’re not, in fact, in some world of absolute values. There is no “true price” that we can either divine nor trade to. What there is what other people value these things at. We are trading against the market, recall? A market is only the aggregate beliefs – if we prefer, the aggregate actions – of other people.

That does make things easier. For what we’re then trying to identify is when other people are wrong. That other people are wrong is something that’s obvious as anyone who has observed humans for more than 5 minutes knows– we’ve just got to, now, identify when and in which direction.