Alternative Investments

As the name suggests, “Alternative Investments” are an “alternative” to the traditional asset classes such as Bonds or Debt Instruments, Equities or Shares and the most liquid asset of all, Cash.

So, that would appear to open up a vast spectrum of alternative vehicles that one can invest in.

That correctly implies the field of alternatives is not bound by a narrow definition, except it can be a tangible asset such: Aeroplanes, Antiques, Art, Boats/Ships, Books, Cars, Coins, Fashion, Jewellery, Manuscripts, Stamps, Whisky and Wine…i.e. anything that is collectable and has an appeal to an investor.

One may look at a friend’s collection and feel puzzled; but remember, one person’s trash is another’s treasure and beauty is in the eye of the beholder.

However, one can also include financial investments such as:

- Commodities (Agricultural, Energy, Metals)

One can be more granular as:

- Agricultural = Grains, Meats and Softs

- Energy = Coal, Crude Oil, Heating Oil, Jet Fuel, Natural Gas and Palm Oil

- Metals = Industrial and Precious

Indeed, that list is could be broken down even further if so desired.

Then one could consider investing into Aircraft Leases, Automobile Leases, Carbon Credits, Equity Crowd Funding, Hedge Funds, Mortgages which lead to Property or Real Estate (Buildings, Forestry and Land), Film Finance, Financial Derivatives, Private Equity, Tax Receivables, Venture Capital and of course the curiosity that is Cryptocurrencies plus Non Fungible Tokens.

(Note: This is far from an exhaustive list)

It would appear that if an asset can be deemed of value to two or more parties then a market for trading said asset can be established and an investment can be made. Whether it is a liquid market is another matter, however.

All of the investments listed above can be perceived as offering an opportunity to preserve wealth even though many items, especially in the collectable space are extremely difficult to value.

Why Invest In Alternatives?

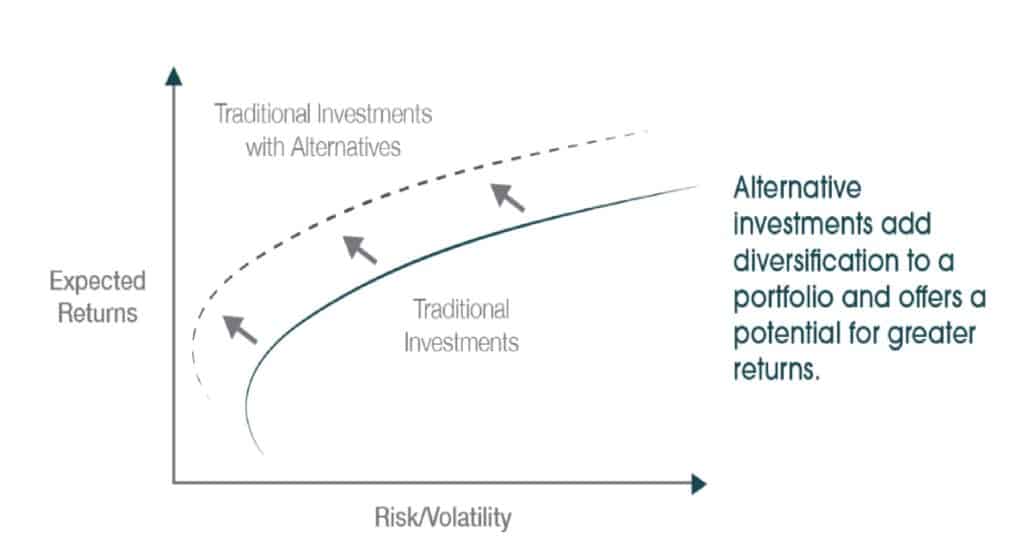

Alternative investments and private markets with their ability to offer diversification from traditional asset classes allow an investor to build a more balanced investment portfolio. One can target returns that are uncorrelated with public markets. They also offer the potential for higher returns in exchange for less liquidity, however, as always, but especially here, remember “Caveat Emptor” ~ “Buyer Beware”.

One must not assume that alternatives are a rare bird in the investment market. They have increasingly become what one may refer to as “Main Stream”.

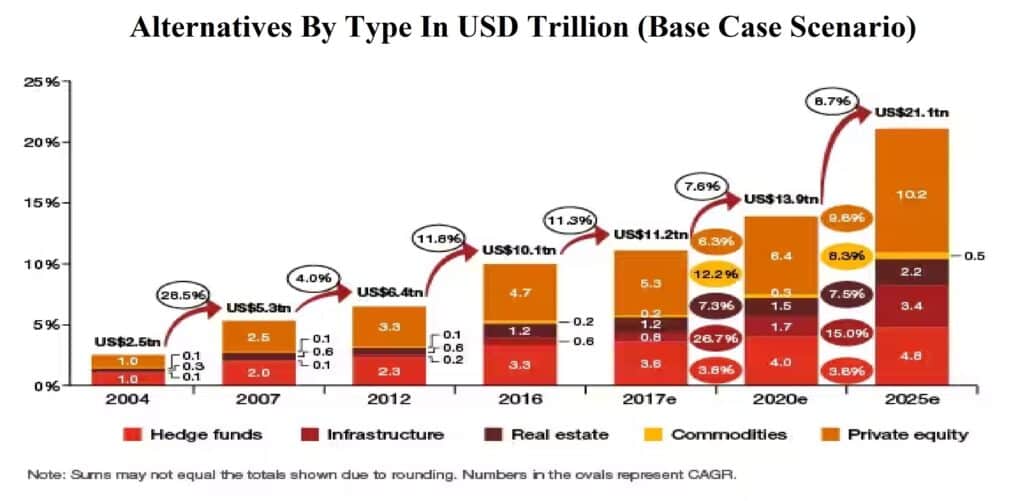

Connection Capital has estimated that there was more than USD 13 Trillion allocated globally to alternative investment asset classes at the beginning of 2022, with the total expected to exceed USD 23 Trillion by 2026. These figures are in line with the research of PwC and the Wealth Management Research Centre, Figure 1.

Source: PwC and the Wealth Management Research Centre, Past Data from Lipper and Prequin

The catalyst to driving interest in the alternative space was the fact that post the Global Financial Crisis (GFC), rates were cut to historically low levels and when combined with quantitative easing many traditional markets became expensive.

From 2007 to 2015:

- Standard & Poor’s 500 rose from 1515 to 2092 + 38.1%

- U.S. Treasury 10-Year Note Future rose from 106.41 to 130.84 + 23.0%

The flood of cheap money drove valuations ever higher and as such the potential for further upside began to fade. Thus, alternatives seemed to be showing the best lustre, a better chance of earning pure upside alpha.

Correlation Considered

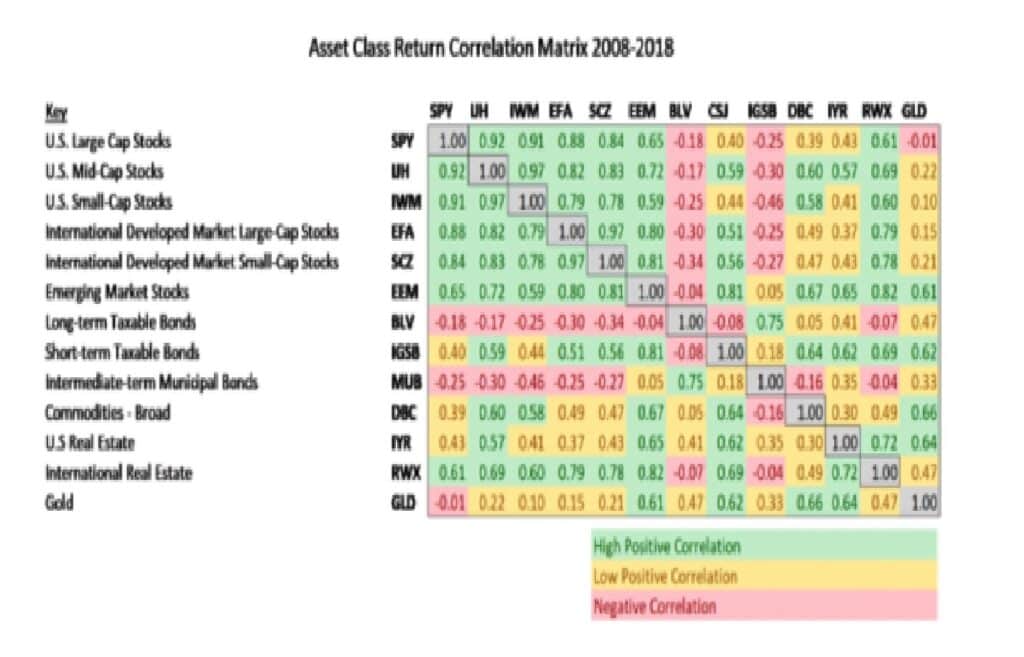

Traditional, liquid asset classes become highly correlated in times of market stress. This means that they move in the same direction which flies in the face of “Modern Portfolio Theory” i.e. pick assets for your portfolio that move in opposite directions in response to the same stimulus. The aim is to reduce risk over time.

If one accepts the rather broad brush approach to suggest that there are two investment groups, Traditional and Alternative, the correlation between these two categories changes from less positively correlated to neutral to negatively correlated, Figure 2. This is because the correlations change over time and can on occasion reverse over the short-run. At all times investors have to take into account the volatility of investment assets and also the volatility of correlations between the assets themselves.

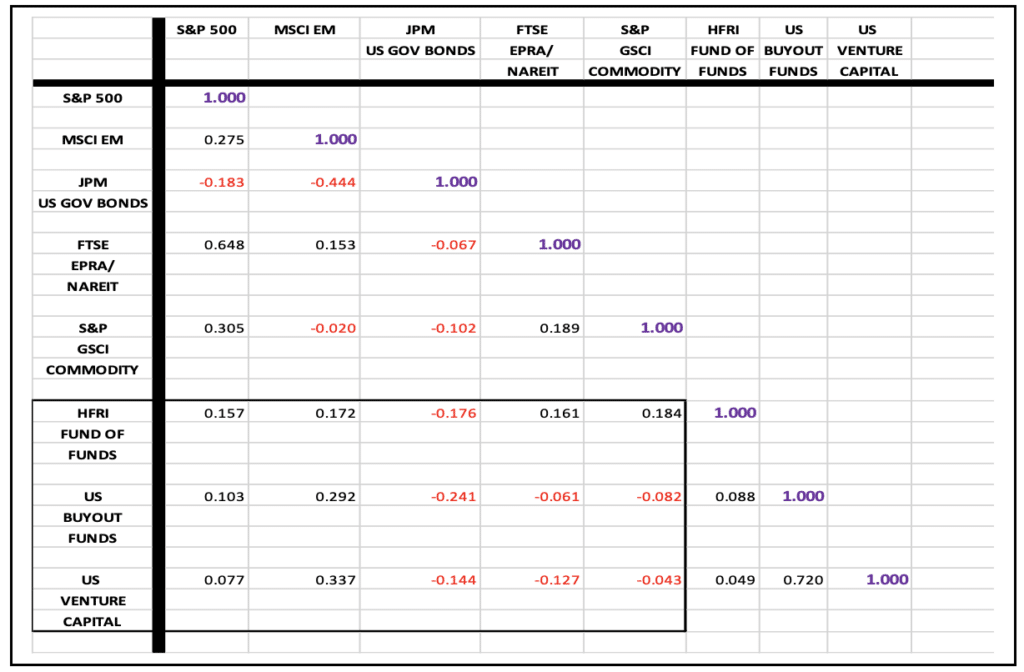

In Figure 3 one sees that hedge funds, private equity, and venture capital opportunities are displaying excellent levels of diversification versus traditional asset classes; values of R2 ranging from 0.05 to 0.35.

Given the correlation between assets can move one has to ask; “What can drive such changes?”.

Large macroeconomic events can lead uncorrelated assets to suddenly become correlated. In the past and indeed in more recent times, these events have included:

- Fear

- Decline in natural market liquidity

- Decrease in credit availability

- Expectation of medium-term inflation increases

- Commodity prices fluctuate wildly

- Global economic slowdown

With the events listed above some are related and other independent, however, if too many occur at once, the fluid interrelation between them decays and can alter asset class correlations for a considerable period of time.

Can We Find Non-Correlation?

During an event that may become a crisis, non-correlation may briefly vanish. That does not mean we should stop looking for diversification of both category and correlation as we know that places the investor in the best position for growth as the markets find a new equilibrium and start to recover.

For an investor that has built a properly diversified portfolio and they are in no major hurry then their best option during these market-wide disruptions is to hold onto their strategic asset allocation.

Why so? A 1% increase in annual returns in a USD 100,000 portfolio can earn an extra USD146,000 over 30-years.

Of course, it is not as simple as it sounds. The dynamic impact of herd movement can impact correlations.

In a study commissioned by IAG Wealth Management, Kirk Chisholm and Joseph W. Chase, , concluded that

“…as the world becomes smaller, correlations should be expected to increase. As people invest in a greater number of markets in the search for low-correlation assets, we expect these sought-after markets to become more correlated as a result of increased interest. …”

Since the 1980’s investors have gained greater access to international markets and technology has fostered investment platforms that have granted access to commodities and other assets that in the past were difficult to invest in previously given the minimum size or storage requirements.

Investing in assets that are off-exchange and not widely held may have liquidity issues, however, it can build stability as investors may be able to shield a portion of their portfolio from broad downturns that may adversely impact a narrow highly correlated book of traditional assets

Size Matters

A minimum investment is the smallest monetary amount or quantity that an investor has to purchase when investing in a specific security, fund, or opportunity.

Unfortunately, certain asset classes are not available to every investor. Investing in private equity funds, is only possible for professional (EU) or accredited (U.S.) investors. The minimum investment amount that will be entertained is usually in excess of USD 1 Million.

Even if one can afford the size of investment an investment portfolio may not be adequately diversified if the underlying assets derive their returns from the same sources of risk.

Just looking back to early 2022, against the backdrop of the lingering impact of the COVID-19 pandemic and the emerging Russia Ukraine crisis, both equities and bonds, usually showing an inverse correlation to each other, were both negative for the first four months of the year.

From January 3 to April 29:

- Standard & Poor’s 500 fell from 4796.56 to 4131.93 -13.9%

- U.S. Treasury 10-Year Note Future fell from 129.44 to 119.16 – 7.9%

No wonder investors have looked to diversify the sources of risk and the types of returns in their portfolios in ever greater numbers, Figure 4.

As COVID-19 struck and lockdowns drove a change in the way many people work and interact with technology, new disruptors have upended old business models and challenged the survival of once dominant players.

This much can apply to the world of asset management as well and trading platforms are always widening their offering of instruments.

New technology, crowdfunding methods, legislation, and deregulation are providing ways for retail investors with an understanding of alternative assets to add them to their portfolio for three main reasons:

- Diversification…as we have considered above

- Enhanced portfolio returns

- Diversified income potential

Currently, retail investors have very little opportunity in the way of alternative investments. No less an authority than “Institutional Investor” estimates that anywhere from 2% to 10% percent of individual investors’ funds are allocated to alternative investments.

This represents a sharp contrast to institutions that have been following alternatives for several decades with the average pension having committed 25% to 35% to alternatives.

The figures are even higher when one looks at large endowments and foundations who are seen to have allocations in the 35% -50% range.

This sense of “under-allocation” by the retail investor base presents an opportunity for disruptors in the investment space, but the famous names of Wall Street and the rest of the world are increasingly targeting this class of client.

Alternatives Democratised

While one can see High Net Worth Individuals (HNWI) with assets greater than USD 1 Million committing more to hedge funds and private equity funds there are gaps that can suits clients with smaller net worth.

The “Jumpstart Our Business Startups Act”, or “JOBS Act”, is a law intended to encourage funding of small businesses in the U.S. by easing many of the country’s securities regulations. It passed with bipartisan support and was signed into law by President Barack Obama on April 5, 2012.

Blackstone Group said in April 2022 that three funds designed for individual investors were attracting USD 4.5 Billion of inflows a month. In May, Carlyle CEO Kewsong Lee claimed that over the past year or so the firm had raised 10% – 15% of its capital from individual investors.

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co. reported that it expects to see up to half of total fundraising come from the retail channel in the not-too-distant future.

This is all being driven by the fact that smaller investors are able to make smaller investments and n 2022 Pitchbook reported that 50% of all the funds in the market had under USD 100 Million assets under management (AUM). This compares to 38% in 2010.

Because of the JOBS Act, there are now products in the U.S. that pool investor money together into a Special Purpose Vehicle (SPV) or funds for as low as a USD 50, 000. That entity acts as the “institution” and buys into target fund obtaining access for all its pooled investors.

Large institutions have to make minimum investments in funds, often over USD 100 Million. Pool a good number of smaller investors via an SPV and one can see why a fund with just USD 50 Million AUM can draw in the money.