Investing in Mutual Funds

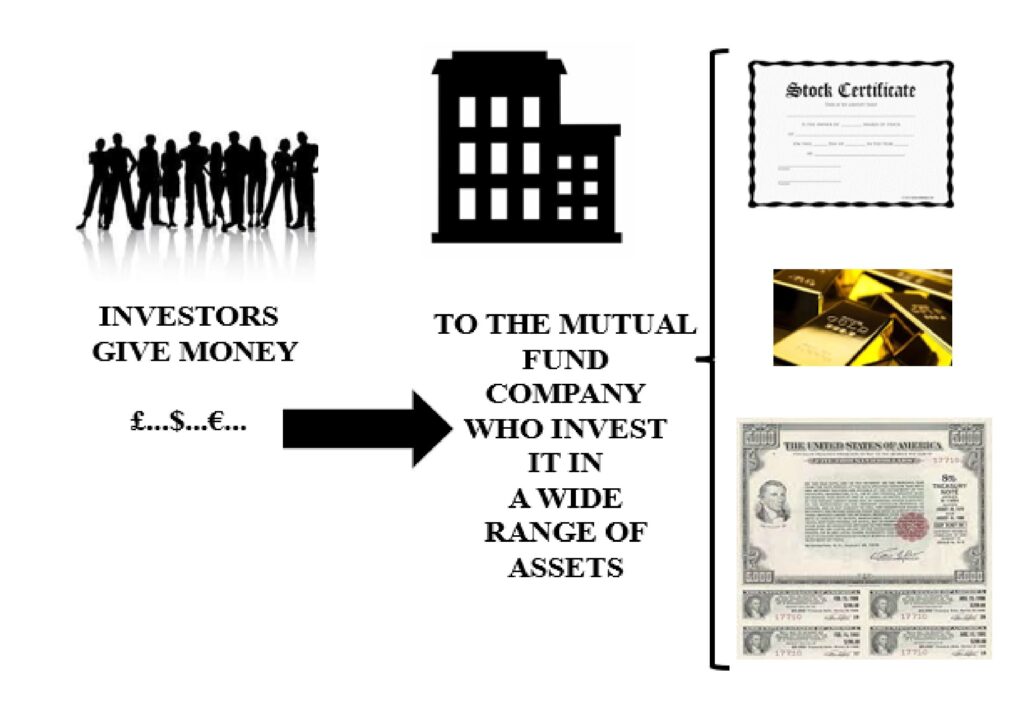

“Mutual Fund” (MF), is an investment fund that is professionally managed and looks to pool investment capital from many investors, with the aim of purchasing various securities such as Stocks, Bonds, Gold, Money Market Instruments etc.

What Are Mutual Funds & How Do They Work?

The term is most commonly heard in the U.S., Canada, and India. In Europe, a common term to describe the is “Société D’investissement A’ Capital Variable”, (SICAV) and an “Open-Ended Investment Company” in the U.K.

MF’s can be either “Open-Ended” i.e., always open for investments or “Close-Ended” where they are open for investment only during the initial offer period. Following that, new investors can only buy units of such a mutual fund from the relevant stock exchange. These mutual funds work remain in existence for a fixed period of time after which they are and they withdraw money, all invested capital is returned to the investors.

As an investor, one should know one their own portfolio’s risk profile and so, can act for oneself directly acquiring financial assets and other value of investments, such as stocks, bonds, gold or one their own portfolio and other investments and can save a great deal of time and even less than you invest effort to start investing by making use of investment instruments like MF’s.

As we have seen the MF is an investment scheme holding either a single class of assets or with multiple assets of different assets classes. The investment portfolio full of securities accumulated for investment advice the MF can be designed to reflect the risk appetite financial goals of individual circumstances and a diverse pool of investors.

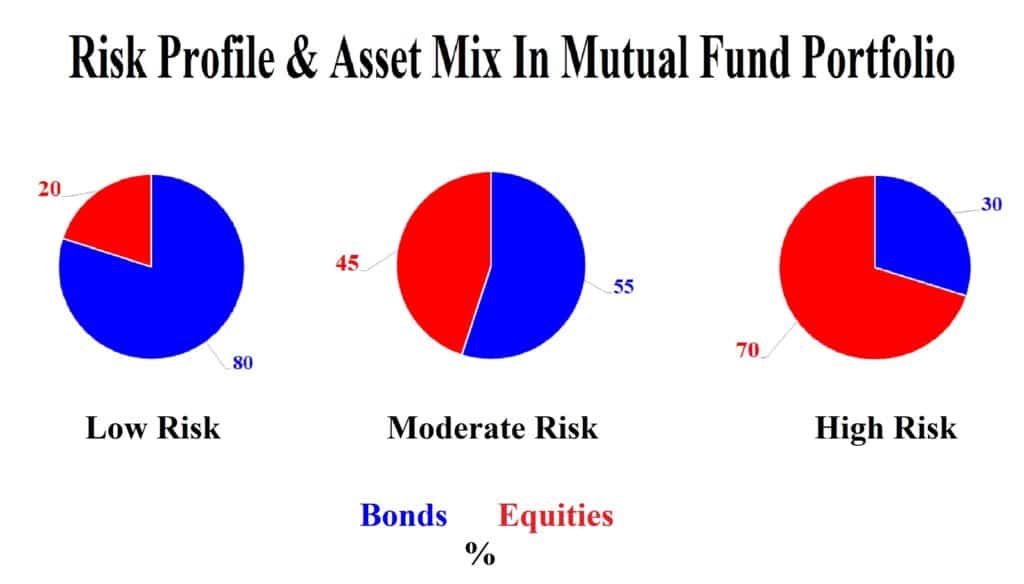

Risk-averse investors usually seek a MF with relatively lower risk and large proportion of high grade fixed-interest bonds. They are perceived as safer i.e., low-yield and pay a regular income.

For those with a medium risk appetite can go for a mixture of equities and bonds for if the stock market endures prolonged declines, even a crash, the loss on the stock market exposure can be ameliorated by the safety of the fixed interest rates of the bonds. If one risk level is more aggressive, then a larger equity element is built into the portfolio, Figure 2.

Investing Via A “SIP”

Given one’s specified risk profile a “Systematic Investment Plan”, (SIP) for MF’s simplifies the task of investing in an orderly manner. The SIP option is like opening a “Recurring Deposit”, (RD) with a bank. In this way the SIP will deduct a fixed amount from a specified bank at regular intervals; most often, a set date every month is chosen.

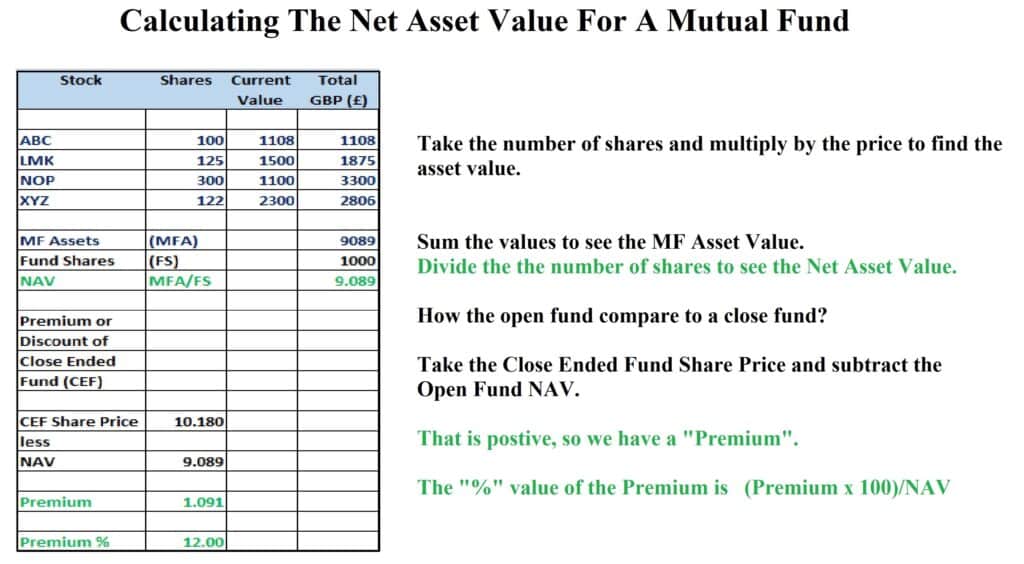

However, one must note the main difference from single investment being the RD will pay a fixed percentage as interest on the investment. In contrast to single investment only, the returns from your MF SIP will be determined by the “Net Asset Value”, (NAV) of the mutual fund scheme.

The NAV represents the market average of the current market value of the underlying securities, and it fluctuates daily.

Each top fund manager has their per share market value represented by the MF NAV. It is the price at which investors buy (bid price) fund shares or units from a top ten fund manager or fund management company and sell them at market price (redemption price) to a fund manager or fund management company again.

MF NAV = Total value of all the cash and securities in a fund manager‘s portfolio – Total value of liabilities The number of shares outstanding

Source: Pope Family Office and Investment Excel Help Videos ~ Michael Nuget

Consider The Type of Funds Available

Debt Or Fixed Income Bond Funds

Debt MF provide opportunities other investors to invest money in interest bearing securities e.g., Government, Agency and Corporate Bonds. In addition, one can gain access to money through the Money Market funds and products such as Term Deposits and Money Market Instruments.

Liquid funds

Investment horizon is up to a month as these target highly liquid money market securities and other short term debt instruments.

Short to Medium Term Debt Funds

These various fund investments seek stability to balance the risk element of equity investments in portfolios. Therefore, they will invest in interest bearing securities such as bonds issued by firms, (to gain a yield premium or spread over Government paper), as well as investments such as term deposits. They are ideal investments for 3-months to 2-years.

Income Funds and Actively Managed Debt Funds

These look to take advantage of changing market interest rates and invest in a wide variety of fixed income securities like a bond, debentures, treasury bills (TB’s) and commercial papers (CP).

Gilt Funds

These funds allow access to fund types of U.K. Government Bonds that may not be available to individual investors given the larger sizes they tend to trade in. (Fund managers that focuses on U.S. Treasuries, German Bunds etc will also be available).

Fixed Maturity Plans and other Close ended Debt Funds

These usually have a specified date of maturity when the MF will be wound up and proceeds distributed to the investors.

Hybrid Funds

Balanced Funds

These funds invest partly in debt and partly in equity instruments and aim to generate income provide both growth and regular income.

Monthly Income Plans (MIP)

Tending to invest in fixed income securities and also invest a small portion of the income generated pay dividends and from other securities in your money equity markets. They seek income generation from the debt securities and capture long-term growth from equity securities and aim for periodic distribution of dividends.

Equity Funds

As we have seen, these are higher risk funds and there are different kinds of funds that seek to exploit greater risk in specific investment strategies.

Diversified Equity Funds

These invest in shares of companies of any type and carry a broad mix of sectors and companies diversified portfolio.

Sector Funds

Looking to invest in a fund for particular sector of the equity market, e.g., Auto Manufacturing, Fast Moving Consumer Goods (FMCG), Mining, Pharmaceuticals etc… This offers the opportunity to take your capital gain a focused exposure to a particular sector.

Thematic Funds

These are schemes which invest in funds work on a particular theme, e.g., Environmental, Social, and Governance (ESG), Infrastructure, Technology etc.

Index Funds

These schemes try to sell funds to replicate a specific stock index with an aim of providing returns matching the underlying index.

For example, a FTSE 100 fund manager, would invest in the stocks forming the FTSE 100 index in the same proportion as the index. The fund manager simply copies the index and behaves as money market funds in a passive manner.

Exchange Traded Funds (ETF’s)

Similar to index funds, however, the fund manager sell shares that are listed on the stock exchange. These can be traded on the stock exchange.

Tax Saving Funds

Often known as “Equity Linked Saving Schemes”, (ELSS). These are diversified funds with tax benefits as investors can claim tax deductions. Funds within an ISA are exempt from tax, whereas stocks and bonds are liable to income, dividends, and capital gains tax.

Global Funds

These funds invest in overseas companies listed in markets across the world. They give an opportunity to invest in globally renowned companies that may not be available for investment by individual investors in one’s home nation.

Gold Funds

Gold Funds allow investment in gold in a disciplined manner without having to worry about purity, storage, making-charges and safe-keeping.

Fund of Funds

Here a mutual funds invest in other mutual funds and suit the varying needs of different investor categories based on their risk profiles, return expectations and investment goals. It provides investors an opportunity to own investment funds and take advantage of the benefits of diversification.

Growth Over Time…The Power of Compounding:

Mutual funds have certain advantages over direct investments. One key example is that MF’s harness the power of compounding to generate interest on interest on the initial investment. This means the value of an initial investment amount keeps growing, leading to a significant increase in value.

MF’s have helped the young, those with limited or fixed income due to tax rules, their affordability and the option of SIP’s. Of course, older, wealthier individuals can also enjoy the MF structure and enjoy the fact open-ended mutual funds work provide greater liquidity while many bring down the tax liability.