What Are Investment Trusts?

An investment trust is a public limited company (PLC) traded on the London Stock Exchange, (LSE), that investors buy and sell from the market. It invests in other companies, seeking to generate profit for its shareholders. Owning shares in an investment trust is a convenient way to invest in a variety of different companies.

The shareholders will elect an independent board of directors to observe and advise upon the performance of the company and thereby look after shareholder interests. The board will in turn appoint a professional portfolio manager to manage the company’s investments.

Differences Between Investment Trusts & Unit Trusts

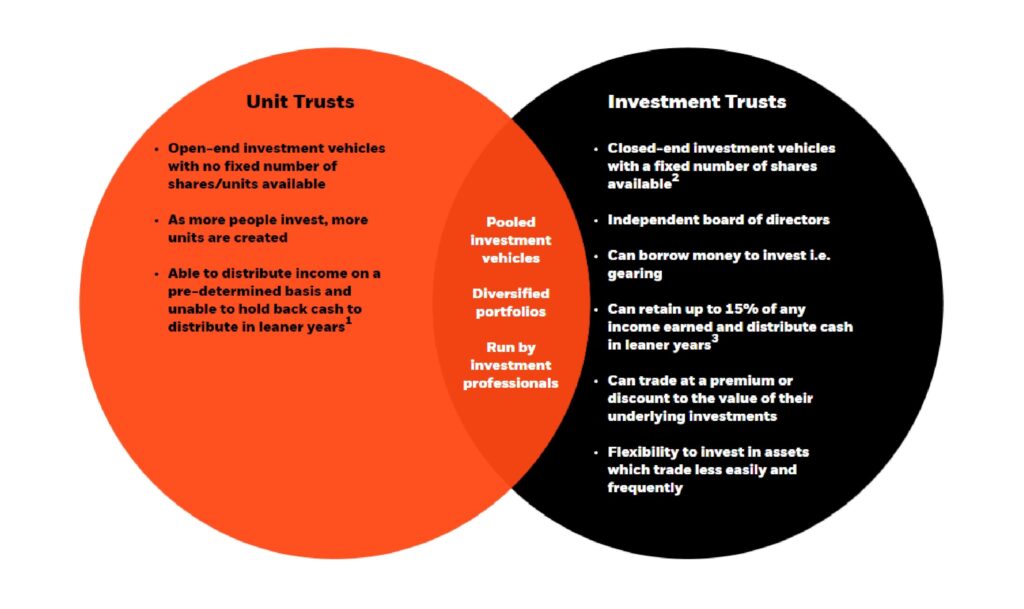

The main difference between investment trusts and unit trusts is that they are run as PLCs.

The investment trust will issue a fixed and specified number of shares when it is first launched. As such, they are classified as “Closed-Ended Funds”.

This structure permits them to adopt a “long-term” view and make use of gearing Δ to create greater exposure to the markets in pursuit of higher returns.

Δ

Financial gearing refers to the relative proportions of debt and equity that a company uses to support its operations. This information can be used to evaluate the risk of failure of a business.

This can be thought of as a “Debt-To-Equity” (D/E) ratio. This is used to assess the degree of leverage. It is calculated by dividing the total liabilities by shareholder equity.

The D/E ratio is an important metric in corporate finance as it is a measure of the degree to which a company is financing its operations with debt rather than its own resources.

The alternative is a unit trust that is an “Open-Ended Fund”. These can continue to issue new units in response to ongoing demand.

What Do Investment Trusts Offer?

All investors know that a desirable characteristic is ease of access to an investment opportunity. In the current market there are many ways to invest in an investment trust.

One is no longer limited to using a stockbrokers or savings scheme. They have become mainstream as one can find retailers such as grocery stores in the U.S. or supermarkets in the U.K. that can offer a range of investment trusts.

Another great benefit of any financial investment is being able to understand how the vehicle or asset is constructed. In this regard investment trusts really are quite simple and they provide access to a wide range of investments that may well be too costly and complex to manage as individual elements within a portfolio.

Given the worries about inflation, central bank policy, economic performance and geopolitical instability all investors would welcome a vehicle that has a sense of reliability.

Investment trusts can retain up to 15% of their revenue as reserves. That implies they can maintain consistent pay-outs through using reserves even in challenging markets.

That said, the investor has to read the fine print as not every investment trust is permitted to accumulate reserves. Of course, in an extreme bear market such surplus income it may prove insufficient to last for a sustained period.

Making A Choice

When choosing between unit trusts and investment trusts, the most important factor is performance.

Research cited by www.whatinvestment.co.uk on the performance of investment trusts versus unit trusts reveals that investment trusts regularly do better in the vast majority of sectors if one looks over a 10-year time horizon. However, this is not the case on a shorter-term basis.

Investments that appreciate in value do not do so in a smooth linear fashion and as such one has to be prepared for additional volatility with an investment trust.

All in all, given the investment trust can take a longer-term perspective and as mentioned above they can in some cases build up reserves. Despite the widespread dividend cuts around 2008 and 2009, many investment trusts were still able to maintain their records of paying out and growing dividends despite a drop in underlying earnings. Therefore, investment trusts have kept income flows stable.

Another key point is the sense of accountability. Were performance to decline, the board of the investment trust is able to hold the fund manager to account; in extreme cases, replace him.

This is a good thing as the separation between the trust’s board and the fund manager should be seen as acting in shareholders’ best interests.

Of course, nothing is certain and any capital invested is placed at risk. One has to recognise that the value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

What Is A Real Estate Investment Trust (REIT)?

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate.

REIT’s pool the capital of numerous investors, like a mutual fund would, to allow individual investors to earn risk-adjusted returns or dividends from diversified real estate investments in a transparent manner without having to buy, manage, or finance any properties themselves.

An Equity REIT owns income generating real estate whereas a Mortgage REIT holds mortgages on property. One can also buy a Hybrid REIT that owns real estate and mortgages.

They are able to generate a steady income stream for investors, however, the offer little in the way of capital appreciation. REIT’s are publicly traded like stocks, which makes them highly liquid in contrast to physical real estate investments. They are subject to market risk and can feature low growth in tough markets