Options Trading

What is options trading? How does options trading work? What are the best options trading platforms in the UK?

Vanilla options are financial instruments that allow their owners to exercise the option of buying or selling an underlying asset at a set price within a set timeframe. Such options do not carry any obligation, so the option owner can choose to exercise his/her right or not. The option owner will only exercise his/her right when the price of the underlying asset has moved in the right direction. One advantage of options trading is that you can earn a profit with much less risk.

A liquid asset is one you can easily convert into cash or buy for cash. Some examples of liquid assets are cash, marketable securities, and various money market instruments. Real estate is an illiquid asset. A home can take a while to convert into cash.

In the context of trading, liquid assets are those that draw many buyers and sellers at all times. Liquid assets also:

- Command tighter Bid/Ask spreads

- Have large daily trading volumes

- Draw much interest

Why would you, as a trader, care about liquidity? Here’s why.

Liquid assets allow you to jump in and out of trades at will. Tighter Bid/Ask spreads let you buy or sell your way out of a contract without leaving much money on the table.

- An asset with a $1/$1.50 Bid/Ask spread will have you pay $1.50 to exit a short position. You would only get $1 when exiting a long position. This may cost you $20, $30, $40, or more per contract.

- An asset with a $1.20/$1.25 Bid/Ask spread is much kinder cost-wise when exiting both long and short positions.

By only trading liquid options, you save money and improve your odds for success. Over the long term, these savings add up and make a sizeable difference in your bottom line.

There are many of brokers offering platforms for options trading. We at FXExplained reviewed multiple of platforms for options trading suitable for traders from the UK. Based on these reviews we found that AvaTrade’s platform is the best options trading platform for UK traders. Then Plus500 and CMC Markets also got their platforms in the top three options trading platforms for the UK market.

The three best options trading platforms in the UK are:

- AvaTrade Options Trading

- Plus500 CFD Options Trading

- CMC Markets Options Trading

1. AvaTrade Options Trading

AvaTrade offers a separate options trading platform from its regular spot trading platform. The strength consists of the tools offered making it the best options trading experience for the trader. Visit AvaTrade

Read more…

73% of retail CFD accounts lose money

2. Plus500 CFD Options Trading

Plus500 offers options CFDs with leverage. The maximum leverage the broker allows on this trading instrument is 1:5 and Plus500 does not charge any commission on these options CFDs. Visit Plus500

Read more…

80% of retail investor accounts lose money when trading CFDs with this provider.

3. CMC Markets Options Trading

CMC Markets offers one single sign-on account for spot trading as well as for options trading, where you can trade exchange-traded options. Options trading with CMC Markets is easy on the eyes with easy navigation. Visit CMC Markets

Read more…

AvaTrade Options Trading

Regulated brokers offering vanilla options, such as AVATrade, give traders many of opportunities compared to regular spot trading. Such options allow traders to:

- Hedge their exposure to any given asset.

- Earn a profit with less risk involved.

- Manage risk effectively.

- Express any view they may have of the market.

- Use a bevy of creative trading strategies to achieve their goals.

At first glance, vanilla options seem intimidating on account of their perceived complexity, but they are a boon for traders, and those who take the time to figure them out usually get hooked on them.

What are Vanilla Options?

Vanilla options are plain Put or Call options with no special features – hence their name. They allow owners to buy or sell an asset at a predetermined price, within a set timeframe. Vanilla options do not carry any obligations.

Some exchanges standardize their vanilla options. Traders use these options to hedge their exposure to an asset.

Vanilla options are called “vanilla” because they are the simplest, most barebones approach to options trading. They do not have much in common with binary options.

There are only two types of vanilla options traders can buy or sell.

- Traders who think the price will go up will deal in CALL options, either buying or selling them.

- Those who think it will go down will deal in PUT options, either buying or selling those.

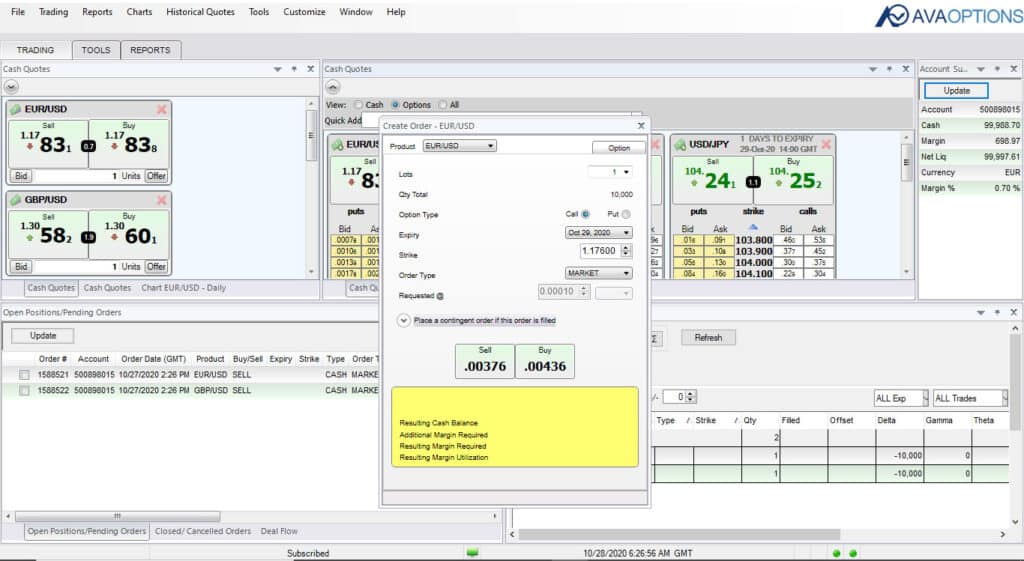

AVATrade’s Options Trading Platform

AVATrade’s options trading platform is available for download at the broker’s official site. This platform is a separate entity from the spot trading platform of the broker, although it too features spot trading tiles.

Available in iOS, Android, and desktop versions, the platform takes less than a minute to download and install.

The AVATrade options platform is available in a Demo version, which is great for getting a taste of what it has to offer.

When you load the platform, you can choose to create a new workspace, or you can pick from two preset modes: simple and advanced.

In default mode, the spot trading tiles are on the left, and the options quotes are in the middle. The trading space is fully customizable.

The options quick quotes section features the expiry times, the puts, the calls, and the strike price highlighted in bold.

Options highlighted in yellow are out of the money. Traders can track their open positions and pending orders on the bottom left.

To trade a vanilla option, double-click in the cell that best represents your view of the market/risk tolerance. For example, you can buy a Call option if you are cautiously optimistic about future price action.

Once you click the cell corresponding to a Call buy at your desired strike price, a ticket window opens where you can set the variables of your trade. Click Buy or Sell in the ticket window, and your option trade goes live.

The AVATRade options platform is fully customizable and offers some powerful risk-management tools.

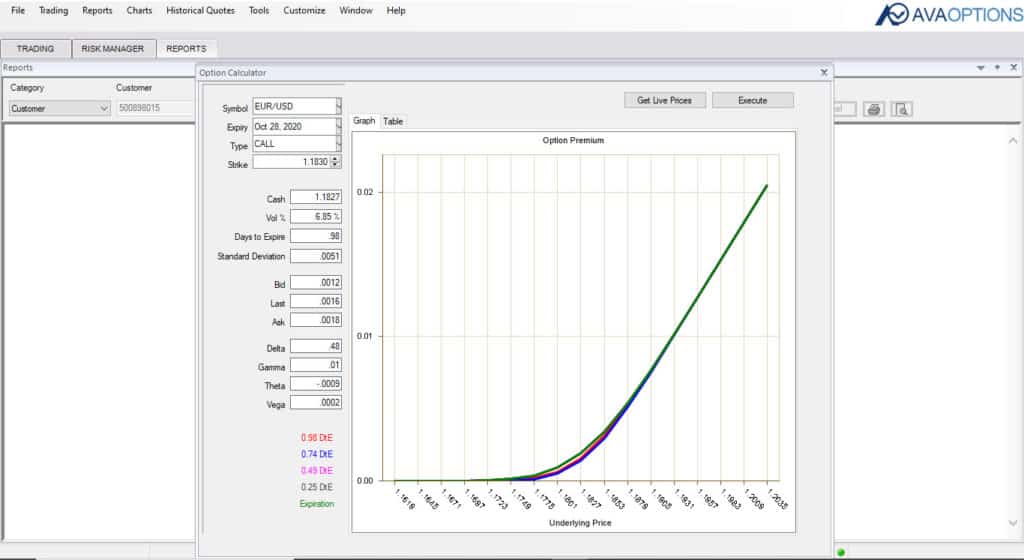

Tools seem to be among the strengths of the AVATrade options platform. The platform features:

- A symbol finder.

- An option calculator to allow traders to visualize the variables pertaining to their trade, such as the bid, the ask, the delta, gamma, theta, vega, etc.

- A margin calculator.

- A risk manager.

- A strategy optimizer.

The AVATrade options platform is a one-stop trading destination, even for advanced options traders.

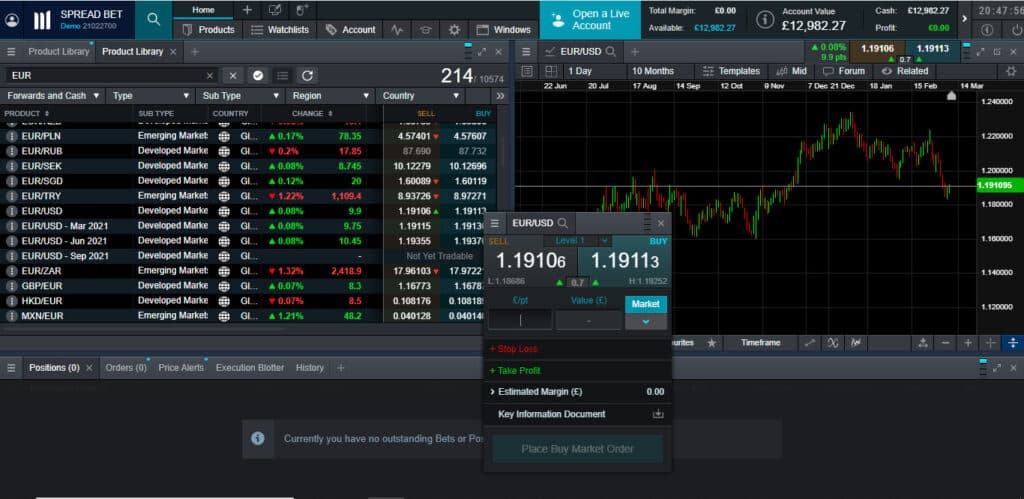

CMC Markets Options Trading

Unlike some of its competitors, CMC Markets has integrated options trading in a single sign-on account. Traders can use this account for spot trading as well as options trading.

Options are available on CMC Markets’ Stockbroking Standard platform as well as its Stockbroking Pro platform.

Options are derivatives that give traders the right to buy or sell an underlying asset for a set price within a set timeframe.

As such, options allow traders to use an astounding array of trading strategies. CMC Markets has made the available trading strategies dependent on a level system. Traders need to reach level four to be able to implement custom strategies.

Why Would You Trade Options at CMC Markets?

The options CMC Markets offers its traders are regulated trading instruments. They are listed on the Australian Securities Exchange and are therefore known as Exchange Traded Options.

ETOs cover an impressive range of underlying assets, such as stocks, indices, ETFs, and currency pairs.

- As mentioned, CMC Markets offers options under a single sign-in account, thus simplifying registration and account management for its traders.

- Options trading strategies may be intimidating for beginners on account of their apparent complexity. CMC Markets’ Pro platform features tools that allow traders to set up and execute strategies quickly and easily.

- The broker also offers options strategy analysis and diagrams illustrating real-time payoffs. Through such analysis, traders can simulate various hypothetical scenarios in real-time.

- Finding options and estimating pricing/margin requirements is easy with CMC Markets’ tools.

- The broker uses STP (Straight Through Processing) for the placing of options trades.

- The CMC Markets platform hands traders full control over their orders. It even allows for the placement of options/equity combination orders, adding a new dimension to hedging.

- CMC Markets features attractive brokerage rates. For trades worth less than $10,000, the fixed rate is $33. For values over $10,000, the rate is 0.33 percent.

Signing up and getting approved for a CMC Markets stockbroking account requires traders to complete, sign, and send in an application form. Those interested can download this form from the official CMC Markets website.

CMC Markets Stockbroking/Options Trading Platforms

The Stockbroking Standard Platform offers advanced charting packages, trading tools, and access to unlimited conditional orders. The standard platform also assists with tax reporting, and it supports live chat.

The Stockbroking Pro Platform features professional charting packages and trading tools. Both platforms are available in desktop, iOs, and Android variants.

If you opt for the Standard Platform, tools-wise you get a stock-filter, an economic calendar, a market depth analysis tool, and a dividend tool for ASX companies. This latter tool offers you a superb overview of ex-dividend dates, franking percentages, cents per share, etc.

The Pro Platform offers enhanced customization options such as multiple layouts. It even allows traders to group and link different platform modules, such as news, charts, the quote module, etc.

Despite its complexity and advanced capabilities, the CMC Markets Stockbroking platforms are easy on the eyes and easy to navigate.

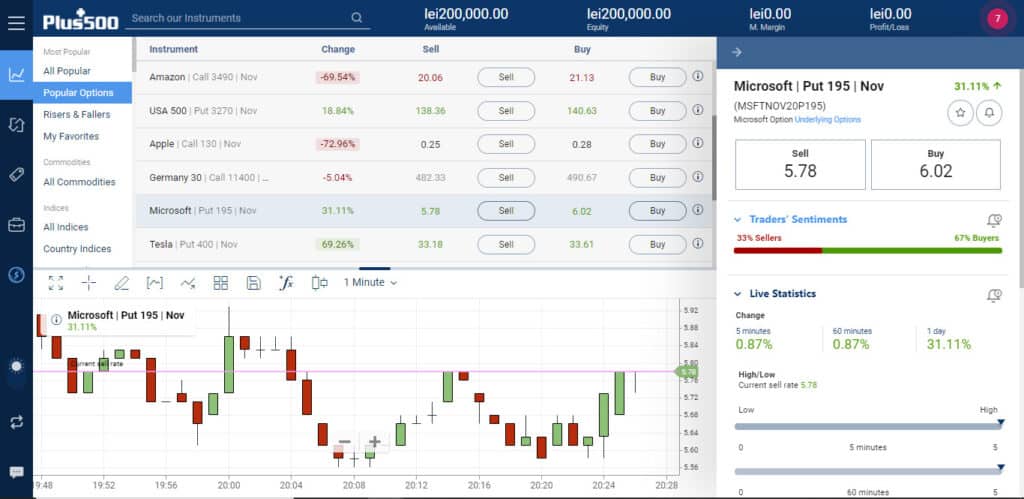

Plus500 CFD Options Trading

More and more online brokers offer their clients options trading. UK-regulated Plus500 has an options product on offer as well, with a bit of a twist.

Instead of plain vanilla options, Plus500 features options CFDs with leverage. The maximum leverage the broker allows on this trading instrument is 1:5. Traders should be extra cautious with leveraged instruments. Leverage can amplify profits, but it can also increase losses.

What makes Plus500’s options CFDs special and different from traditional options?

A traditional vanilla option gives its purchaser the right to buy or sell an underlying instrument for a set price within a set time-frame. The owner of the option can exercise this right but is never compelled to do so.

An options CFD considers the price of the underlying asset at the time of its expiry and then credits or debits the account of the trader, based on the difference in the opening and closing price.

If you trade such CFDs at Plus500, you can never expose yourself to unlimited losses, as you cannot lose more than your account balance.

Plus500 does not charge a commission on these options CFDs.

How Can You Trade Plus500’s Options CFDs?

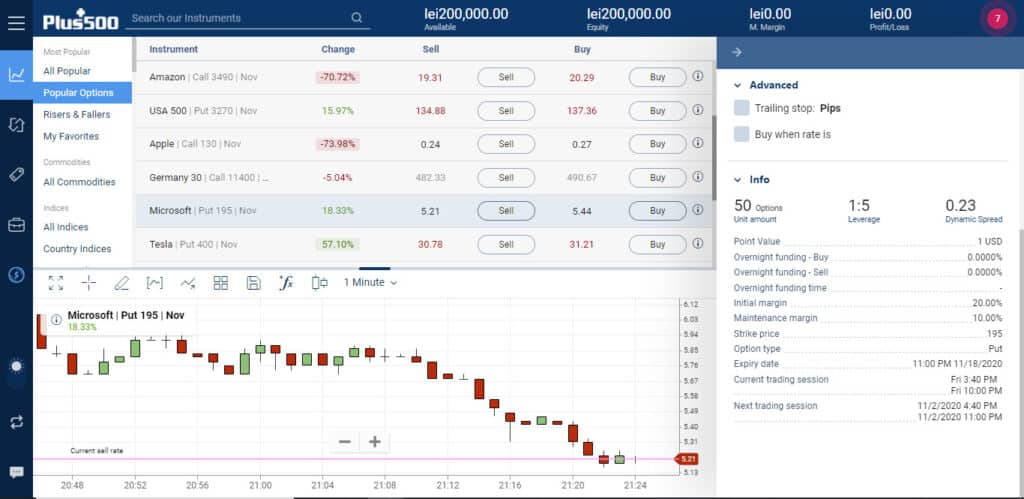

Log into your Plus500 account and open the Web Trader or download the broker’s trading platform. Select options from the tradable asset section. The format you will see is Microsoft/Put 195/Nov.

This describes a Put contract on Microsoft stock that expires in November. If you click this option, a trading ticket window will pop up that will give you the exact expiry date in the info section. The strike price is 195.

If you sell such an option, you expect the price of the asset to be below 195 when it expires.

The Plus500 Options CFD Trading Platform

As options trading platforms go, the Plus500 platform is a simplistic one. It lacks many of the advanced tools and calculators some of the other brokers offer.

The essential tools are, however, present. Traders can use Stop Losses and Trailing Stops to manage their risk. There is also a Guaranteed Stop feature that allows traders to avoid slippage altogether.

When you click on the Buy or Sell option of an options CFD, a ticket pops up where you can set your stop losses and refine the variables of your trade. In this window, the broker has also included a trading sentiment indicator. The tool provides a graphical illustration of how your peers have recently traded that same asset.

The info section contains all the detailed information you need to know about the trade you are about to launch.

The simplistic nature of the trading interface means that you can manage your orders and your account through a few clicks.

The charting section of the trading interface includes an impressive selection of drawing tools, technical indicators, and time frames.

80% of retail investor accounts lose money when trading CFDs with this provider.

Happy trading!

If you want to compare options trading to spot trading you can read our reviews of the overall best trading platforms in the UK here.

Please share all the comments you might have on options trading in the comment field below. Which is the best options trading platform in the UK according to you?