In this article and accompanying video we are looking at the different asset classes that investors and traders can invest in and trade.

The four main asset classes we are going to look at are:

- Equities, stocks, shares (including indices, or averages)

- Bonds (Government and Corporate)

- Commodities

- Foreign Exchange (Forex, FX and currencies)

Equities, stocks, shares (including indices, or averages)

- Equities are also known as stocks or shares.

- These are ownership of a company, usually a public listed company.

- The ownership of part a company or a “share” indicates that the owner of the share has voting rights in the company and also is entitled to a divided in the company, which is usually based on profits.

- This divided provides a potential income over time, but the owner of the share would also look for capital growth, which is achieved when the stock price increases.

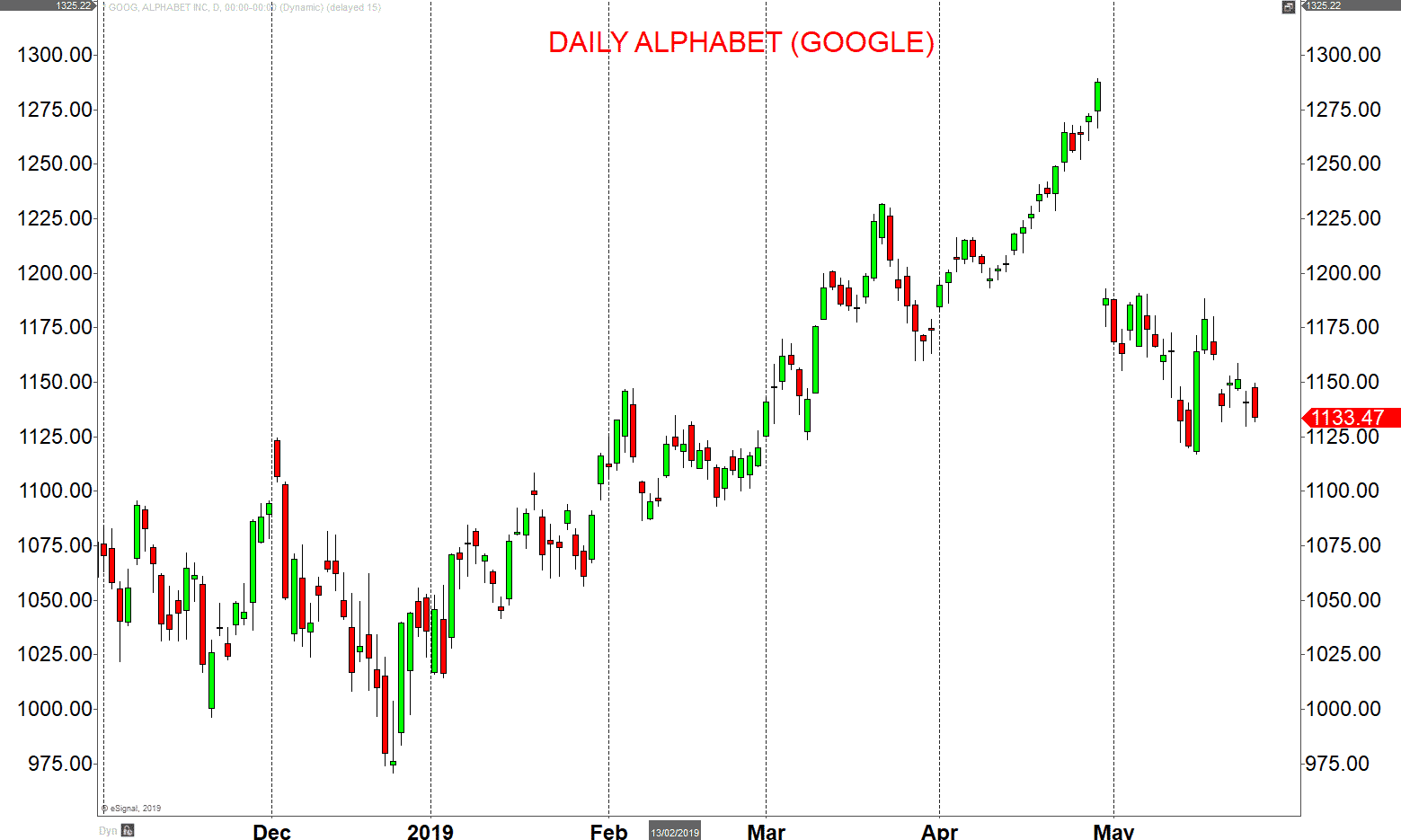

- Popular and well know shares would include British Petroleum (BP), Facebook and Alphabet (Google’s parent company).

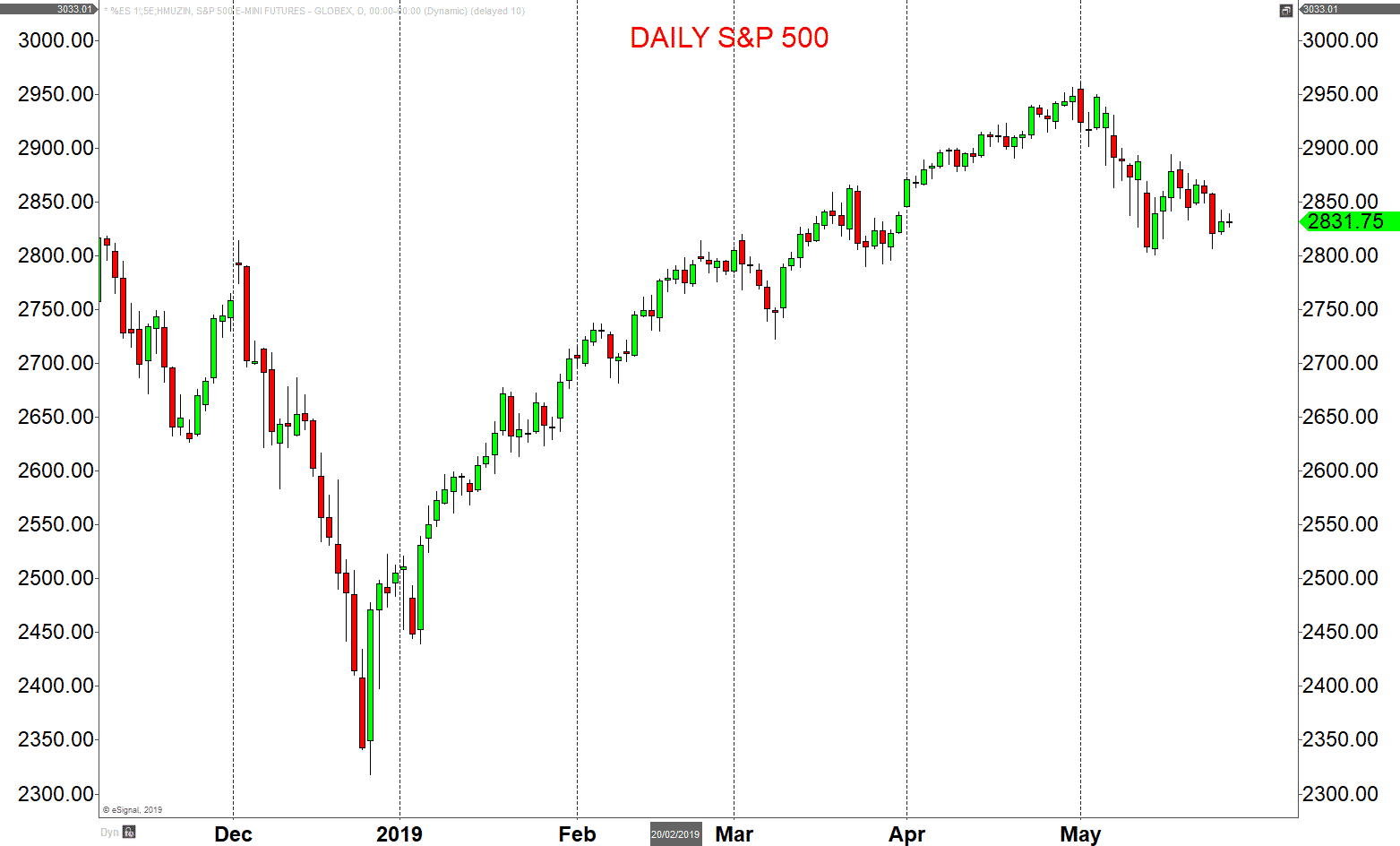

- Equity or stock indices are also described as stock averages.

- These are based on an average of a number of shares from a different sector of the economy, or as a reflection of a whole economy. An example of a stock average would be the S&P 500, which is the index of the largest 500 shares on the US stock market.

Bonds (Government and Corporate)

- Bonds are debt. Governments and Corporates issue Bonds in order to raise longer term funds.

- As Bonds are debt, they are viewed as less risky than stocks, and in particular Government Bonds are seen as a safe haven or low risk asset (depending on the issuing depending on the issuing Government).

- Bond buyers received a fixed payment, usually annually, hence Bond market are also known as Fixed Income markets (and also credit markets).

- The fixed payment received is called the coupon.

Commodities

- Commodities are defined as a raw material or primary agricultural product that can be bought and sold.

- Commodities do not usually earn the owner any income (like stocks or a bonds do), but speculators buy or sell commodities to make capital gains (or losses).

- Commodities are often broken down into different classes.

- These would include:

- Base Metals, including Copper, Aluminium, Lead, Zinc

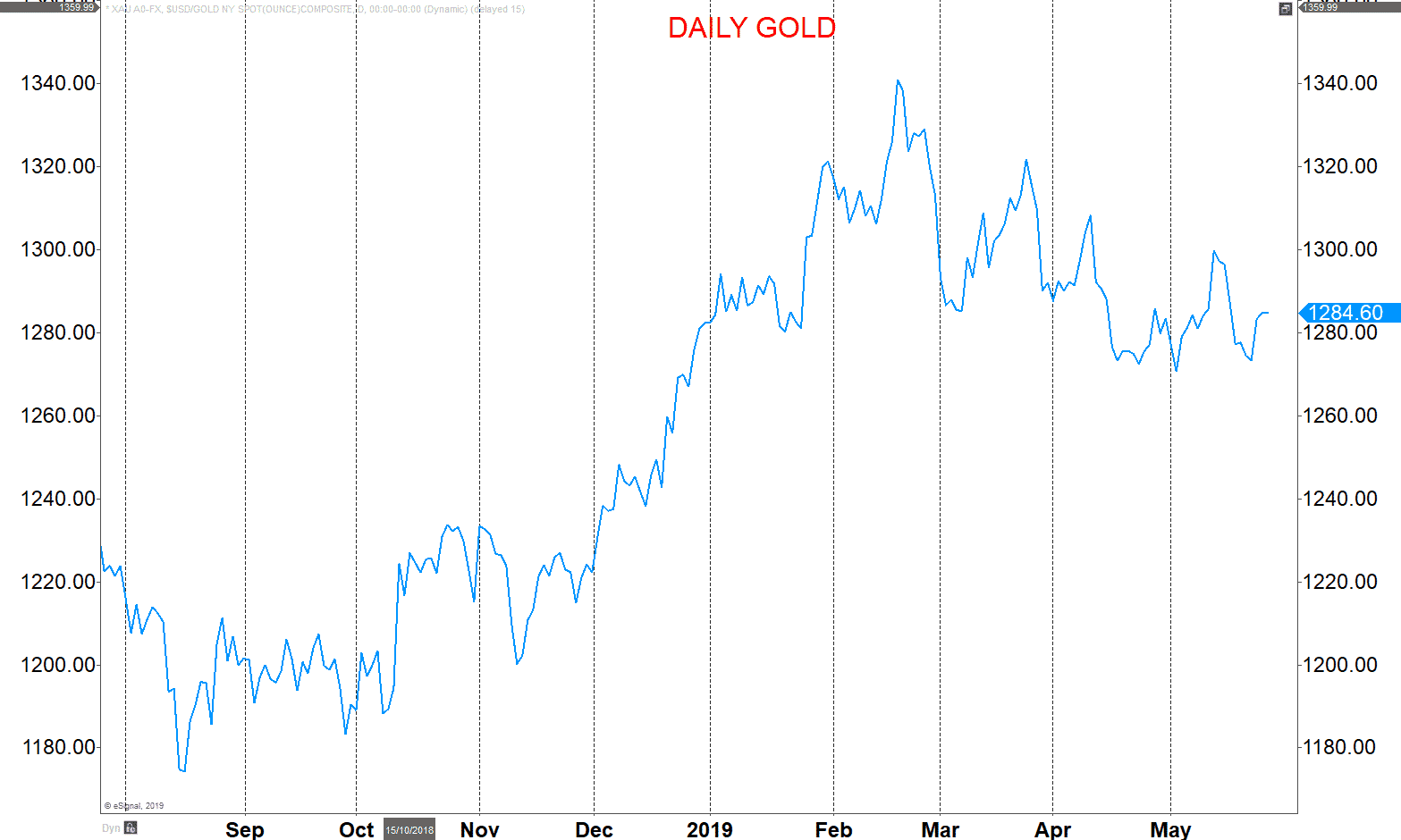

- Precious Metals, including Gold and Silver

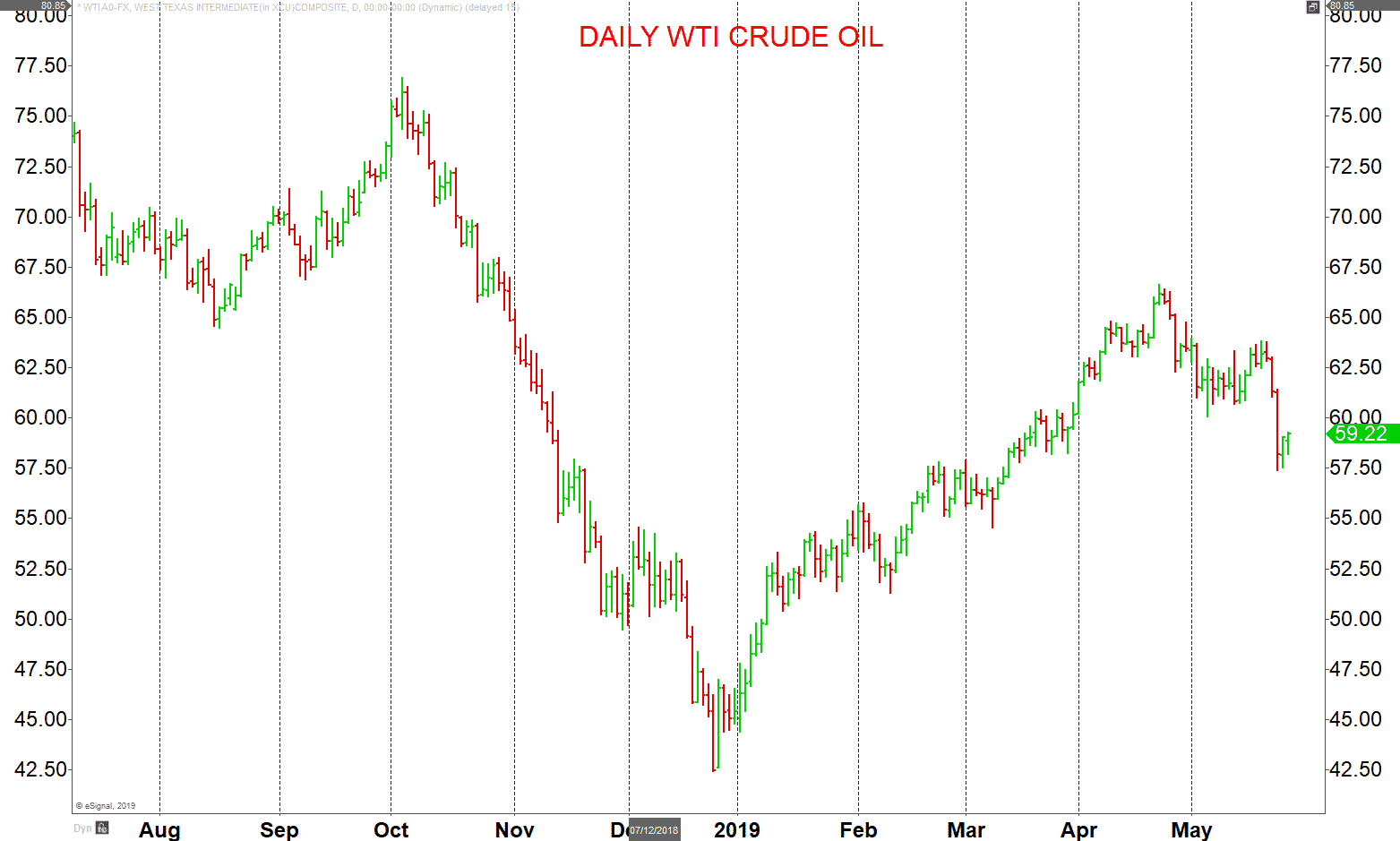

- Energy, which include Oil and Gas

- Agriculturals, including Coffee and Wheat

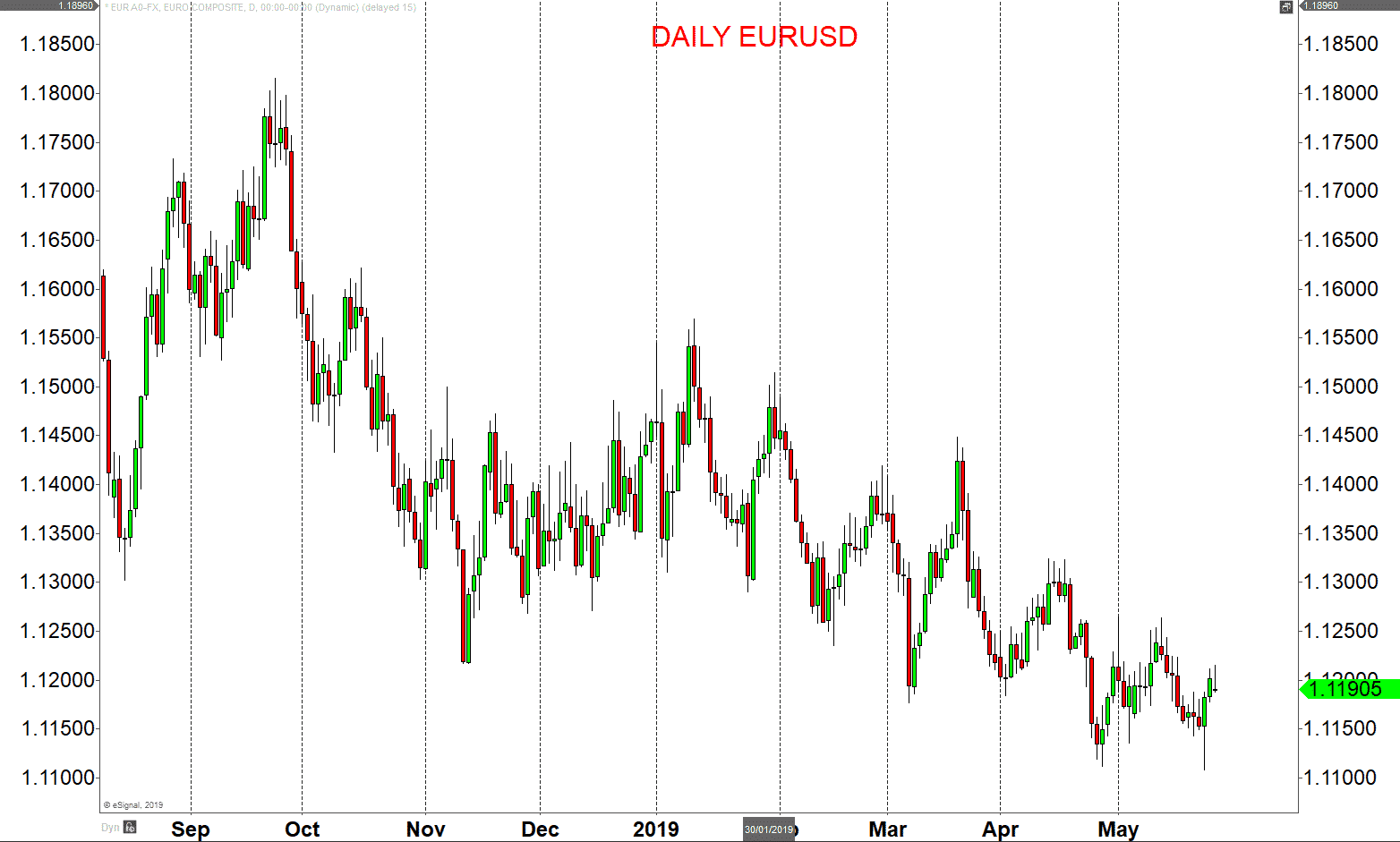

Foreign Exchange (Forex, FX and currencies)

- Foreign Exchange markets are slightly different to the other asset classes, as they are a “relative” meaning that the trader or investors buys one currency relative to another.

- Foreign Exchange markets are also called Forex, FX or currency markets.

- The currency pairs for the largest economies are the called the “Majors” and would include the US Dollar, the Euro, the Japanese Yen, the Pound, the Swiss Franc, plus the Australian, New Zealand and Canadian Dollars.

- Most global currencies can be traded, with Emerging Markets currencies such as the Brazilian Real and Indian Rupee often (though not always) more volatile than the Majors.

Further reading on financial markets and asset classes here.